Recently Unveiled Annual Budget Highly Positive for Indian Stocks

Since the unveiling of the Indian national budget on February 29th, Indian stocks have been on a tear; the MSCI India Index have rallied by 12%, respectively, outperforming the MSCI All Country World Index by more than 6%, and the MSCI Emerging Markets Index by more than 2%. However, India’s recent outperformance is neither a new or surprising phenomenon (e.g. over the last three years, the MSCI India Index is up 2.2% annually, outperforming the MSCI Emerging Markets Index by 9.6% on an annual basis), for several reasons: 1) India is now the fastest growing and one of the most stable major economies in the world. Its 2015 GDP growth topped 7.5%, while its inflation rate hovered near its multi-year low of 6%, 2) India experienced a significant shrinkage of its trade deficit last year due to (likely structural) lower oil prices, allowing the country to boost its foreign exchange reserves to more than $350 billion, and 3) the Indian government’s ongoing commitment to business-friendly reforms.

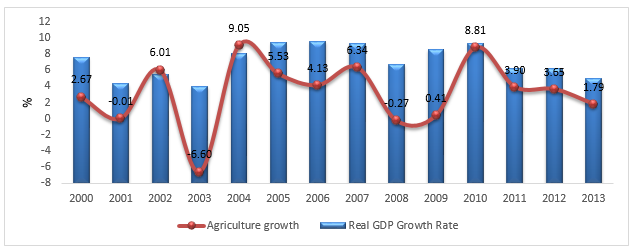

While India’s economy wasn’t immune from the recent financial market volatility, a global slowdown in foreign trade, and a disappointing monsoon season, I believe India has the wherewithal to sustain its recent GDP growth rates of 7.5% or over. A major reason is the government’s ongoing commitment to business-friendly reforms; however, the ruling party is also very pragmatic, as exemplified by its recent budget which aims to fuel further economic growth while prudently controlling expenditures. The budget rightly showcases fiscal conservatism with a fiscal deficit target of 3.5% for 2017. The government also shows its pragmatic side by emphasizing the rural economy as it plans to double famers’ income in five years and dedicate a lion’s share of the resources to jump-starting the agricultural sector, the latter of which contributes to 16% of Indian GDP and is the primary means of support for 60% of the Indian population.

Termed the “Robin Hood” budget, India’s finance minister, Mr. Arun Jaitley, has budgeted around $3 billion for a new irrigation fund. This is meant to protect farmers from the volatile Monsoon season, as more than 50% of Indian farmers still rely on rainfall as their sole source of water. As such, inadequate rainfall can have significant effect on India’s GDP growth and food inflation. This initiative will facilitate means for manual irrigation and dilute the disastrous effect of disappointing rainfall on the Indian GDP while keeping food inflation under control, and subsequently boosting rural income. Even a 10% annual growth in the agriculture sector will add around 8% to India’s GDP over five years.

Figure 1: Agricultural Growth is One of Major Growth Drivers of the Indian Economy

Source: http://www.censusindia.gov.in/, www.Knoema.com

In addition, the Indian government has allocated an additional record-high amount of $7 billion to expedite the expansion of highways and rural roads. Since 70% of India’s population reside in rural areas, improved connectivity and accessibility will provide a significant tailwind to the country’s economic growth. E.g. a 2008 report by the World Bank estimates that India loses about 40% of its fruit and vegetable production post-harvest each year, mostly due to a lack of high-quality transportation infrastructure. Furthermore, investment in rural infrastructure will provide access to education, healthcare and create new employment opportunities resulting in more disposable income amongst the rural population.

Rural India also provides a solid untapped consumer base. According to an Economist Intelligence Unit (EIU) study, Indian consumer spending is slated to almost double, to $2.4 trillion by 2018-19. More than half of total Indian household spending come from the 800 million plus consumers residing in rural India. According to the India Brand Equity Foundation (IBEF), rural consumers are expected to add $100 billion in consumption demand by 2017; while growth in the Fast-Moving Consumer Goods (FMCG) sector in rural and semi-urban India is expected to cross the $20 billion mark by 2018. The spill-over effect of the growth in the agriculture industry will be evident in complementary industries such as fertilizer, auto, and electronics (including mobile handsets).

