The stock market has been on a tear since mid-February with the S&P 500 up about 12% during this span. But, the IPO market has barely nudged and the doors have remained closed – with one exception. So far in 2016, there have been seven IPOs (not including blank checks), and each one of them has either been a pharmaceutical or biotech company.

This trend is a continuation of what we saw in 2015, when well over half of all IPOs were healthcare-related. Within the healthcare space, there has been a particular interest for pharmaceutical companies focused on immune-oncology due to the promising clinical trial results occurring there.

Two well-known names in the field are Juno Therapeutics (JUNO), which went public on December 19, 2014, and Kite Pharma (KITE), which went public on June 20, 2014. As we discuss below, those two stocks put in monster gains following their IPOs.

Which brings us to the next immune-oncology company to go public: Corvus Pharmaceuticals (CRVS). Like JUNO and KITE, there is plenty of promise and it could be on the path to a major break-through in cancer research. However, it is a very early stage company and CRVS has not secured major third party partnerships with global pharmaceutical companies, as JUNO and KITE has.

A Closer Look at Immuno-Oncology

CRVS is a clinical stage biopharmaceutical company that is focused on developing and commercializing immuno-oncology therapies designed to harness the immune system to attack cancer cells. Before discussing CRVS and its programs in more detail, it’s helpful to have some background on immuno-oncology in general.

Immuno-oncology therapies are designed to stimulate or enhance immune responses to tumors, and, are thought to have a few key advantages over other therapies. For instance, the immune system exhibits immunologic diversity and selectivity, which enables it to response to a large number of potential targets.

Additionally, once triggered, the immune response can be amplified, offering the potential to enhance the efficacy of treatment.

And lastly, once activated, the immune system possesses immunologic memory, potentially providing for a durable and long-lasting response.

Immuno-oncology is drawing quite a bit of enthusiasm in the cancer research field, as well as among investors. In the recent past, there have been a few other immuno-oncology focused companies to go public.

Most recently, on March 3, Syndax Pharmaceuticals (SNDX) went public, pricing its 4.4 million share IPO at $12, below the $14-$16 expected price range. After a forgettable opening at $12.11, shares spiked up to $16.30 on March 9, then promptly coughed up those gains, but the stock again surged higher on March 22, and is currently up 11% versus its IPO price.

Prior to SNDX, there were a couple huge gainers in this field. Specifically, Juno Therapeutics (JUNO) is currently trading 58% above its IPO, and gained as much as 189% at its peak; and Kite Pharma (KITE) is currently trading 165% above its IPO price and gained as much as 429% at its peak.

CRVS’ Clinical Pipeline

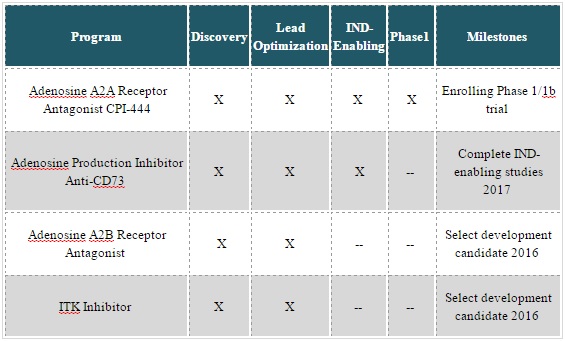

CRVS has a pipeline of four immuno-oncology programs, three of which focus on the adenosine-cancer axis to modulate an immune response. Adenosine activates an immune checkpoint (adenosine A2A receptor), that is used by the body to limit inflammation and immune responses. The company says that several pre-clinical tumor model studies have shown that treatment with A2A receptor inhibitors can counter these survival mechanisms and lead to tumor regression, and that this effect can be further enhanced when administered with various other checkpoint inhibitors. CRVS’ fourth program is aimed at developing product candidates that regulate T-cell activation and differentiation by inhibiting interlukin-2 inducible kinase (ITK)

Its lead product candidate is CPI-444, an oral, small molecule antagonist of the A2A receptor of adenosine. This January, the company began enrolling patients in a large expansion cohort trial. This Phase 1/1b trial is designed to examine safety, tolerability, biomarkers and preliminary efficacy in several solid tumor types, both as a single agent and in combination with Genentech’s investigational cancer immunotherapy, atezolizumab.

CRVS’ has another lead candidate for a second program, an anti-CD73 (an enzyme that mediates the production of adenosine during acute inflammatory processes) monoclonal antibody that inhibits the production of adenosine. The company plans to select development candidates for its other two programs this year.

Financials

Since its inception, the company has funded its operations primary through the sale of convertible preferred stock. In November 2014, January 2015, and June 2015, it received aggregate net proceeds of $33.3 million from the sale of its Series A convertible preferred, and in September 2015, it received net proceeds of $74.8 million from the sale of its Series B.

As of December 31, 2015, CRVS had cash, cash equivalents, and marketable securities of $94.4 million. The company does not expect its capital resources — including the proceeds from this IPO — to be sufficient in funding the completion of its clinical trials and the remaining development program of CPI-444 through commercialization.

To date, the company hasn’t generated any revenue, nor does it expect to receive any revenues from product candidates that it develops unless and until it obtains regulatory approval and commercialize its products or enter into a revenue-generating collaboration agreement with a third party.

For the year ended January 31, 2015, CRVS had a loss from operations of ($13.7) million compared to ($161)K in the year ago period.

Conclusion

Investors haven’t been enthusiastic about IPOs for quite some time, but, one area that has captured investors’ attention has been oncology-focused pharmaceutical IPOs. This has the potential to work in CRVS’ favor. However, it is worth noting that CRVS’ main product candidate is only now beginning to enroll patients in its Phase 1 trials. Other recent IPOs involved in immuno-oncology have candidates that are more advanced.

For instance, Juno Therapeutics (JUNO) has a Phase 2 trial ongoing for acute lymphoblastic leukemia and Kite Pharma (KITE) has already announced Phase 1 data from its study for KTE-C19 for the treatment of non-Hodgkin Lymphoma.

It is also noteworthy that CRVS currently does not have any development partnerships with large-scale pharmaceutical companies. On March 17, KITE announced a clinical collaboration with Roche’s Genentech, and, Celgene has partnered with JUNO, which also invested heavily in the company.

In sum, CRVS could perform well simply because it is an immuno-oncology play, but, it doesn’t seem to stack up favorably to the CAR-T recent IPOs of JUNO and KITE.