Coming into 2016, global banks had already been underperforming the broad markets despite the economic recovery since the 2008-09 global financial crisis. From 2010-2015, Morningstar’s index of global banks only returned 2.3% annually, while the MSCI All-Country World Index returned 5.3% annually. Interestingly, this underperformance occurred despite the record-setting highs in global banking profits. According to McKinsey’s 2015 Global Banking Annual Review, after-tax global banking profits topped a record-setting US$1 trillion in 2014, driven by strong profit growth in China, North America, and rest-of-Asia.

Despite the impressive trajectory of global bank profits, investors have stayed away from bank stocks for the following reasons: 1) ongoing regulatory pressures resulting in higher capital requirements and other compliance costs, especially for systemically important banks, 2) weakness in European bank lending due to the lingering effects of the European sovereign debt crisis, and 3) concerns over increasing competition from non-bank entities such as “fintech” upstarts (e.g. Lending Club) or credit funds that are willing to lend to riskier corporate customers. Since the beginning of 2016, investors’ concerns over bank stocks have multiplied; specifically, investors have become more concerned about banks’ loan exposures in the energy sector as well as a slowdown in investment banking activity due to higher financial market volatility.

UBS—a global standout within the private banking industry (i.e. wealth and asset management services catering to high net worth families and individuals)—has not been immune from such concerns. While UBS has outperformed both the MSCI All-Country World Index and Morningstar’s index of global bank stocks, it stock price is still down 6.5% over the last 12 months. Over the long-run, I believe UBS will remain a stand-out among global banks, as the firm: 1) regains its strength and reputation as the premier global private bank, while others are exiting the industry, 2) pulls back on investing in other divisions where returns on equity (ROEs) are traditionally lower, and 3) is trading at a decent valuation while possessing one of the highest ROEs among global banks.

UBS has a market value of $59 billion, and an annual dividend yield of 3.5%. I find UBS to be a compelling play as part of a global banking recovery for the following three reasons.

1. UBS regains its strength and reputation as the world’s number one private bank in the world

UBS is the world’s largest (with US$2 trillion in assets under management) and fastest-growing (8% annual growth in assets over the last three years) private wealth manager. By and large, wealth management is a consistent, low-risk and highly-scalable business, as most of the revenues come from asset-based fees that are levied on a permanent base of capital. For UBS, its private banking division is also the most profitable, having consistently earned an ROE in the 40s.

Moreover—at its core—the private banking business is all about focusing on customer relationships. UBS, being the only truly global wealth management firm, can tailor each relationship according to its clients’ unique needs—whether they are estate planning, second-generation education, or finding unique private equity investments. Tailored relationships and strong deal flow has and will insulate UBS’ private banking division from increasing encroachment by fintech firms, i.e. robo advisors can never serve the unique needs of a typical UBS private banking customer.

2. UBS’ strategic focus on core, higher-return businesses

UBS’ strategic decision to scale back its highly volatile investment banking business and in general, reducing balance sheet-intensive activity in the wake of the 2008-09 global financial crisis has been and is key to long-term, sustainable profits. Because of this renewed focus, UBS has been able to: (i) achieve a Basel III common equity ratio of 14.5% in the most recent quarter, far ahead of the 10.0% requirement, (ii) lift the firm-wide ROE to over 11%, with plans to increase this further, and (iii) reduce the firm’s tail risks substantially, since it has now pared back from making direct loans to clients or investing in illiquid securities. While the firm does have some energy loan exposure, its investment banking activity today is mostly focused on the advisory and research side—areas that I feel UBS can effectively compete in.

3. UBS is one of the world’s best-run banks with a decent valuation

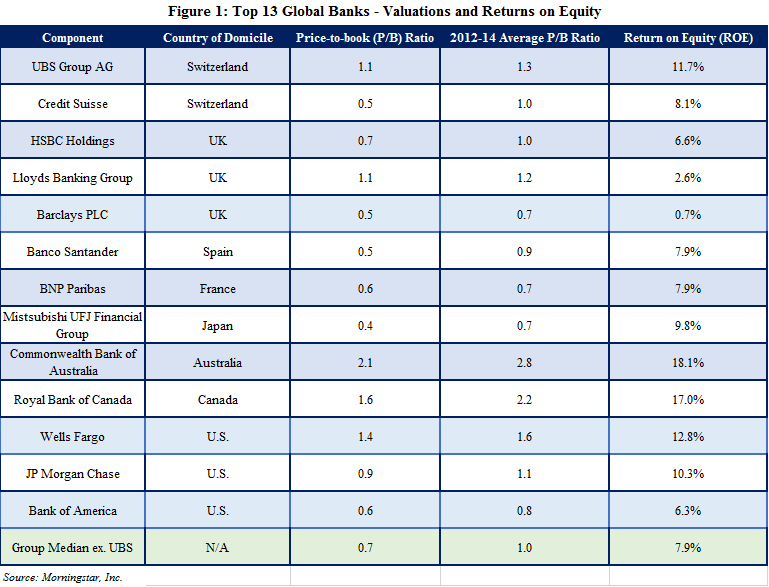

Given UBS’ status as the world’s number one private bank—as well as its sustainable, leading ROE—I believe UBS should trade at a valuation that is near the top of the valuation range for global banks. As seen in Figure 1 below, UBS’ price-to-book (P/B) ratio is 1.1, which is significantly below its three-year average of 1.3; it also trades at a 20% discount to Wells Fargo’s P/B ratio of 1.4 (although both banks have a similar ROE), and at the same valuation as Lloyds, the latter of which has a ROE of less than 3%. Over the next 12 months, I expect UBS to re-rate to at least its 3-year average P/B of 1.3. This re-rating, even assuming minimal earnings growth this year, should propel the stock higher by nearly 20%. My target price for the UBS ADR is thus $19 over the next 12 months.

Disclosure: My firm, CB Capital Partners and I do not hold shares in UBS.

Henry To, CFA, CAIA, FRM is Partner & Chief Investment Officer at CB Capital Partners. Established in 2001, CB Capital Partners is a global financial advisory and investment firm headquartered in Newport Beach, California, with an office in Dallas, Texas, Shanghai, China and an affiliate office in Mumbai, India. Visit http://www.cbcapital.com and http://www.cbcapitalresearch.com for more information.