The US Dollar Index has been trading sideways for nearly a year. We believe that the broad consolidation pattern is signaling a move higher and the consistent actions of the commercial trader group reinforce this notion. This makes the recent pullback a solid buying opportunity for a trend that could really get moving depending on the outcome of the FOMC meeting on the 16th. We’ll examine the Dollar’s backstory and briefly outline the current situation.

The US Dollar is trading at levels it hasn’t seen since 2003. Much of this is based on the notion that our economy is healthier than most. This is a relative term based on the size of our economy and where we currently stand in our economic cycle. The FOMC believes their swift and decisive actions during the 2009 meltdown provided the foundation our economy needed to snap back. It’s hard to argue based on headline numbers like unemployment, stock market values and the general absence of inflation. However, where we once looked to Chinese commodity demand to pull us through the depths of our crisis, China and Europe are now looking to us and wondering the same thing. Is the US economy strong enough to pull Europe and China through their own economic slack? Therein lies the crux of this month’s FOMC meeting.

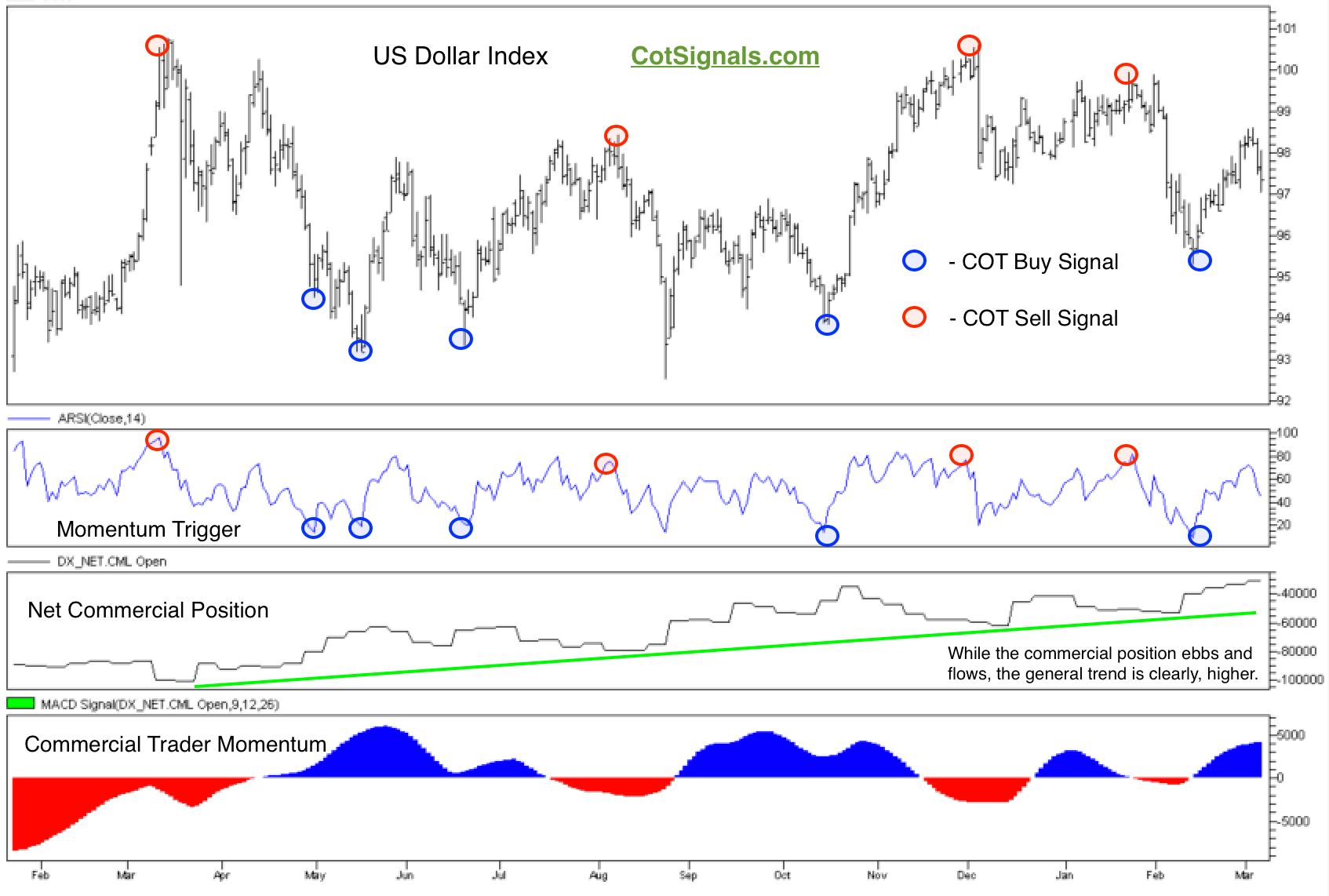

We usually refer to our methodology as a mean reversion or, reversal strategy because commercial trader valuation is the primary key to our actions. Their actions are based on whether a given market is over or, undervalued enough to impact their pricing models in which case, they’ll buy or sell accordingly as they expect prices to return towards their previous levels. However, there are times when a market is set to move structurally higher or, lower. The market’s players are acting in unison. This is what the commercial traders are doing in the US Dollar Index as you can see in the third pane of the included chart. While they’re still exhibiting their classic value hunting behavior as illustrated in the COT buy and sell signals, there’s no question that they’re net buyers. Their collective purchases are a clear indicator of their expectations of structurally higher prices ahead.

This brings us to the current situation. The commercial traders are buyers on weakness and we hope to emulate their actions. Therefore, further weakness here and below Friday’s low at 97 should be watched closely for buying opportunities. We think the market should hold above 95 and will place our protective sell stop accordingly once the trade is initiated. As always, we’ll issue the official signal and exact protective stop price in our discretionary COT signals once everything lines up.

Sign up for a 30-day free trial and receive all of the Discretionary COT Signals through the FOMC meeting and the end of the month.