As I noted a few days ago, the pessimism in the air from experienced traders should be taken as a contrary indicator. The rally won’t stop until ‘smart’ traders stop labeling it a bear market rally. I say this because what’s ‘obvious’ in the market is never worth anything. As a general rule in modern markets, one should fade the obvious and buy the surprise.

If pullbacks in an uptrend are considered signs of weakness, then the rally will continue. If pullbacks in a downtrend are considered signs of strength, then the downtrend will continue. That’s simply the way market psychology operates.

I noted in the recent article that the S&P futures are above their Volume Profile Point of Control over the last 60 trading days, which is 1920. That level is still important technical support and endorses the bullish thesis.

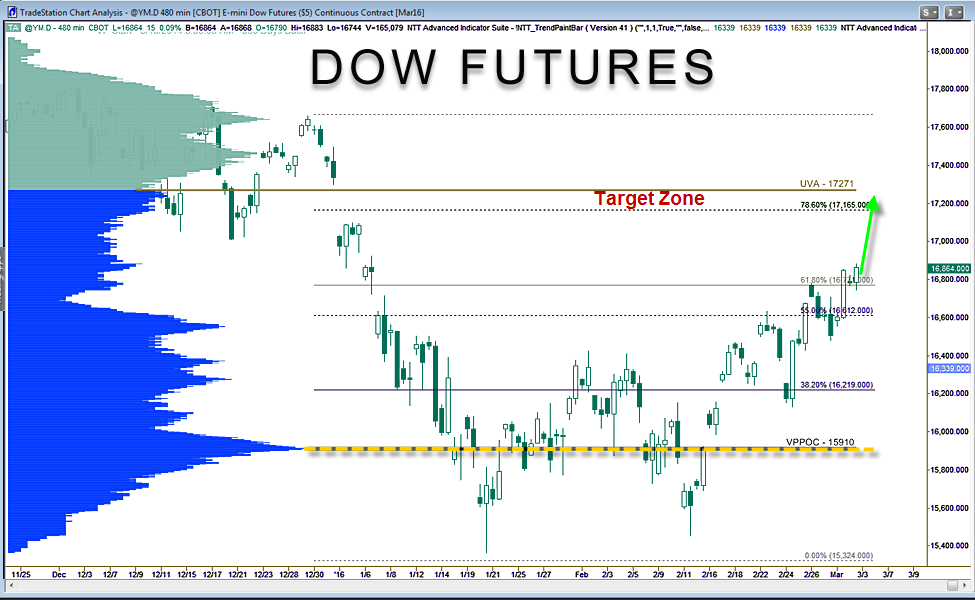

Similarly, the Dow is above its VPPOC from 2 years ago, which is 15,910. The Upper Value Area for the Dow is 17,271 and that’s the near-term target. It coincides fairly closely with the 78.6% retracement level of the January-February down swing. (By the way, the UVA level is calculated as one standard deviation above the VPPOC for a given look back period.)

With little volume resistance between here and the target (no humps on the accompanying Volume Profile chart), the up-move should be quick and direct… probably completed by Friday to make sure as many weekly puts as possible expire worthless. When people are losing money on their put options they either sell some premium or buy the common to hedge. The latter can add fuel to an already bullish run.

www.daytradingpsychology.com (Coaching for private traders.)

www.trader-analytics.com (Peak performance consulting to RIAs, hedge funds

and banks.)