SPX: It is going to be a busy week. Here’s what to watch

First watch the Fed. Samson slew the Philistines with the jawbone of an ass, and the Fed thinks that’s such a good idea they are trying it on the market.

This week we have no fewer than eight emissaries from the Fed opining on whither now interest rates, the economy, the market and perhaps the discovery of gravity waves. Somebody is speaking publicly ever day but today, and some days — Wednesday for example – there will be someone on the podium morning, noon and night.

This pretty close to a full-court press, and it has to be seen as an expression of concern about the impact the very modest December rate increase has had on the market this year.

There is no telling what they will say, and any casual comment can be enough to ignite the momentum plays and send the market careening one way or the other. The one thing we don’t expect to hear is an announcement that the Fed is going to continue raising interest rates this year.

In our view they are closer to some re-worked version of Quantitative Easing under a different name than they are to more rate increases, at least for the time being. Next month may be another story.

Second, watch for the economic data. There is a ton of it this week, some of it important.

PMI services and manufacturing; New Home Sales and Existing Home Sales; Consumer Confidence and Consumer Sentiment and Consumer Comfort; Case-Shiller and the Richmond Fed Manufacturing Index; the Petroleum Status Report and the Natural Gas Report; the Durable Goods orders, the GDP report, the Jobless Claims, the Mortgage Applications, the Personal Income report.

TMI, as the kids say.

One way to deal with this onslaught is to stay in bed and wait for it to pass. Some of this stuff will be the excuse to move the market around this week; by next week, none of it will be important.

Third, some technical levels to watch. In contrast to the madness of the economic data this week, the technical outlook is calm, almost serene.

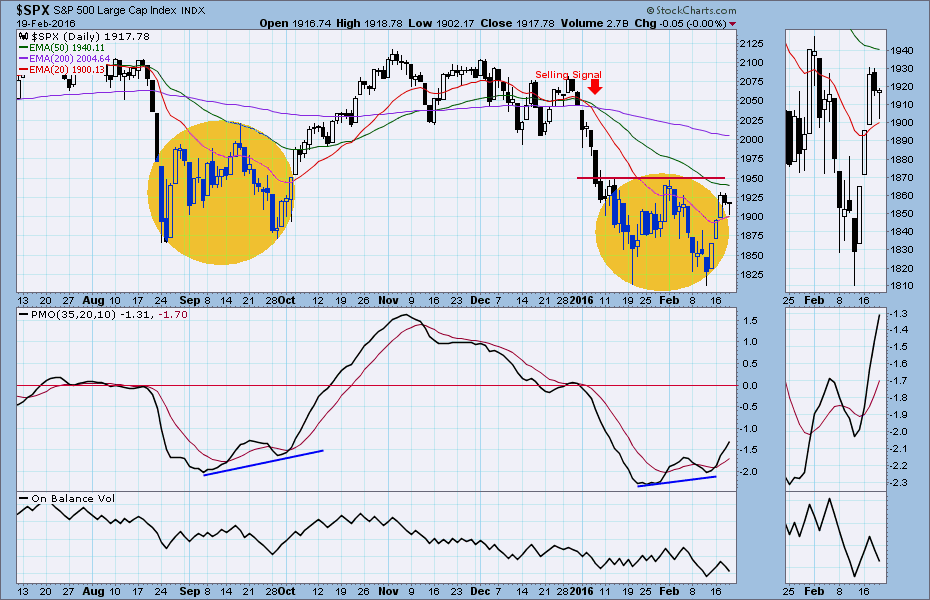

We’ve had a nice little bounce that recouped some of the earlier losses. The S&P500 cash index (SPX) closed at 1917.78 on Friday, up 53 points on the week, leaving us just about flat for February, but down about 6% since the first of the year.

The market has bounced from a long-term support area around 1802, and is currently trying to decide it will continue last week’s bounce, or continue January’s dump.

If you are hoping for an upside move the area to watch is 1940 to 1950, a major resistance area that must be passed before there can be any real recovery. If we see a continuation rally that does not get past that barrier, you could be watching a bull trap developing.

If you favour the downside, watch the broad support area around 1890-1900. If 1890 fails to hold this week, expect the decline to continue and the shorts to come down from the hills to murder the wounded.

Or you could just amuse yourself by trying to make sense of the conflicting statements the Fed will be broadcasting this week.

Futures

The S&P500 mini futures (ES) has two gaps to fill, one just above the current price at 1916.50 and one just below it at 1888.75. One or both could be filled early this week, but the lower gap will have to get past a strong support level around 1895.

One the upside, 1927-28 and 1933-35 will act to hold the price down; on the downside 1889-1891 will act as support. If either is broken, expect the price to continue to move in the direction of the break-out.

Major support levels: 1893-92, 1881-75, 1833-31, 1802-05

Major resistance levels: 1935.50-33.25, 1950-56, 1975-78

Visit www.naturus.com to see Naturus.com’s full outlook for the week ahead, free of charge.

Chart: SPX Daily chart to Feb. 19. 2016