After reporting stellar Q4 numbers in late January, Facebook’s stock reached a new all-time high with a market capitalization greater than Exxon Mobil and Berkshire Hathaway. Since then, shares have pulled back along with the rest of the FANG gang. Facebook’s correction, however, has been modest.

One reason is that with 40% annual revenue growth, Facebook outperforms all mega cap companies regardless of market sector. 80% of Facebook’s revenue comes from mobile ads, which is a segment growing revenue at 30%+ annually. After AAPL, which is in a league of its own, FB generates the most revenue per employee of any large cap tech company: $1.4 million.

Simply put, the company is growing like a weed, generating a river of cash, and has huge untapped potential for monetizing its 1.5 billion monthly users.

Moreover, true to its Millennial-mindset, the company wants to save the world. According to CEO Zuckerberg, Facebook’s mission is to make the world a more understanding and transparent place. What’s not to like?

But, is FB a ‘buy’?

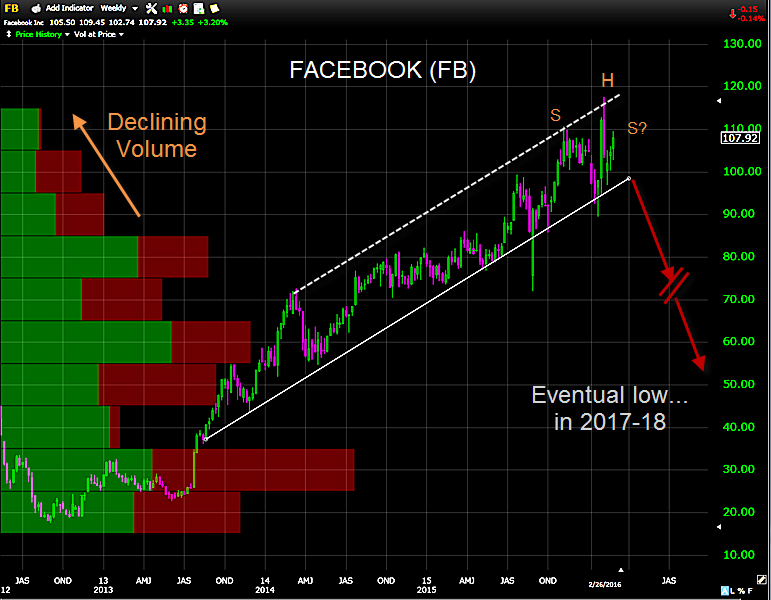

Based on a simple trend-following method I recently outlined for Trader Planet readers using a monthly chart with a trendline and a 13-ema, there is no technical indication that Facebook stock is about to perform an about-face. That said, the accompanying chart does indicate some slight vulnerability, including a possible weekly Head and Shoulders topping pattern. The real risk to FB, however, is nothing short-term.

During the last bear market, shares of AAPL where cut in half and at the 2008-2009 low, AAPL was finally trading at a reasonable valuation. FB currently has a trailing 12-month P/E of 83. If we do begin a bear market in 2016, and if it is accompanied by a global demand-driven recession, I suspect that Facebook shares will also be halved.

That’s why I’m watching FB as a ‘tell’ and why I don’t think there’s any need to rush in. Until FB breaks, the Bull still stands. Bear markets, however, mark-down even the best companies. During the next bear market, Facebook will only get stronger as a company, even as its shares slide. So I suggest keeping some powder dry so you can buy shares for your kids and grandkids when everyone hates the stock market again. Facebook is my #1 Pick… for 2018.

www.daytradingpsychology.com (Coaching for private traders.)

www.trader-analytics.com (Peak performance consulting to RIAs, hedge funds

and banks.)