Last week’s forecast for a high in the Dow on February 1st (Eighth Year Returns) was a perfect hit. As of last Friday, equities have fallen 261 points since last Monday’s high.

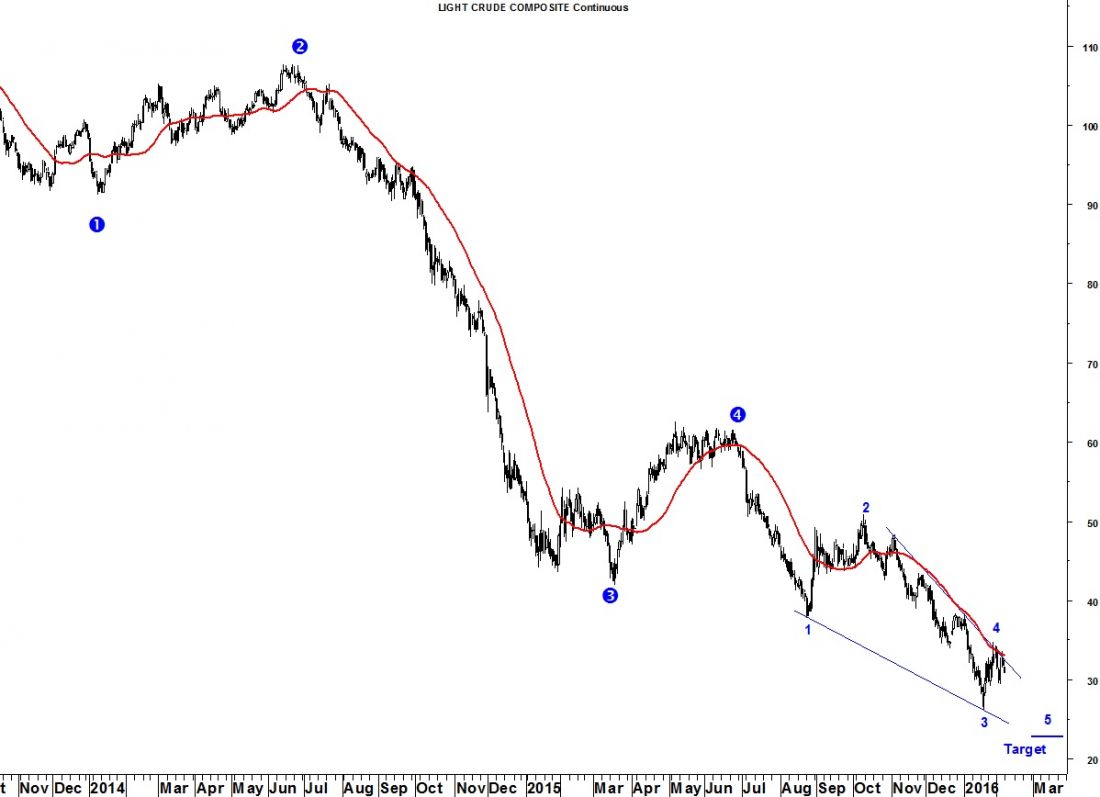

Crude spent last week trying to breakout from the 34-dma but, in the end, fell $2.73/bbl. for the week closing at 30.89 and printed an engulfing bearish candlestick on the weekly chart.

If 30.00 is broken again, my price forecasting model generates a target of 22.90. However, a break out above the 34-dma would be bullish and a close above 37.90 would ‘seal the deal’.

Cycles point to an important low in the second week of March and seasonality is distinctly bearish in February.

Try a “sneak-peek” this month at Seattle Technical Advisors.com