A month ago I noted that although Facebook (FB) sold off after reporting stellar earnings numbers in late January, the stock has been by far the strongest member of the celebrated ‘FANG’ gang and there are good reasons for the relative strength.

Facebook has over 1.5 billion monthly active users (MAUs). Its in-house Skype-like service (WhatsApp) has over 1 billion monthly users and all calls to phone numbers are free, which makes it better than Skype. Facebook also owns Instagram, which has over 400 million monthly users. To put this in perspective, Twitter has a mere 320 million monthly users.

Facebook has more ‘friends’ than any company anywhere has ever had and it is starting to carefully monetize that friendship network. We are talking 40% annual revenue growth, $18 billion in cash and virtually no debt. Although Facebook is not the most profitable company in the world, it is one of the most efficient in generating revenue per employee ($1.4 million).

The company is a community on the outside and an advertising agency on the inside. 80% of Facebook’s revenue comes from mobile ads, a market segment growing revenue at 30% annually. Management knows much more about its members than Google ever will and that’s why FB is ‘special.’

It’s also why Facebook plays an unusual role in the market and not just the Nasdaq. Its 2-letter trading symbol aptly suggests a more elite status and I believe the company is indeed the key market leader at this time. We won’t have a true and scary bear market until Facebook actually breaks.

Stocks like Autozone (AZO) and some of the small cap semiconductor plays are making new all-time highs, which is always ‘nice,’ but what really matters is whether Facebook does.

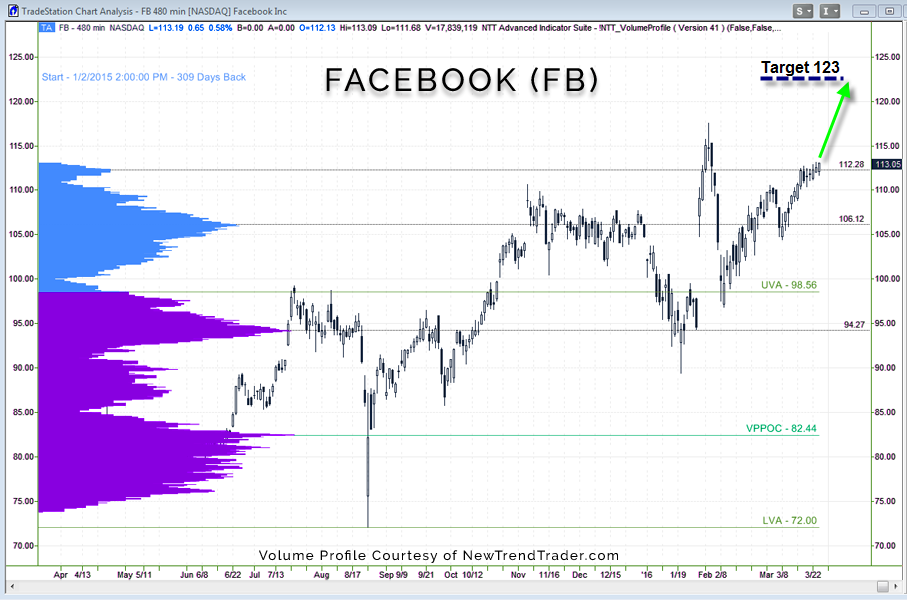

I believe this will happen this very week and it will cause even more short-covering and panic buying that will continue to fuel “the rally that no one trusts.” The Volume Profile chart shows blue sky above. A reasonable upside target before FB’s next earnings report at the end of April is the 127% Fib extension at $123.

What’s not to like?

www.daytradingpsychology.com (Coaching for private traders.)

www.trader-analytics.com (Peak performance consulting to RIAs, hedge funds and banks.)