I have never been a fan of making market predictions. The reason? Simply because if I was honest to myself, I get it wrong as much as I get it right.

However, that is not to say that I don’t have an opinion from time to time and become cautious when I believe the market has gone up too far, too quickly.

A false market reversal in late January, resulted in vanishing expected profits. The market fell back to where it was by mid-February.

However, from mid-February, as the world was all playing to the same tune about oil price collapsing even further, the market surprised most with an incredible 10% upwards move since then.

This goes to show that no one really knows, so you can only prepare and react when the time comes.

With the market up over 10% from both the January and February lows, the question is, has the market run too far ahead of itself?

In my humble opinion, yes. Both fundamental value as well as technical parameters indicate so, despite the daily sentiment of Fed rates, negative European rates and oil prices which are driving market index levels.

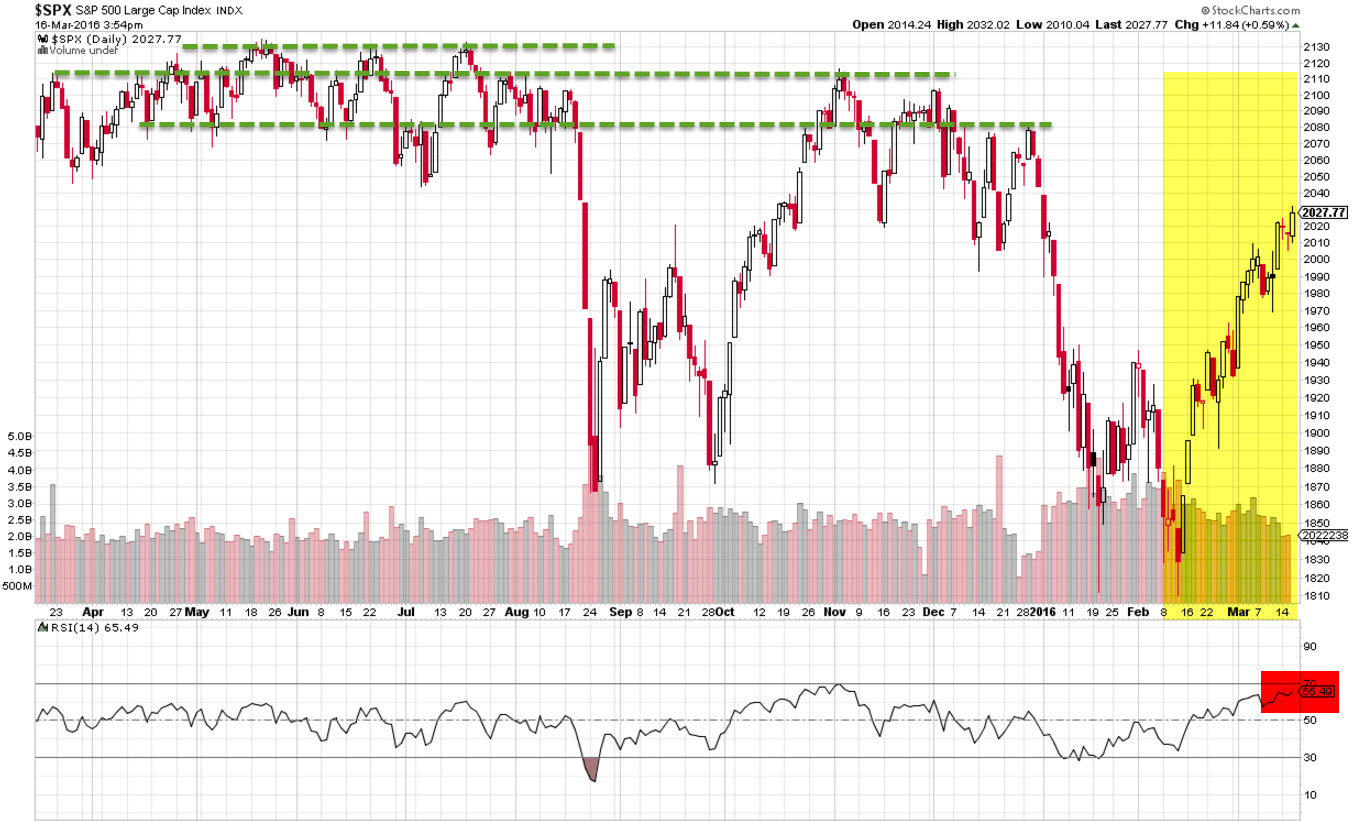

Can the market go even further higher from here? Of course it can. However, with strong resistance sitting at the 2080-2130 level, which has failed over ten times since mid-2015, there is certainly a higher probability for the market to drop back to January and February lows, than advance a further 4% towards the 2100 resistance level.

Multiple momentum indicators like the Relative Strength Indicator (RSI), also suggest the market has moved into overbought territory and it is only a matter of time that a market reversal will occur.

Added with the fact where there has been literally no bullish investment or trading opportunities in the past fortnight for value investors like myself to buy into and support the market, we may want to turn our attention into protection mode.

While there has been talk that there is plenty of money sitting on the sidelines, value managers have already made their bulk purchases during the January and February lows and they have since pulled back from their buying in recent weeks, myself included.

One must never forget that the market is made up of individual people like us, as well as big institutions buying and selling, and it is demand and supply that drives price direction. Without excessive demand at current levels, the overall market will struggle to advance much further.

So am I totally bearish on the American economy and do I think there is a recession any time soon?

Not at all, and far from it. All I am doing is preparing for another market decline to take advantage of in coming weeks or months.

Like a lot of other ‘smart money managers’, I am also waiting patiently for another opportunity to come by.

There is no need for rush in this volatile market. Safety always comes first before making profits.

Find out how you can safely increase your returns, even in current volatile markets, click here.