Another week and another seven days of conflicting market information. While the domestic unemployment picture lends credence to the Fed’s actions, global economic slack leaves the world second guessing the Fed’s decision. The end result has led to bond spreads foreshadowing a global economic slowdown while the equity markets tank. We’ve written before that the powers that be will do everything they can to keep the global economy from coming off the rails. While we may make solid cases for just such an occurrence, we’ve made a lot more money betting that it won’t. Therefore, we’ll review a likely stock market scenario that could climax this coming week.

Let’s begin with some perspective based on the following points:

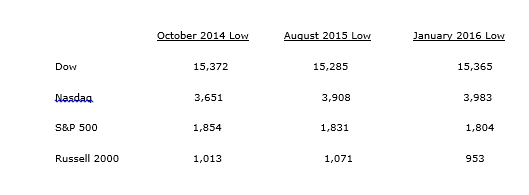

Roughly speaking, this is the first multi-year low we’ve tested since the 2011-2012 sideways period. Interestingly, other than the 2011 potential government shutdown, the same economic issues are still in place. We’re still discussing the global debt overhang, stagnant wages, inconsistent Chinese data and conflict in the Middle East. Many of the answers to these problems are politically unpalatable. Any speech that may include the phrase, “tighten our belts” is sure to leave that candidate on the outside looking in. The point then, is not whether we can analyze the issues and try to fix them. The point is, how we can make money trading in a world that never answers the very questions they themselves raise.

My simple answer is that we don’t try to figure it out. We simply look for consistent trading setups and use this to compare current market setups to ones we’ve seen play out in the past. The pattern here is that while the stock market is threatening multi-year lows, commercial traders have been consistently buying on weakness. Commercial traders in the Commitment of Traders report have been net buyers in the Dow futures for 5 straight weeks to the tune of more than 52,000 contracts. Let me put this in perspective – total open interest in the Dow futures is just over 60,000 contracts. Furthermore, open interest in the Dow has declined by nearly 25% since the beginning of the year. Speculators are giving up on the long side and are afraid to sell on weakness. This is leaving a larger portion of the market in the hands of the commercial traders who expect the market to move higher over the next several weeks.

This pattern is similar in the other stock index futures with the S&P 500, Nasdaq and Russell 2000 commercial traders all adding to their positions over the markets recent declines. Again, as retail and speculative traders find themselves increasingly on the sidelines. Commercial traders in the Nasdaq for example, now control nearly 70% of the market’s open interest. Historically, when they control more than 75% of the market’s open interest, big moves come quickly in their favor. The S&P on the other hand, is gaining open interest as the market falls. This could be index traders taking advantage of the early decline to beat the year’s averages. After all, buying in here guarantees you’ll beat the average by more than 8.5% and that will make any money manager a nice year-end bonus.

After a week’s worth of consolidation near the lows, I think the S&P 500 and Dow will fall through their multi-year lows. This will create panic selling on the part of retail investors and speculators as the commercial traders wait patiently underneath to buy their offerings. I don’t expect that anything will be resolved regarding the world’s economic issues over the next week. Somehow, the dialogue will simply shift to another topic as the market bounces higher. Therefore, we’ll buy the dip and bet that the world won’t end. We will however, place a protective stop…in case it does.

Register for a free trial of COT Signals to receive the COT Buy signal by email when published.