Fed scenarios and interest rate rhetoric abound but there’s one story teller that will not lie… the chart.

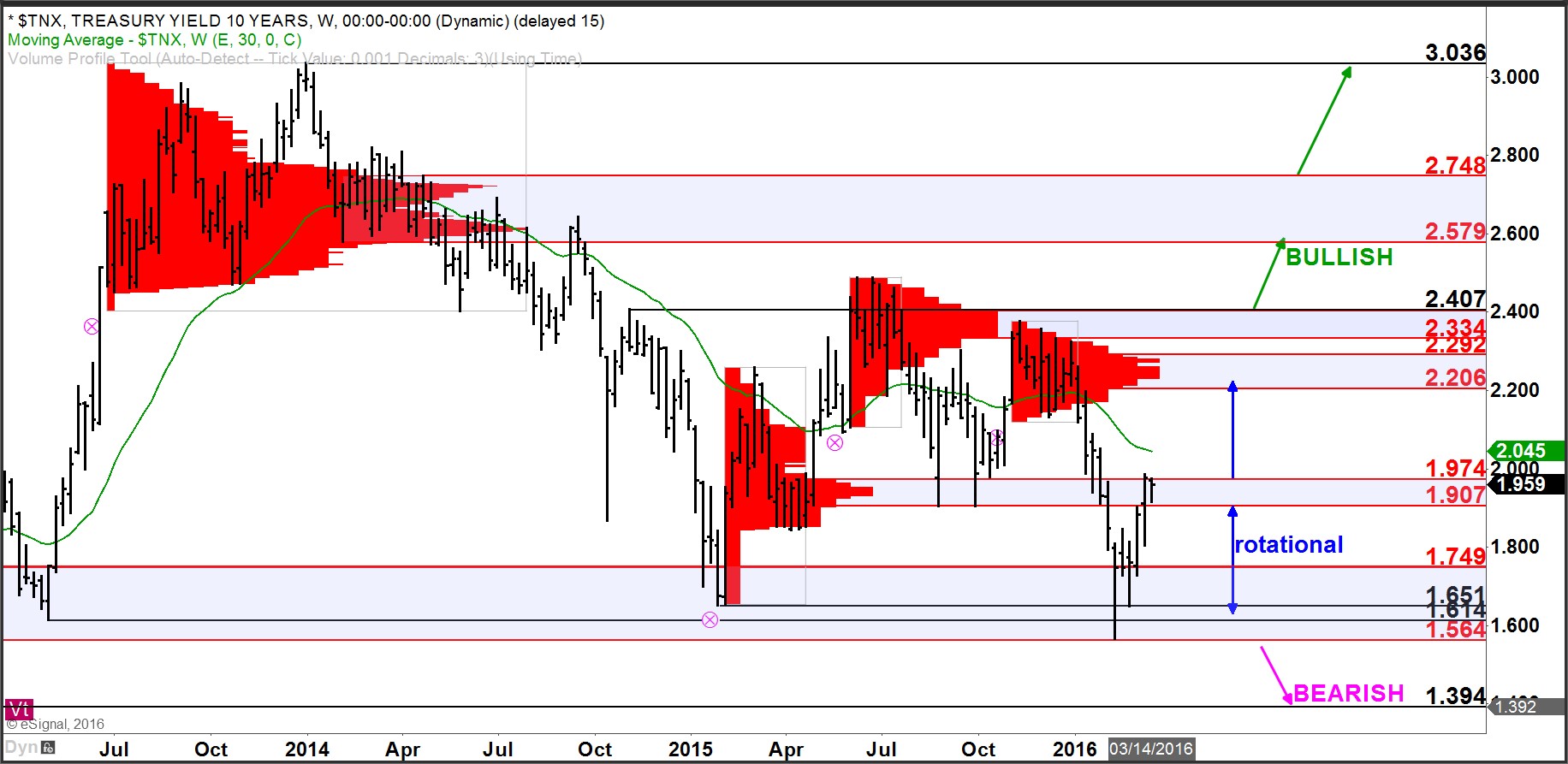

Interest rates, as reflected by the ten-year yield ($TNX), are back testing resistance at 1.907 – 1.974. Any move above this zone of resistance, where rates have currently paused, will open the door for further upside. This would mean higher rates dead ahead.

Click here to watch a video explaining how to read any market using volume at price.

On any move above 1.974, the next upside target / resistance zone in the ten-year yield is at 2.206 – 2.292.

The lows in ten-year rates earlier this year held the key zone of support that was established several years back at 1.564 – 1.651. This key zone of support remains intact with higher support established at 1.749 on any pullback.