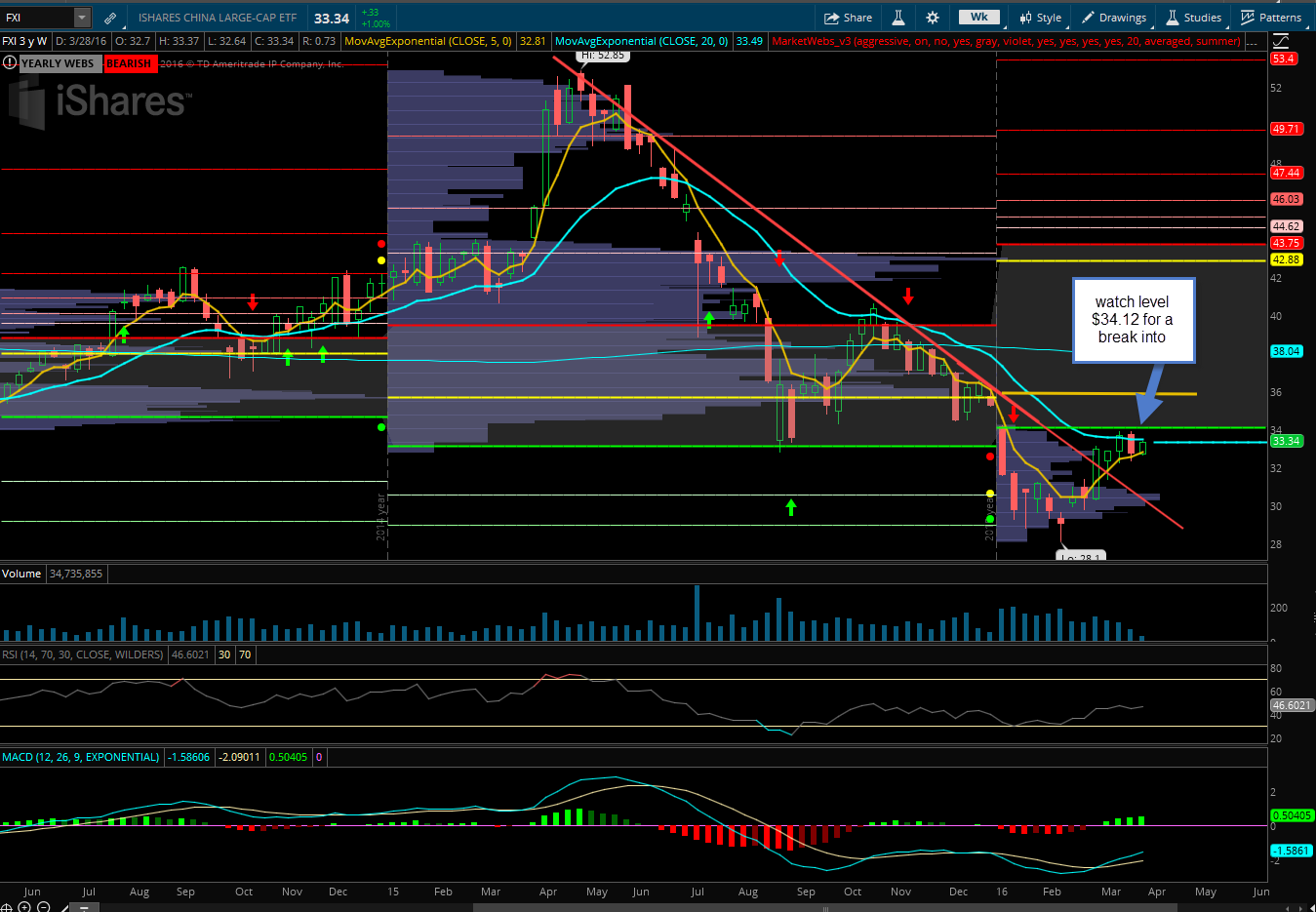

US Equities have had a tremendous run since mid-February and are starting to get a bit overbought. However, many International markets may have more room to run. Case in point FXI, the iShares China Large-Cap ETF, recently broke through downward sloping trend line and is starting to look constructive on the weekly chart (see below). In addition, there have been recent sizable option trades.

On Monday, March 28th, 30,000 Aug 36.5 calls traded for roughly $0.70 and 9,000 Jan 38 calls traded for $0.97. What I like about these trades is both are opening trades and had no open interest at the time of the trade. I also like that these are bit further out in terms of maturity. With FXI trading at $33.34 these call options are expressing a view of an increase in 9.5% by August and a 14% move by January.

In the weekly chart below I am watching for a break into the value are above $34.12.

If FXI breaks above $34.12, a trade to consider is buying the FXI Aug 36.5 calls @ $0.75.

LEARN MORE ABOUT CHRISTIAN’S NEWSLETTERS, TRADING ROOM AND WEBINARS AT TRIBECA TRADE GROUP