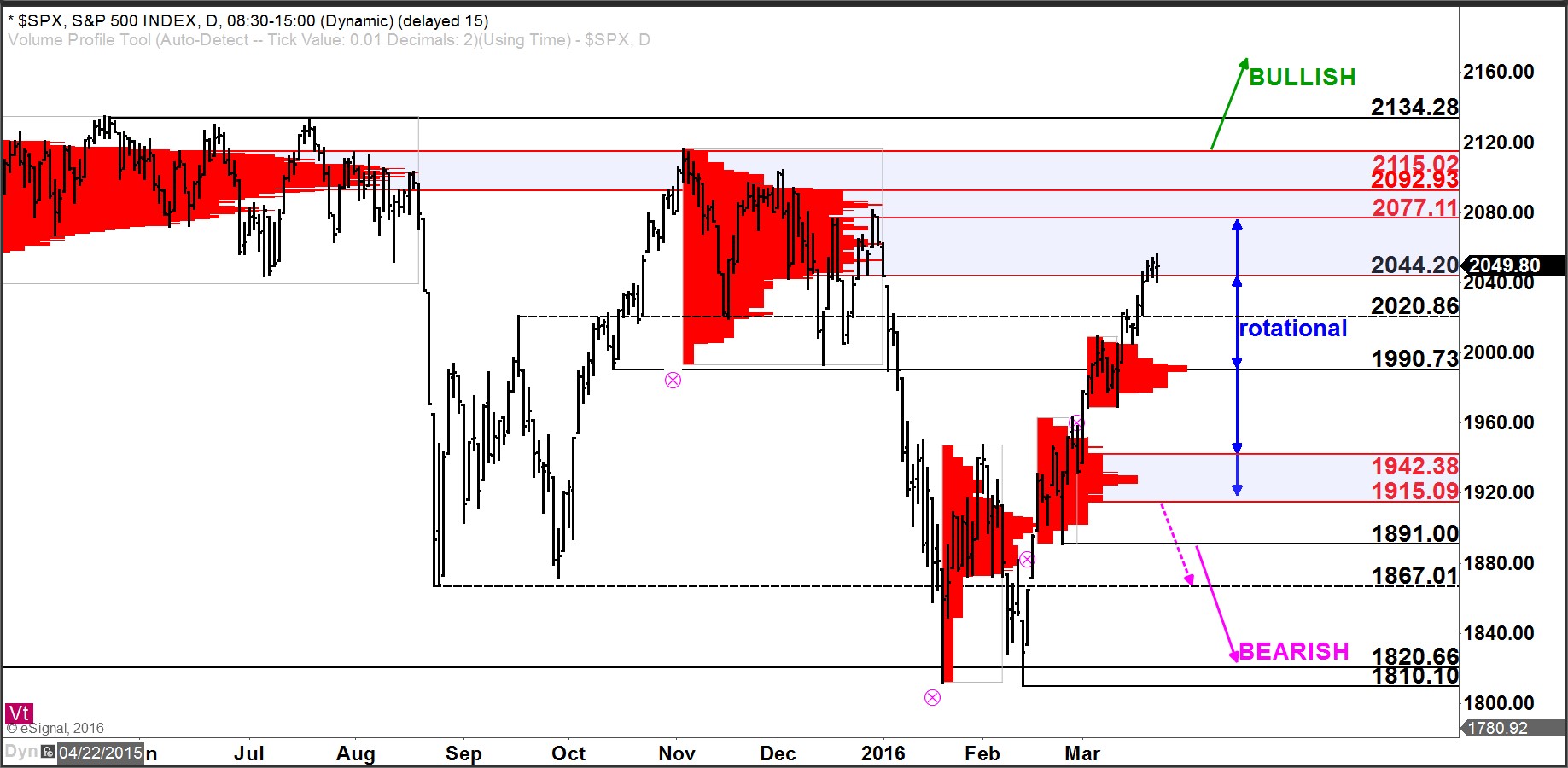

The S&P 500 index has hit an important zone of resistance. The SPX has progressed just as I laid out 3 weeks ago in my TraderPlanet article from March 2nd, Bulls Turn the Tide in Stocks, where I called for the S&P 500 to continue immediately to the upside targeting 2044 – 2092.

Click here to watch a video explaining how to read the stock market using volume at price.

This zone at 2044 – 2092 is a bit of a wide zone of resistance but my expectation is that the upside momentum will give way to rotational price action and any further attempts higher will be tempered by selling.

Given the strong run into this area, it is unlikely that the SPX would reverse itself and begin a persistent decline straightaway. The more likely scenario is that the index establishes a rotational range with highs within this zone of resistance and lows near support at 1990. In this scenario, the next persistent directional move would follow a period of consolidation/rotation that is presently setting in.