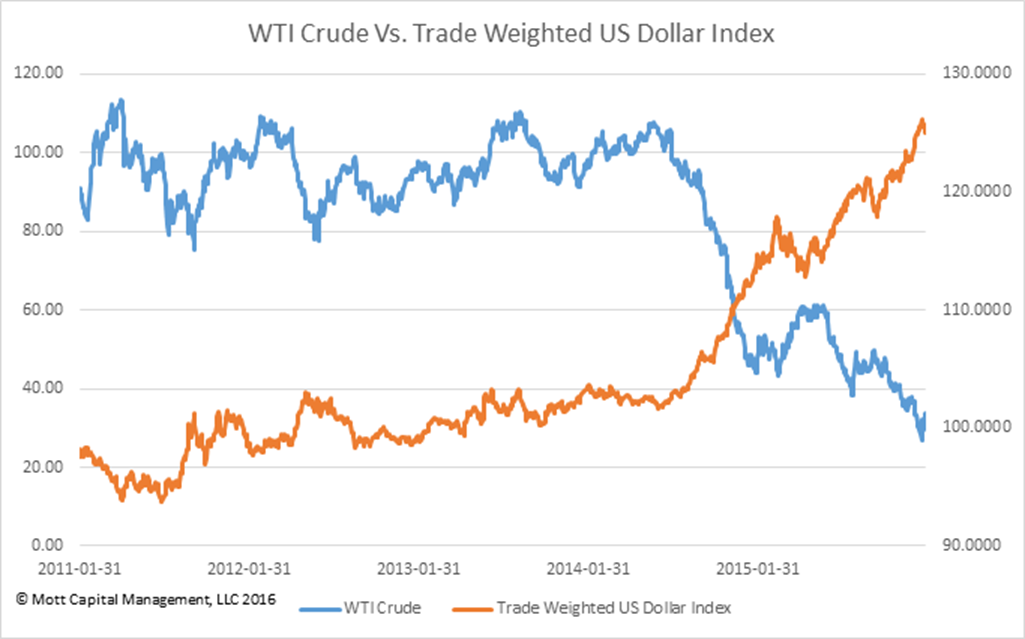

The Bond and Currency markets are painting a different picture than the Equity market. Watch the Dollar Index it continues to weaken and the Euro is now nearly at 1.12. The Ten Treasury Bond is holding firm around 1.88%. What is this telling me? Well if the ECB and BOJ is in the midst of QE and Negative Rates with no sign of letting up. This means the bond and currency markets are believing more and more the rate picture is continuing to shift here in the US. A weakening dollar is a positive for Oil. This is why Oil is up over 3% again today. I ran the analysis this morning. Since Jan. 2011, the price of Oil is down 63%, while the trade weighted dollar index is up nearly 28%. They are -91% inversely correlated during that time, with an R^2 of 0.82. That means the correlation is highly and statistically significant. The dollar index is entering a very interesting area around this 94-96 area. Something to watch closely. It is not just a supply and demand issue for Oil.

Subscibe To The Market Watch Newsletter

Advisory Services are offered through Mott Capital Management, LLC a registered investment adviser.

Investment

Investment