After rallying all week, Oil prices fell sharply last Friday as the focus shifted back to the persistent global supply glut in the market. On Thursday the EIA reported another build in the stockpiles (2.1 million barrels) to set an all-time supply high of 504.1 million barrels.

Cushing Oklahoma (the nation’s largest storage facility) is nearing full capacity on the report that inventory rose by additional 36,000 barrels.

This coming week will have several key reports being released as well as the indication that the OPEC and Non-OPEC producers will have reached a consensus on production cuts by March 1st.

Technical Analysis for week of February 22nd

Monthly Chart

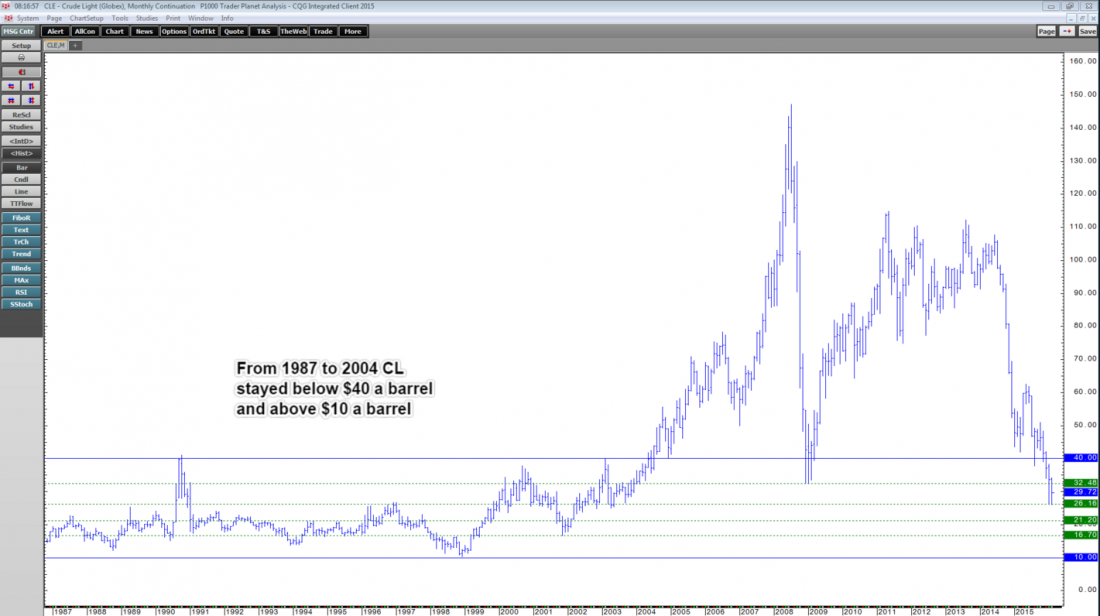

From the big picture perspective, I don’t see that we have finished putting in a bottom. If you look at the years between 1987 and 2004, Oil maintained price action between the low of $10 / barrel and the high of $40 / barrel.

At present, January and February 2016 have begun to stabilize around the lows of 2003. We will need to continue to build a base around this area if we are to begin to see a sustained rally. My overall sentiment remains bearish.