Whether you call this a ‘bull market’ or a ‘bear-market-in-the-making’ depends on whether you tend to see ‘the glass’ as half full or half empty.

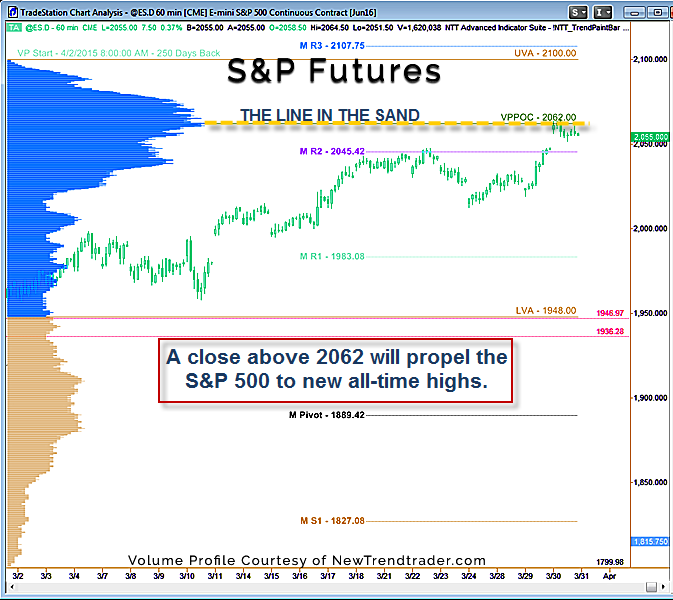

Regardless, there is an objective line in the sand in the S&P 500 futures at 2062, which is seven points above where we closed yesterday… after another lovely gap up. The SPY has gapped up 8 times since it’s mid-February low. All but two of the gaps are now filled… the first gap on 2/16 and the last gap on 3/30 still beckon.

During bearish phases the market literally goes on gap hunts, so you might as well mark these zones on a longer-term chart. In the meantime, the key level is 2062, which happens to be the Volume Profile Point of Control over the last 250 days.

This line in the sand is a ‘big deal’. As most of the skeptics have quieted down and believe the rally, it is a good time for the market to sell off. The spinning top candle in the SPY just begs for an opening down gap today (Thursday), which would set up a bearish ‘evening star’ or (‘abandoned baby’) candlestick pattern that every candle watcher would recognize.

A 60-point drop in the S&P would be ‘normal’ here, and it would probably get a lot of folks bearish. That’s just what we need to set up a continuation move higher.

www.daytradingpsychology.com (Coaching for private traders.)

www.trader-analytics.com (Peak performance consulting to RIAs, hedge funds

and banks.)