I began discussing an expected ‘bear market bounce’ for the market at large in mid-February. It was not difficult to see the signs of strength in the beaten down FANG stocks, as well as shares of Tesla. And I was also expecting Biotech to participate, but instead it came down with the flu.

For the Nasdaq, Biotech is one of the most important sectors, as its market cap nearly rivals the FANG gang. The sexy sector propelled the 4-letter index out of its last bear market swoon, but it is currently dragging on the snap, crackle and pop provided by the FANGs.

Indeed, if one compares a chart of the Biotech ETF (IBB) with a chart of Amazon, Alphabet or Netflix over the last few weeks it’s clear that the Biotech sector can barely get out of bed.

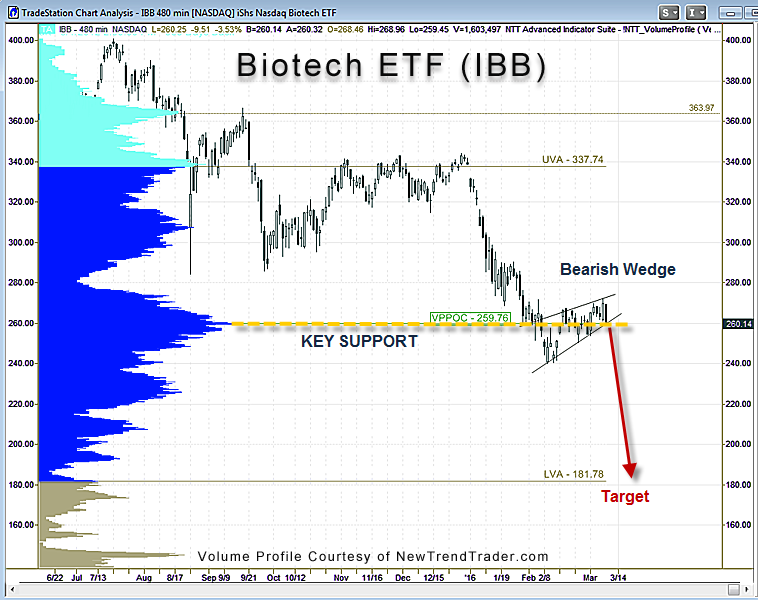

Instead of a nice V-shaped reversal, we have a technical pattern known as a “bearish wedge,” which is, as the name implies, bearish when it occurs in the midst of a downtrend. It is a consolidation pattern, not a sign of a trend reversal. Moreover, this one is particularly lethargic.

On Monday the Nasdaq 100 fell almost 1% due to a 3% decline in Biotech. The sudden drop puts the ETF right at its Volume Profile Point of Control, which acts as a key pivot for a stock or an index on all timeframes. The VPPOC represents the price at which the most volume was transacted for the lookback period, which in this case is 969 days. In other words, this is no ordinary pivot.

Here’s the key point: if IBB closes a couple of daily bars below $259, then market gravity will begin to accelerate shares toward the Lower Value Area (LVA) boundary at $181. That will morph the flu into full blown pneumonia and take the ETF patient into the ICU.

www.daytradingpsychology.com (Peak performance coaching for private traders)

www.trader-analytics.com (Services for traders at RIAs, banks and hedge funds)