For the Nasdaq, Biotech is one of the most important sectors, as its market cap nearly rivals the FANG gang. Lately, the sector has dramatically underperformed the rest of the market. Blame it on a contagion from companies like Valeant (VRX) that appear to have systemic management issues. While biotech swooned, chips took over the heavy lifting for the 4-letter crowd.

Last week I was short Biotech and long the rest of the market, but that trade had me worried. Generally, it’s not a good idea to be short the weakest sector in a strong uptrend, but if you do a “pairs trade,” be surgical about your entries and exits.

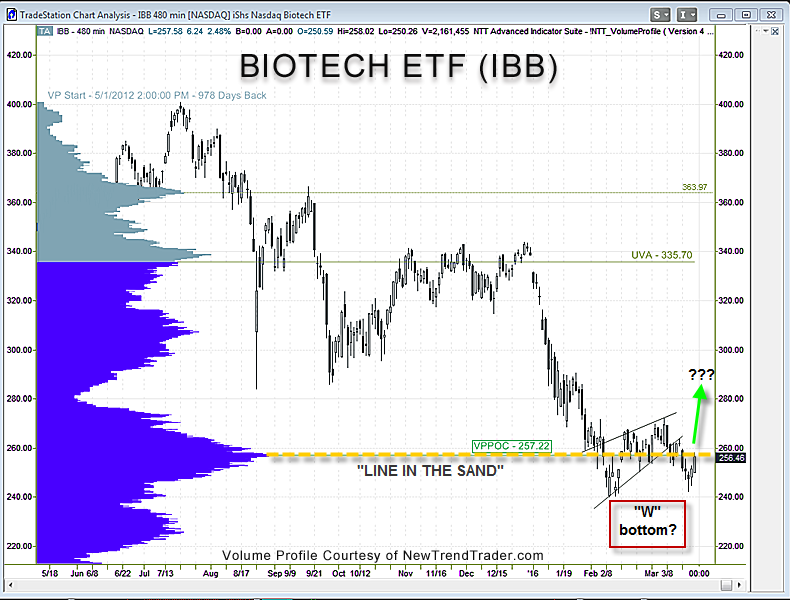

As of Monday night, it appears the biotech ETF is trying to print a ‘W’ bottom. This is occurring at a very key level for IBB, the Volume Profile Point of Control at $257. The VPPOC represents the price at which the most volume was transacted for the lookback period, which in this case is 969 days. In other words, this is no ordinary pivot. It is a line in the sand.

Most pundits are very skeptical of this rally and are calling (praying) for a top. I think their stubbornness will propel this market to new all-time highs. It is unknown whether biotech will participate. If it does, then we get a blow off rally, which is what I’m expecting. But if it doesn’t, we just move steadily higher, without much momentum.

For clues, watch how IBB acts in the next few days. A close above $272.07 will ignite the Nasdaq.

www.daytradingpsychology.com (Peak performance coaching for private traders)

www.trader-analytics.com (Services for traders at RIAs, banks and hedge funds)