Yes, in a nutshell I’m preoccupied with biotech… and oh, and by the way, if you are looking for a paired trade, I would short gold here.

Why? Gold has been in a bear market since January 2013, so this pop is by definition a bear market rally. Moreover, I think the equity market is about to start its very first bear market rally. (Party hats anyone?)

If so, fast money will rotate out of gold and back into stocks. And this gold-equity flip-flop could happen repeatedly over the next few years, like two bears exchanging fleas.

Bear market rallies in equities don’t always require a rational catalyst, and they run much further than most people expect. Because I ponder the psychological side of market behavior, my guess is that the immediate panic over crude oil trading below $30 has largely dissipated at this time. And since no banks have yet failed in Europe, China or Texas, it might be time to look at the glass as half full.

Evidence? There has been some quiet dip buying in the FANG stocks; all four closed up last the week. NFLX, which like Tesla (TSLA) has a nasty short selling cohort, is showing relative strength compared to AMZN and GOOGL. Plus, there have been double digit overnight earnings pops this past week in small caps, which indicates that animal spirits have been dormant, but are not entirely extinguished.

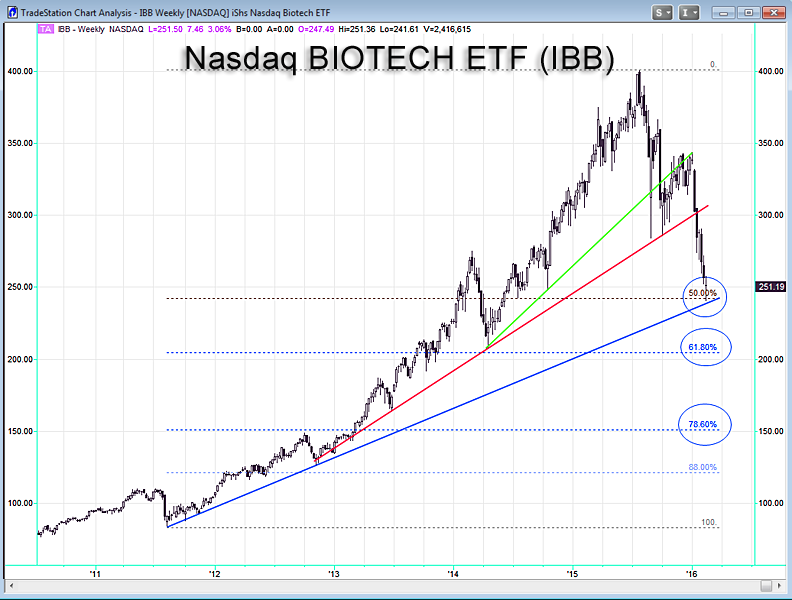

Although I have much lower downside targets for the Biotech ETF ($175 and $150), I presented a Volume Profile chart on Friday that showed IBB at the Lower Value Area (LVA). That is a technical ‘floor’ that would support a tradable bounce.

So unlike previous attempts, on Friday IBB was finally able to gain almost 3% and closed at the top of the daily range. Like the Nasdaq itself, IBB has support here from 2014, but looking even further back in time, the weekly chart of IBB accompanying this article shows that this level is also the 50% retracement of the Big Bull Biotech Run. This is a significant retracement number that should also encourage shorts to exhale. Apparently some of that is happening as I write this during the Sunday night futures session.

But before we break out the bubbly, if the debt super cycle folks are correct, and I think they are, we are probably starting a 3-4 year bear market. Even so, you don’t want to miss out on the rallies.

www.daytradingpsychology.com (Peak performance coaching for private traders)

www.trader-analytics.com (Services for traders at RIAs, banks and hedge funds)