Pairs trading can be a bit troublesome, especially in this market where normal correlations seem to have completely vanished. But, it always helps to have balance in your portfolio. Balance is even more advantageous when you have a fundamental basis to your positions and not just saying to yourself: “Well, I am long three stocks and short three stocks so I am balanced”.

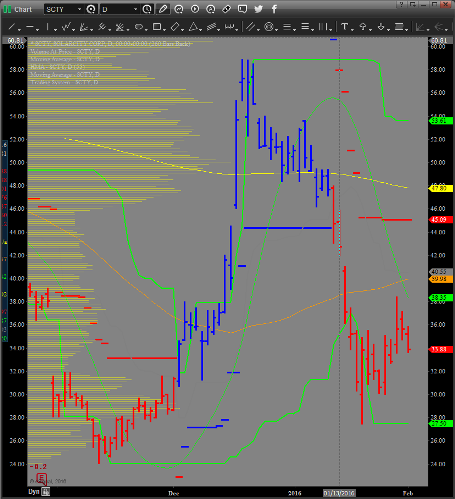

Let’s take our position in FXC. This is the ETF that tracks the Canadian Dollar. For a number of reasons, we have a long position partially as a proxy long Crude Oil play. We are long the March 72/74 call spread for $0.35. On one of our scanners today, we had an alert for one of our technical indicators pop up on Solar City (SCTY). It was a sell signal. It stands to reason that continued negative oil prices could weigh down on FXC. You could also reason that cheaper oil would be bad for SCTY. Cheap oil makes solar technology even more expensive. So, if we can construct a technical case for our fundamental one, it makes sense for the portfolio. SCTY has its earnings set to be released on 2/9/16 so its IV is very high and we may have to take this position through earnings. It tends not to do well on earnings going down 5 out of last 8 times with last earnings posting a -22% break. We considered the following signal:

To sell the 2/12 weekly expiration 39/41 call spread for a CREDIT of $0.50. This leaves us laying even odds that SCTY will not experience a move up of 20.5% before 2/12/16! After the earnings report, we can reassess and put on another signal in SCTY.