On April 17th, 2016, OPEC and other major oil producers will be meeting in Doha to discuss the production issues that have caused the price of oil to drop sharply since November of 2014. The simple truth is that there is far too much supply and not enough demand…I know, I know, “tell me something I don’t already know Sherlock”. There have been talks and attempted agreements made to cut back and even freeze oil production but these “deals” have failed and thus “failed” to keep oil prices from continuing to fall. According to CNN Money when oil ministers from Saudi Arabia, Russia, and other countries met in February of 2016, prices rose 5% but were quickly taken back when the deal to cut production fizzled. It’s no wonder this agreement failed when the Saudi Arabia’s oil minister was quoted as saying: “We don’t want significant gyrations in prices. We want to meet demand and we want a stable oil price.” However, the Saudi minister added: “We don’t want reduction in supply.”

OK, so let me get this straight: They want stabilize oil prices (preferably rising) but they don’t want to cut production? The law of supply and demand will NOT allow this to happen. In order for price to rise and stabilize, demand MUST rise in order for this to happen, its simple economics….SIMPLE! Well, they’re at it again, as mentioned above there will be an OPEC meeting this coming April 17th; the Saudis, Russia, and many other oil producing nations will be attending to discuss their decline in profits and how to reduce the “glut” of oil that according to Reuters, will not be going away any time before 2017! Talks of this meeting APPEAR to have caused the small rally that began mid-February, 2016; the real question is this oil finally bottoming out or is it just the fundamental aspects causing price to temporarily rise for the time being?

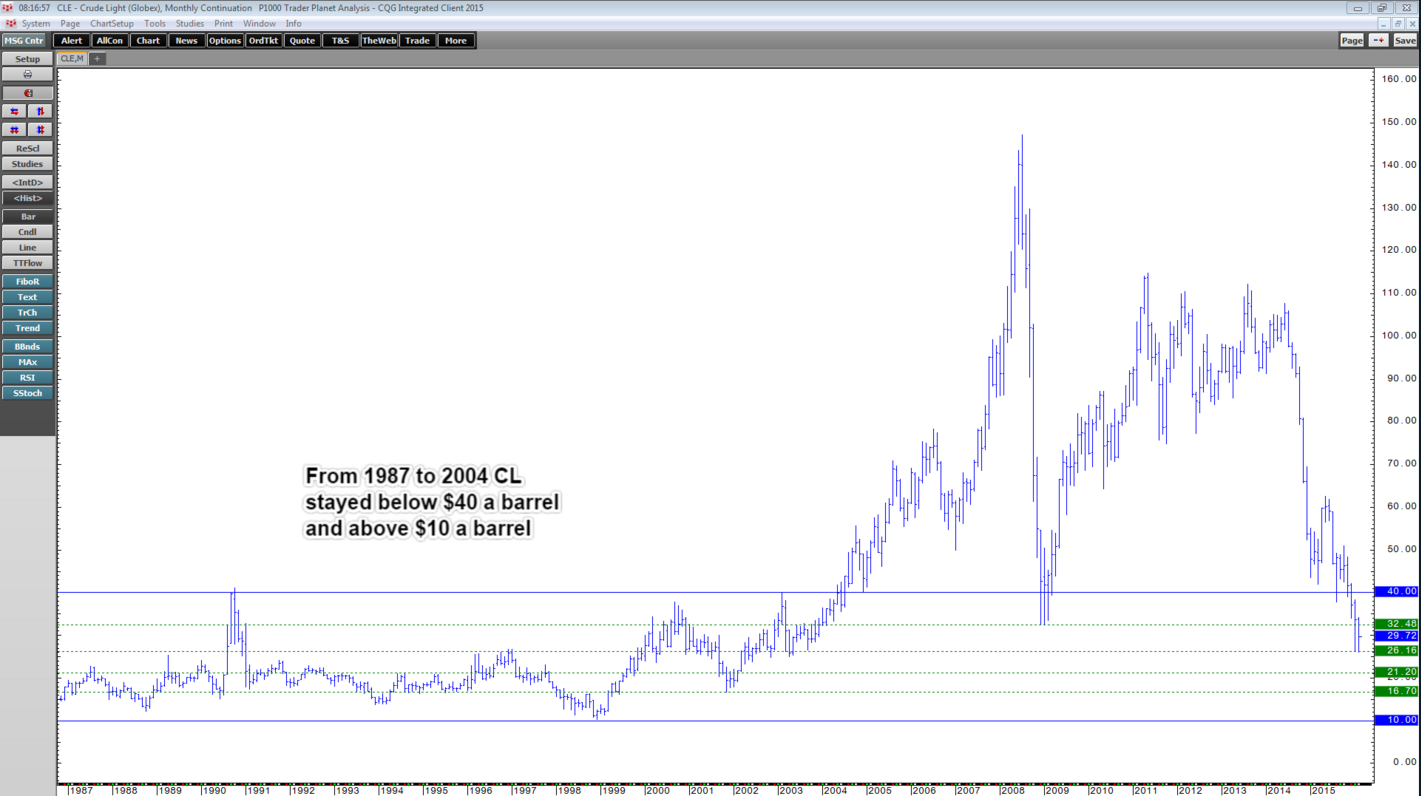

My biggest question is that while this meeting to try to stabilize oil prices is all well and good, in order for this agreement/deal to really get traction EVERYONE that is attending this meeting needs to be in agreement. Again, this is all great, but it doesn’t appear to have worked out very well in the past in my humble opinion. Although everyone hates high fuel prices, the reality is that MANY economies all over the world are driven by the energy market and when that economic resource isn’t profitable, nations can suffer. As far as “oil bottoming”, your guess is as good as mine! Technically oil could go to absolute ZERO; will it happen? I sincerely doubt it, but please keep in mind oil did manage to stay in $10.00 – $40.00 range for over 20 years.