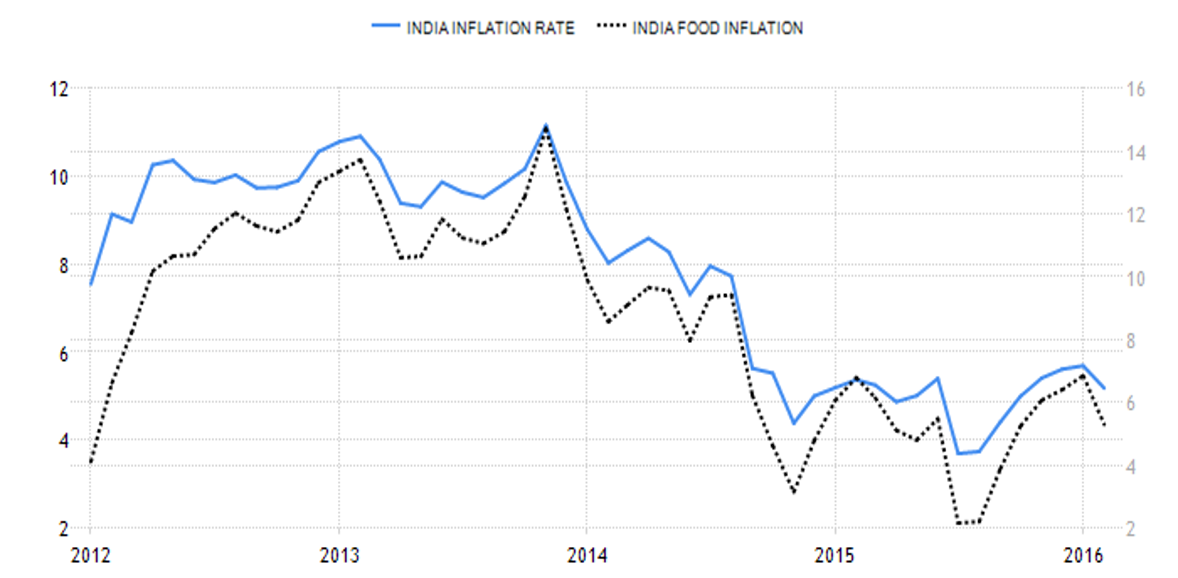

Figure 2: Lowering Food prices is Key to Controlling Inflation in India

Source: www. Trading Economics.com

Some of the other prominent incentives offered in the Indian budget to the rural segment include the deployment ofinternet-based e-markets to sell produce, increased allocation for a rural employment scheme by 11% and increase in agriculture lending by $7.5 billion.

Though the recent global economic slowdown is yet to ebb I believe Indian policymakers are moving in the right direction and have positioned the country for solid, long-term growth. As a result of the agriculture-focused budget, one of the most prominent outcomes of this year’s Indian budget will be low food inflation; since food inflation constitutes 48% of the Indian CPI basket, the Reserve Bank of India (India’s central bank) will be in a good position to cut interest rates further. Because of such pragmatic policies, I believe India will easily achieve the World Bank GDP growth forecast of 7.9% this year.

Investors who would like to invest in Indian companies can consider: iShares MSCI India ETF (ticker INDA), which tracks the MSCI India Index; Market Vectors India Small-Cap ETF (ticker SCI), which tracks the most liquid small-cap stocks; and Wisdom Tree India Earnings Fund (ticker EPI), which tracks the stocks of profitable Indian companies, or iShares India 50 ETF (ticker INDY) which tracks the investment results of an index composed of India’s 50 largest companies.

Meghana Gaikwad is the head of investment banking for India at CB Capital Partners, a global financial advisory and investment firm headquartered in Newport Beach, California. Neither the writer, nor the firm holds shares in any fund mentioned in this article.