Spring can be great time to be a grain trader, especially if you sell options.

Springtime means planting season. As we mentioned in last months newsletter, planting season can bring public speculation. And public speculation can mean option premiums getting inflated. The great thing about trading grains is that the fundamentals are readily available for anyone who takes the time (and knows how) to read them. Clear, reliable data is accumulated and published by the USDA and other private sources.

We’ve analyzed the data for corn in early 2016. Our conclusion is that barring some sort of unforeseen and severe weather event, corn will be a call sellers market for the next several months – possibly longer. Below are our top three reasons you may want to consider taking corn call premiums this spring.

3 Reasons For Selling Corn Calls this Spring

1. Fundamentals

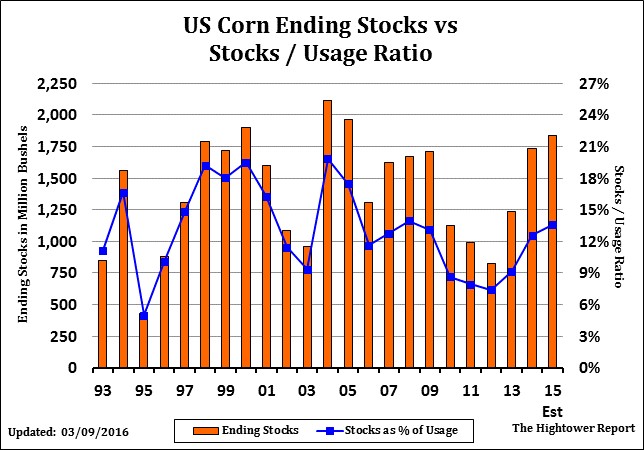

Before we even have a kernel of corn in the ground, the US corn market enters planting season with a considerable supply cushion. The March 9 USDA supply demand report shows US Corn ending stocks at 1.837 billion bushels – the highest in a decade. US stocks to usage is projected at 13.6% – the highest since 2007/08.

As farmers gear up for US planting season, the USDA has already begun forecasting 2016 production. The picture here suggests even bigger supply overhangs in 2016/17.

Corn plantings for 2016 are projected at 90 million acres, up 2.0 million acres from the 2015 final estimate. US 2016 Corn production is estimated up 2% over 2015 with 2016/17 supplies pegged at 15,702 million bushel – a new all time record.

US corn 2015/16 ending stocks are projected to be the largest in over a decade.

Globally, the picture remains similar. The USDA pegs world corn 2015/16 ending stocks at 206.97 million metric tons – the highest since 2005. All of this in the face of sagging US ag exports as a result of a stronger dollar. Overseas shipments of US farm commodities are expected to decline 10.5% in 2016 from 2015’s already reduced levels.* (Source: Kiplingers Ag Letter) The USDA is reflecting this expected rise in supply vs limited demand in its season-average on farm price. USDA pegs 2016/17 average corn price at $3.45 per bushel – down .15 cents from the midpoint of the projected range for 2015/16.

At time of this writing, the price of new crop September corn futures trades at $3.74 per bushel.

(To learn how to use the key fundamental figures of Stocks to Usage and Ending Stocks, in commodities option selling, be sure to watch Michael Gross’s informative video How to Trade Agricultural Fundamentals)

2. Seasonal Tendency

There is a historical price tendency for new crop corn prices tend to decline as Spring progresses. Through the winter months, prices have tended to climb as the market works through supplies from the previous fall harvest. As planting season approaches, anxiety can build ahead of planting as weather concerns and uncertainty often bring speculators into the market. As planting gets underway and the crop gets “put in the ground,” anxiety, along with prices have tended to fade. This pattern, however, is not written in stone. This is an average. Bona fide weather problems in the US Spring can bring price rallies with them. In addition, prices have been weak for much of the US winter, likely the result of larger supplies. Nonetheless, seasonal tendencies clearly reflect a weaker historical price pattern for corn prices during US Spring.

(To learn more about how to use seasonal tendencies in option selling and see the best ones for commodities investors, be sure to review chapters 15 and 16 of The Complete Guide to Option Selling – 3rd Edition)

3. Volatility

Spring is a great time for grain speculators and 2016 is no different. Distant call strikes have opened up with hearty open interest in the new contract months. We were even surprised to see the premium currently available at price levels that (in our opinion) could only be obtained through some kind of powerful and sustained weather event.

The speculators are out this month buying their lottery tickets (deep out of the money call strikes) ahead of US planting. It’s likely that very few of them have done their fundamental homework.

There is talk of wet field conditions in the Delta and perhaps further north into Arkansas delaying planting in some areas. But that is a side story – and there will surely be more this spring. That doesn’t mean a price rally. We advise traders to stay focused on the big picture (presented above) and gladly sell lottery tickets to these willing buyers.

Conclusion and Strategy

With burdensome supply issues and the seasons working against them, corn prices would seem to have a ceiling above them this Spring. That being said, not a kernel of corn has yet been planted. Wetness has been a concern in the South. And as of the latest commitment of traders report, funds hold a record net short position of 247,113 contracts. This will leave the corn market vulnerable to short covering rallies this spring. However, with the massive supply overhang and projections for record corn supplies this fall, rallies should be limited in nature and treated as call selling opportunities.

SEPTEMBER 2016 CORN

Selling the September Corn 4.50 Call Option

We like the September 4.50 calls at premiums of $400-$500 each should corn see a price rally leading up to or immediately after the official planting intentions report on March 31. Slightly more aggressive traders may seek to sell the September 4.40 calls now and add 4.50 or higher strikes should the market rally.

We’ll be working closely with our managed accounts to sell options in the grain markets this Spring. If you would like to learn more about opening a managed account to sell options in corn and other commodities, be sure to request our free Investor Discovery Pack at www.OptionSellers.com/Discovery . Recommended investment is US $1 Million.

James Cordier is president and head trader of OptionSellers.com, a global wealth management firm specializing in option selling portfolios.