Although I have much lower downside targets ($175 and $150), I’ve been periodically bullish about the Biotech ETF (including last week), expecting an oversold bounce… but my timing has been off.

It’s always risky to forecast bounces in a bear market, because the force of fear is much greater than the force of greed. Nevertheless, once again, I’m going to this well.

I believe the Nasdaq is still married to Biotech and their futures are inextricably intertwined. We can’t get a bounce in one without the cooperation of the other. That’s because the market cap of IBB’s top 10 holdings, which represent 60% of total ETF assets, is around $500 billion.

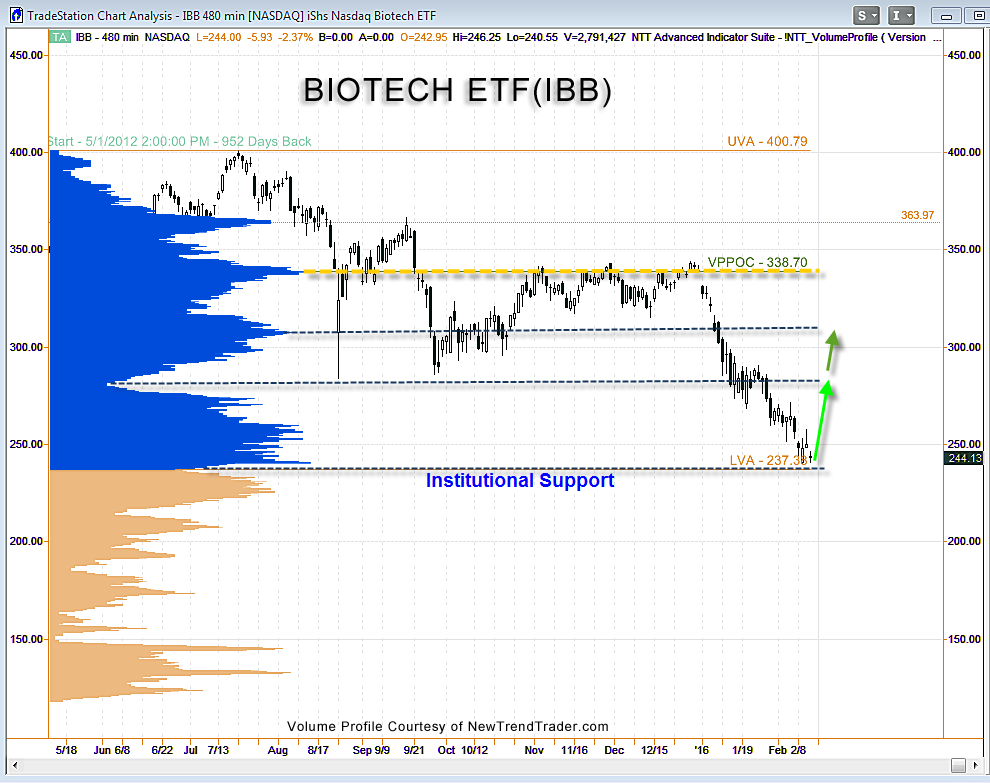

Over the last week both fell together and now Biotech is at a technical support level watched by institutions, which in Volume Profile terminology is called the Lower Value Area (LVA). It is one standard deviation below the central volume pivot known as the Volume Profile Point of Control. The VPPOC varies with the lookback period and for a 900+ day lookback (that’s a lot of trading days) it currently stands at $338.

While I feel a bit cautious forecasting an immediate bounce, there’s a pattern I’ve noticed during bearish periods where the U.S. indices rally on Fridays, in the face of weekend news risk. So once again I’m looking for a nice bounce in IBB and in the Nasdaq… today. Of course, my crystal ball may be hazy, so trade what you actually see.

www.daytradingpsychology.com (Peak performance coaching for private traders)

www.trader-analytics.com (Services for traders at RIAs, banks and hedge funds)