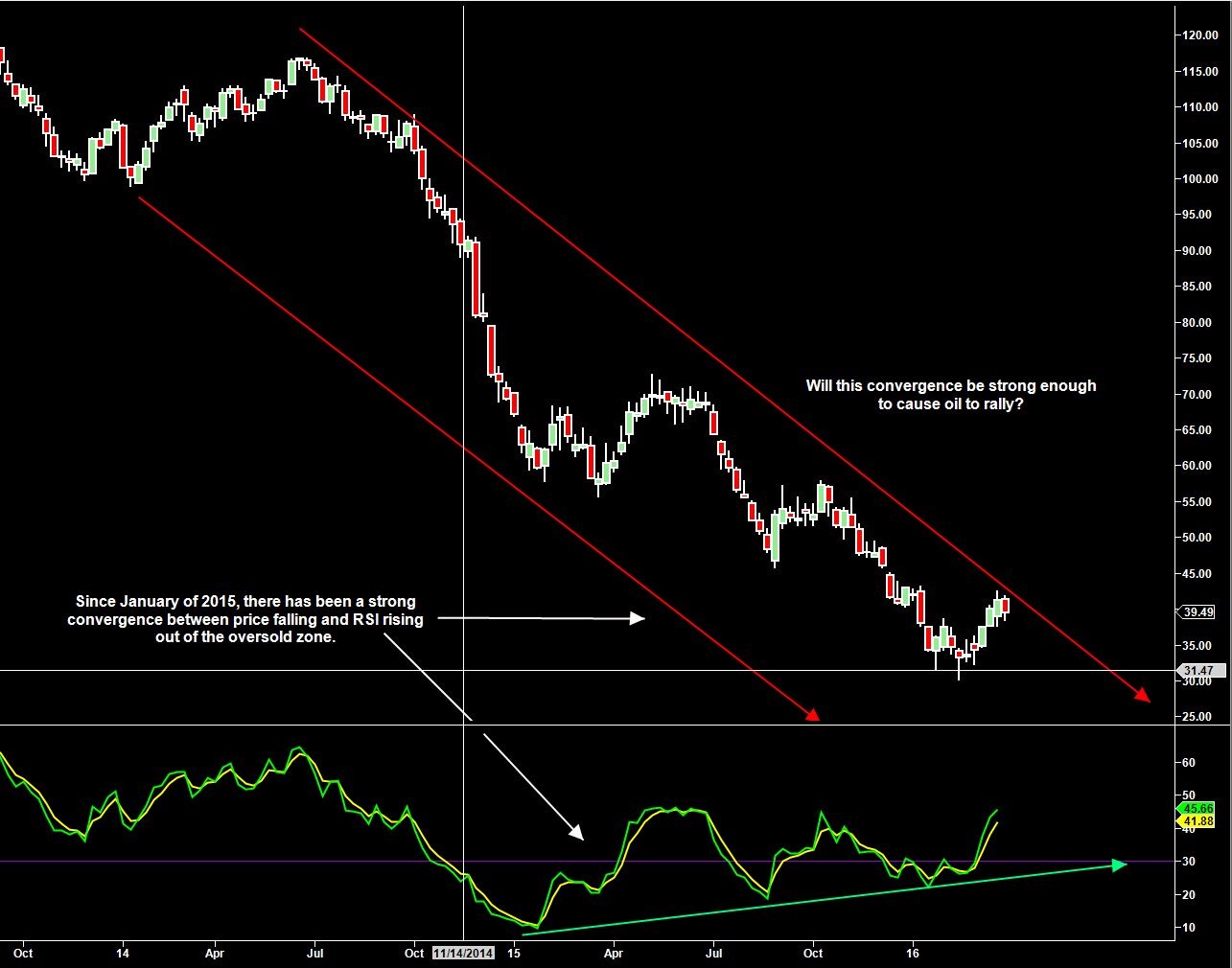

The price range in the chart above actually goes as far back as 1983, but I’m sure you see what I mean regarding the range. As of Easter Sunday, 2016, oil closed at 39.59 per barrel and this is a significant rise in price since lows that were hit back in February of this same year. Are the talks of this important OPEC meeting driving prices higher, or have we reached the long awaited bottoming of oil technically? According to the 14 period RSI on a daily chart for oil we have “technically” been oversold numerous times since November of 2014. I regards to “the bottom”, take a look at the convergence that’s been taking place between the price of oil and RSI rising from the oversold zone.

Is oil ready to bottom? Many oil producing countries (including the United States (shale oil/fracking industry) hope so. The question that will need to be answered on April 17th is that “Will everyone be onboard” with freezing production and reducing the “oil glut” that currently exists in the market? My suggestion for the week of April 17th, 2016 is to be very mindful of the news surrounding this key OPEC meeting and be even more attentive to what price, volume, and the charts tell you.

To receive a free trial from the Oil Trading Group, Click Here