The $10 per barrel rally in crude oil has now brought the market more than 35% off its low made just one month ago. The recent rally could find increasing its gains difficult as it heads into seasonal and technical resistance as you’ll see on the enclosed chart.

There are a couple of large factors at work in the current crude oil environment. First of all, crude oil pricing has clearly shifted its traditional trading boundaries. Crude oil has made every attempt to install systemically higher prices since 2000 when US consumption ramped up on imported oil and drove prices above $140 per barrel thus, auguring in the fracking era. The rush to exploit North American reserves at very profitable margins in the name of, “energy independence” has now created a supply glut and driven prices back to the original $25-$40 per barrel of the early 2000’s. The supply glut is expected to take at least a year to work through at current economic activity levels. However, it is quite possible that forward global GDP will be revised downward as major economies enact negative interest rate policies. Thus, prolonging the supply overhang. Classic economics leads us to believe that prices will equalize, “at the margin” where the most efficient producers can capture market share at lower total prices. We think the 2016 equalization level will be less than $40 per barrel.

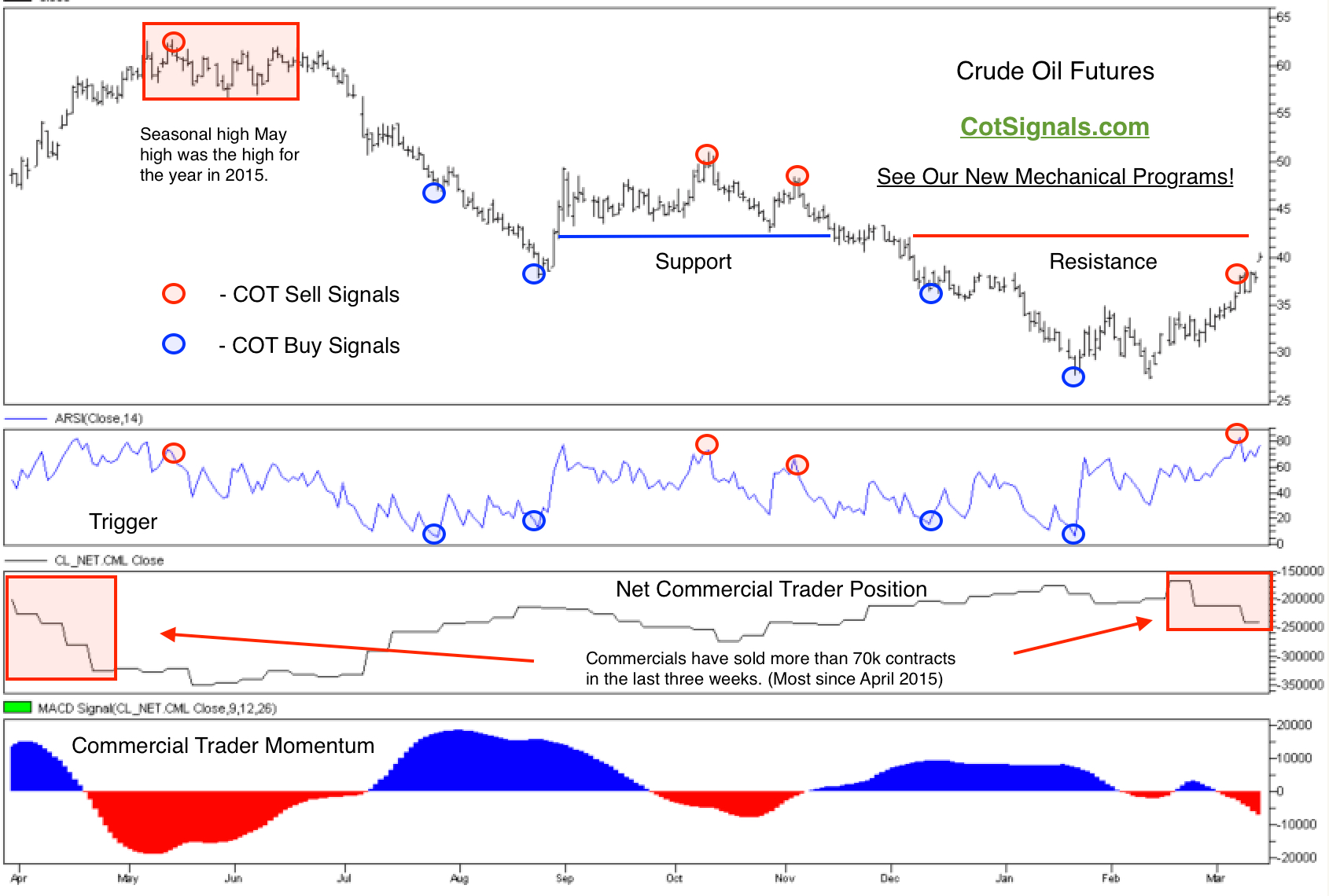

This brings us to the current situation as the recent rally begins to test resistance at $40 per barrel while heading into a classic seasonal peak. We think crude oil’s new upper boundary will be defined by the resistance at $42.50 which had acted as support this past fall. This will also time out well with last of the refiners’ buying as they prepare for Memorial Day’s kickoff of the summer blends and the seasonal peak occurring near the end of April. You can see on the enclosed chart this year’s pattern is taking on a pretty similar appearance to last year’s.

Crude oil is currently overbought on a short-term basis and overvalued based on the commercial traders’ collective actions. When we combine this with overhead technical resistance and the expectation of a seasonal peak, it puts us on the lookout for sellable rallies or momentum reversals lower. Many of these factors have been included in our fully mechanical Commitment of Traders programs. We’ll update this scenario accordingly and announce the sell signal once it’s officially triggered.