There are some interesting things going on in the coffee market. Fundamentally, the El Nino in the Pacific has brought drought to Brazil, Columbia, and Vietnam. These are the three largest growers of Arabic coffee in the world. They compromise about 70% of world production (as of 2014 statistics).

The El Nino event has seriously reduced production, but hard estimates for the fall harvest (our spring) are not yet in. Also consider that there are some areas in South America that are experiencing a sever fungus that will also reduce production. With northern Brazil enduring the worst drought in 80 years and the Roya blight, the outlook for the supply of coffee beans does not look upbeat.

Also consider the fact that with the dollar strong, and the Brazilian Real in the dumps, there has been a big incentive for producers who have held inventory to liquidate. Add to that the economic crunch in South America, and it is not surprising that old crop supplies have fallen. This exacerbates the future inventory constriction with the reduction in this years crop.

Until now, the price of Arabic coffee (the NYBOT Contract), along with many other commodities have been in a brutal bear market. Falling demand in China, Europe, and questions about US Federal Reserve policy have all been weighing on prices. Yet there seems to be a light at the end of the tunnel for commodity bulls (see recent artilce on gold). If commodities have truly bottomed, which I believe, coffee has some major upside in price.

Technically things are looking better, but no real confirmation has been given yet to convenience me. First, the weekly ADX in the chart above needs to turn up. At such a low level, that would be a huge positive signal for price.

Some might look at the fact that weekly price has pushed above the upper Bollinger band as bearish, I do not. The fact that the band has become so narrow suggests that the market is coiling and a breakout imminent. Further upside in the price of coffee will probably start to push the bands and cause them to expand away from each other. That would be a very bullish development.

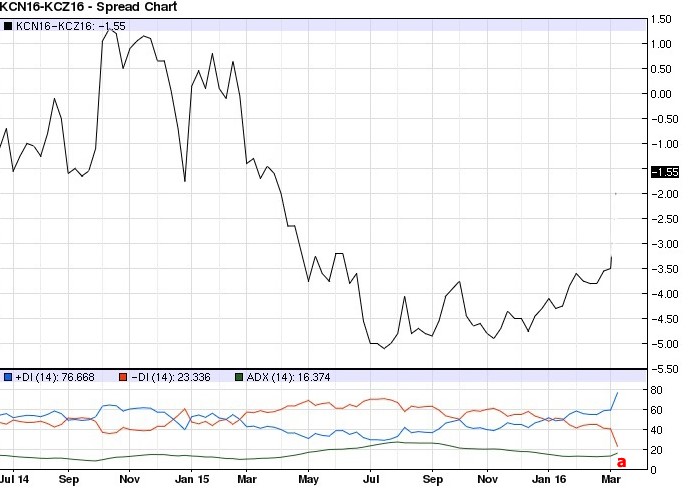

Another indicator that I have been watching is much more convincing. If indeed there will be a shortage of coffee due to a poor harvest we should see tightness begin in the spreads. That means there should develop a premium in the front months to encourage supply on to the market. The chart below of the weekly July 2016 and December 2016 NYBOT contract seems to suggest this is happening. Also notice how the ADX (lower green line) has turned up (a).

One of the things I like about spreads is that they are a wonderful leading indicator. That is they seem to be ahead of the game in calling a turn in price.

There are several options if one were to consider taking a bullish position in coffee. Obviously the first would be to just buy the contract outright. However, I believe if you wanted to invest in the prospect of higher coffee prices due to the current drought, you would be better served buy buying the July/December spread. It would reduce the risk if the commodity turn was just a bounce, but still give you plenty of leverage if this move was for real.

Monitor the weekly Bollinger Bands and ADX for confirmation that an uptrend has started.

TO RECEIVE MORE ANALYSIS, VISIT PAUL’S website