Last week I spoke of LinkedIn (LNKD) and compared investing in LinkedIn just like buying a Toyota but at a Ferrari price.

Twitter (TWTR) is another example.

In Twitter’s case, I would go as far as even saying it’s like paying for a Ferrari but getting a Tata (an Indian vehicle) and not even a Toyota.

Sure I use the Twitter service for social media and helping me spread my message, but investing in it is an entirely different story, especially when it finds itself in a dilemma of trying to achieve profitable ad revenue without alienating its users.

Twitter shareholders have fared even worse than LinkedIn shareholders, losing over 75% from its peak just two years ago.

Here I’m also not exactly sure what investors are holding for or more importantly why they even bought into Twitter initially?

Peter Lynch once said to invest in something you understand and you know a lot of people are using, but that comes with the caveat of firstly being profitable and secondly paying less than what it is worth. Twitter cannot be valued in the traditional sense since it doesn’t have any history of financial stability and profitability.

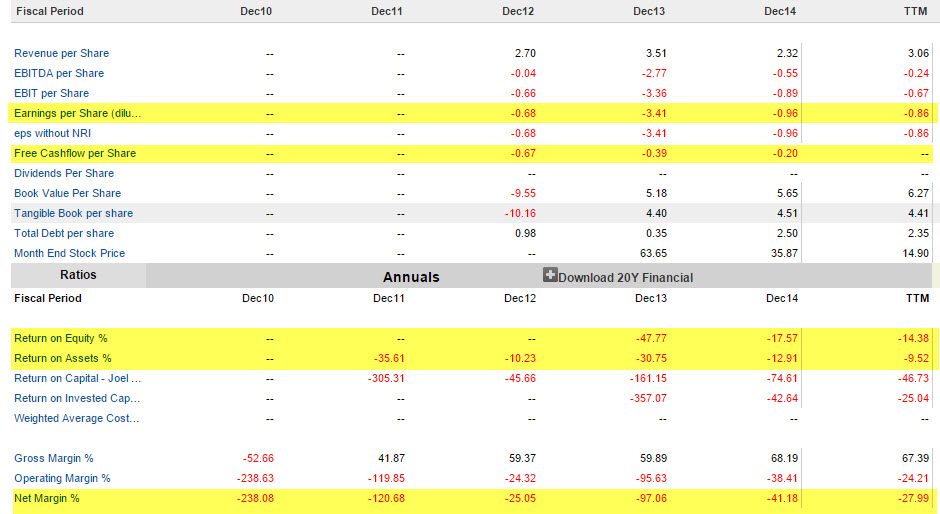

You can see there was a problem from day one when it floated a couple of years ago and has made absolutely no financial progress so the writing has been on the wall for investors who were willing to just take a peek at its financials

- Earnings per share currently at negative (Loss making)

- Negative free cashflow per share of

- Return on Equity currently negative and has been for its whole publicly listed life

- Return on Assets currently negative and has been for its whole publicly listed life

- And negative Net Margin, which is very surprising for an online technology company. Both Google Facebook is over 20% consistently.

Just like LinkedIn, these five simple measures clearly shows Twitter would not pass the most basic screening tests to warrant further investigation or even valuation for that matter.

Even though Twitter has had a recent short term stock price bounce, it is clearly still a company that is struggling to make any money out of its service, as popular as it has been over the years.

Until Twitter can prove itself as a money earner, you may want to simply avoid Twitter and limit your portfolio for any potential permanent capital loss.