Shares of Tesla were hammered during January and early February, ahead of its earnings report on February 10th.

In my last Tesla article in early February I forecast a short-term bounce to the $207 level and then a sell off. That rally did not materialize until after management’s earnings report, which held no negative surprises. Just yesterday TSLA hit $209 and over the last couple of weeks it’s been one of the best performing stocks in the entire market.

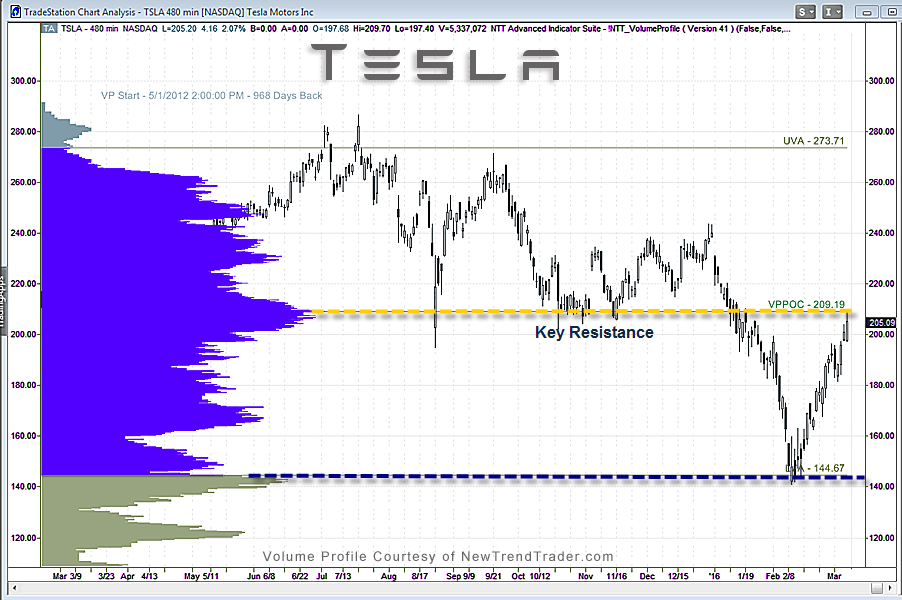

That said, the accompanying Volume Profile chart suggests that this level is a key resistance zone for the stock. It is the point of highest volume over the last 4 years, which makes it very likely that sellers will outnumber buyers at this level.

I love the company and plan to order a Model X this year, yet the bearish tone in the market is a difficult environment for speculative names with high levels of short interest.

If my long-term bearish thesis plays out for the overall market, I would then expect TSLA to stair-step down the support ladder to perhaps $122. If it breaks below $122 then the $100 level would be in play.

www.daytradingpsychology.com (Coaching for private traders.)

www.trader-analytics.com (Peak performance consulting to RIAs, hedge funds and banks.)