Fear is a powerful motivator and a ‘healthy’ emotion. One thing people often don’t realize when thinking about fear, however, is that fear is triggered not only by danger, but also by opportunity… the flip side of danger. And in fact, in trading the two are inseparable.

As a result of this split, there are two types of traders, those who are mostly motivated by the fear of missing out… and those who are mostly motivated by the fear of losing.

Those who are afraid of losing mostly miss out, and those who are afraid of missing out mostly lose.

In clinical terms, this double-sided situation is called approach / avoidance and it is one of the most psychologically stressful problems that humans ever face. Approach avoidance is like driving with one foot on the gas and the other on brake. You rev your engine to the red line, but get nowhere.

It’s like a double bind. People naturally try to avoid double binds and yet in trading we face them all the time. No wonder traders get stressed out.

Aspiring traders make this polarized Approach/Avoidance situation worse by focusing on just one side of the coin, usually reward. But when we do that, when we ignore the reality of the risk and focus exclusively on the upside, we feel emotionally ambushed if the market doesn’t go our way. This throws the trader into a never-ending Cycle of Hope and Despair, or for some traders, endless bloody brawls with Mr. Market.

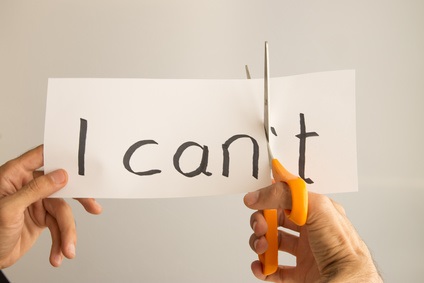

What’s the way out?

There is no reward without risk. To balance the Reward and Risk equation means that we must give the same level of attention to risk that we pay to estimating the potential for reward. If we can hold both possibilities in our mind simultaneously, the potential win and the potential loss, we will eliminate the possibility of being blindsided by nasty surprises, which is what we were afraid of in the first place. If we prepare for the loss in advance and manage position size properly, any loss loses most of its sting.

Therefore, pay equal attention to both.

www.daytradingpsychology.com (Coaching for private traders.)

www.trader-analytics.com (Peak performance consulting to RIAs, hedge funds

and banks.)