It is the last trading day of January, and the first month of the year is ending not a minute too soon for anyone caught with a long position they can’t unload.

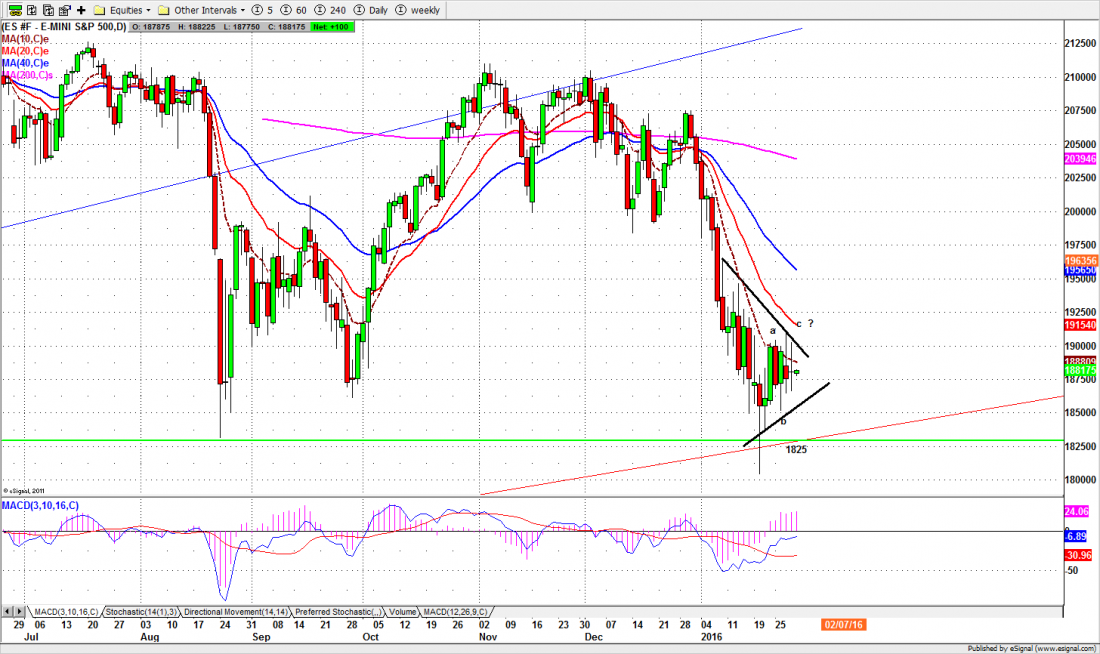

The market is down almost exactly 100 points from the December high, and the little bounce this week really didn’t do anything except create a pennant pattern that is usually seen at the beginning – not the end – of declining markets.

There is only cold comfort in that little bump – really just a momentary pause in the decline. But today’s trading should generate some excitement; just don’t let irrational exuberance dominate your usual good sense. The end of the month is always a struggle, usually driven by the end-of-month window-dressing from the greed-crazed Bulls. But this one is especially important. The Bulls are trying hard to create the impression that the market is not crashing. And so far it hasn’t. The Bears want to remind you that it isn’t crashing yet … but another sharp decline right now would persuade a lot of the fencesitters that it is time to jump.

Overnight the mini-futures, which trade even when the NYSE is closed, have swung through 40 points before midnight: up 20 points, down 20 points, and headed back up at this moment.

The battleground is 1900, as we mentioned on Monday. A close above it will at least make it possible to argue. A close substantially below may well precipitate the rush for the exits that eventually sends this market down to the next major support around 1770.

But that is some time away; here’s what we thing will happen today.

Today

Yesterday the S&P500 mini-futures, the vehicle we use to trade the large-cap index, just repeated the range in made the day before, with a slightly smaller range to form an inside day. It may do the same thing today.

Those inside days, like the wedge forming on the daily chart (below) are a way of killing time until the market catches it’s breathe from the quick sharp decline this month.

They are forming a wedge, normally a continuation pattern. As in continuing down

The 10-day moving average has held the price below 1900 despite strong attempts to push the market back above a psychologically-important level. We don’t think they will succeed today; we’re looking for a month-end close below 1900 but above 1850.

The key line for today: 1877. Above it, the Bulls have a chance; below it, and we may see today’s low 1865.75 tested again. Below that, and we could be talking waterfall.

Major support levels: 1830-1825, 1816-1818, 1800-1795

Major resistance levels: 1907.50-06.75, 1929.50-32.50, 1956.50-57.50

Naturus.com publishes free market previews for gold, the S&P500 and options. You can get on the mailing list here: http://www.naturus.com

Chart: ESH6 on Jan. 28 , 2016. Daily bars.