A banker is a fellow who lends his umbrella when the sun is shining and wants it back the minute it begins to rain.Mark Twain

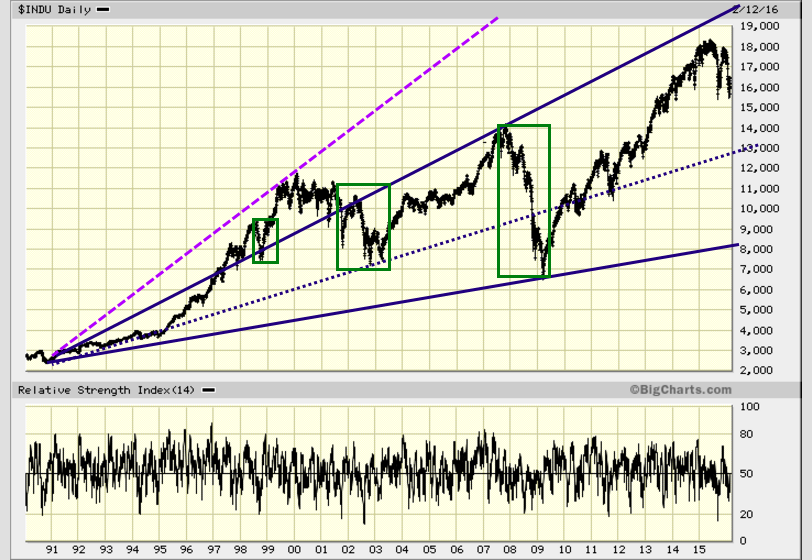

The current correction is the only one since 2011 that is real in nature, and it could prove to be a precursor to a larger upward move. If you recall, the dot.com era, the markets corrected strongly in 1998, it looked like the end was near but then the NASDAQ had its best year ever in 1999. It had tacked on gains of roughly 100%. The chart below highlights this dramatic reversal.

Throughout this bull-run, a plethora of reasons has been laid out to indicate why this bull should have ended years ago. Many of the reason laid out are valid, but being right does not equate to successful investing. The markets are not driven by logic; they are driven by emotion. What one needs to do is understand the emotional state of the masses and then one can plan a course of action. The masses are notorious for jumping in late and for jumping out too early. In both instances, their only gain is pain, for in terms of money they lose on both sides of the equation. Be wary when the masses are joyous and joyous when the masses are worried.

Game Plan

The Fed is on “Mission Speculate”; the end game here is to force as many people as possible to speculate in the markets. How will they achieve this? The mechanism being used is “negative interest rates”. We have moved into the next stage of the currency war games; the era of negative interest rates. Negative rates will eventually force the most conservative of players to take their money out of the banks and speculate

Consider making a list of stocks you would like to own over the long haul. Some companies worth taking a closer look at are GOOG, CALM, FIZZ, RTN, COST, CHL, etc.