Do you hate this market yet?

If you do, I don’t blame you. The level of randomness and reactivity has increased, along with the market’s sensitivity to news. A news-driven market is tough to trade, especially when so many different factors are triggers.

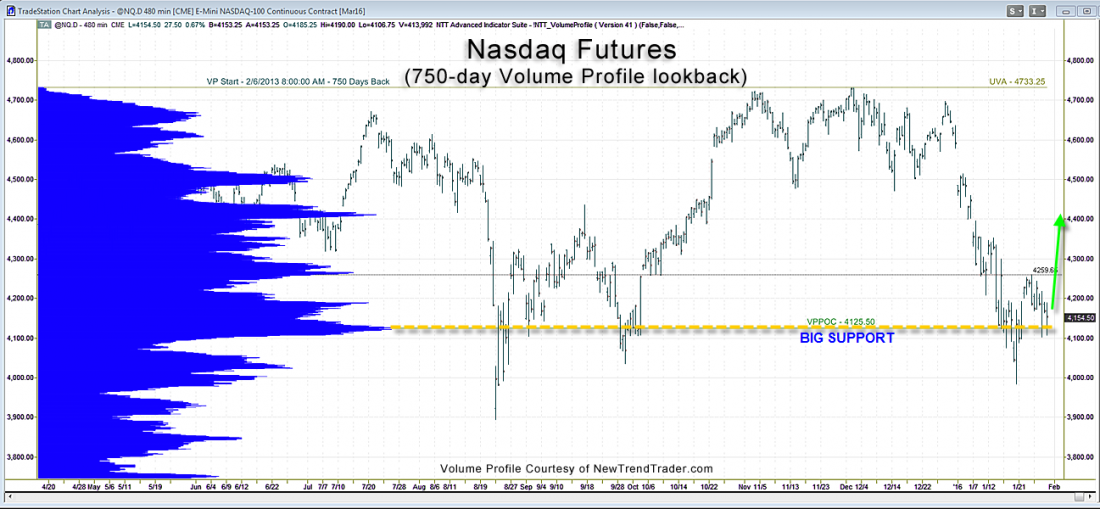

And although I expect that AAPL is headed to $75, which implies significantly lower prices for the Nasdaq, there is a curiously bullish configuration in the Nasdaq futures that is likely to play out soon.

The accompanying Volume Profile chart has a lookback period of 750 days. Over that time the largest volume occurred at a price of 4125.50. This is called the Volume Profile Point of Control and it represents a level of significant long-term support. The last two trading days have tested this support level and on both days, the NQ closed above this key level.

Although the NQ leadership is in disarray, with Facebook (FB) the sole surviving Fangster, I’m nevertheless looking for the NQ to gain upside traction today or Monday. And curiously, the real market leadership at this time is coming from the Dow. If the Dow can close on Friday above 16,000, it will represent a subtle victory for the bulls.

www.daytradingpsychology.com (Coaching for private traders.)

www.trader-analytics.com (Peak performance consulting to RIAs, hedge funds and banks.)