Nickola Tesla was a quirky genius, a supremely gifted inventor and a very poor businessman. There were times in his life when he was flush with cash, but mostly his research was supported by philanthropy from wealthy friends.

When he did make important discoveries, such as the fact that alternating current is better for a power generation grid than direct current, he gave away his right to royalties, which would have probably made him the richest man in America.

There are some obvious parallels with Tesla Motors. The company has a reputation for being visionary, but also ahead of itself. Management is nevertheless attempting to turn this ‘character flaw’ into an asset by asking its customers to deposit $1000 to get on the waiting list for a Model 3. Furthermore, it has boldly suggested that would-be owners should purchase a Model S or Model X if they want to move to the head of the Model 3 line.

Shares of Tesla were down 6% on Wednesday after S&P Global Market Intelligence’s Efraim Levy cut shares to a “Sell” citing valuation and execution risk. Plus the company has a $155 target on the stock.

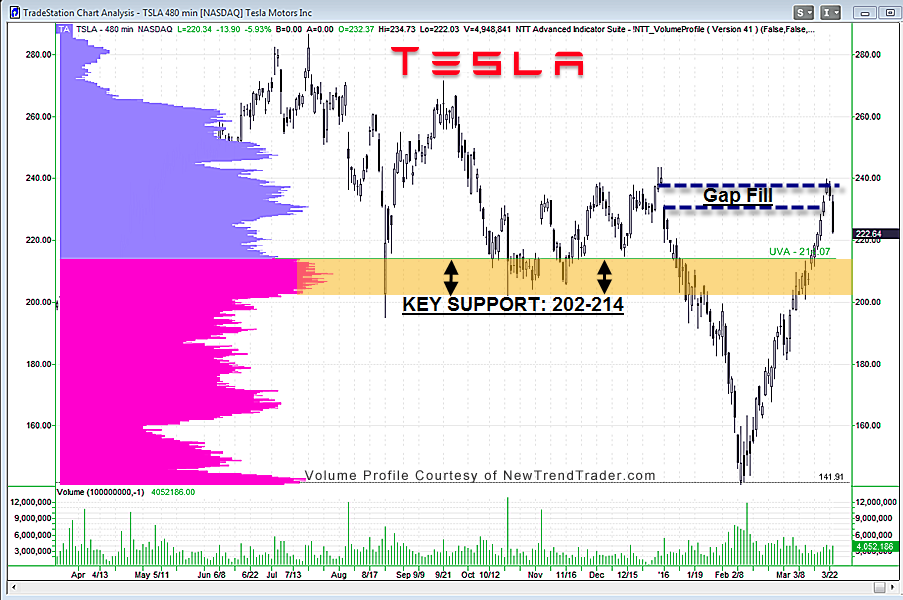

Having rocketed from the $140’s to the $230’s for a perfect gap fill, Wednesday’s blip is the first significant down-day in more than a month. The question du jour is “how far will it fall?”

Based on a simple Volume Profile analysis, TSLA has support between $202 and $214. This is the gold area on the accompanying chart. A move below $200 suggests institutional distribution is underway. I have my doubts about that bearish scenario, however, especially if the general market heads for new highs, which is what I’m expecting.

I’ll be looking to buy the TSLA dip.

www.daytradingpsychology.com (Peak performance coaching for private traders)

www.trader-analytics.com (Services for traders at RIAs, banks and hedge funds)