We’ve been following the Commitments of Traders report for a long time. As such, we get excited when a market’s trader group sets a new record position. After all, this is the biggest tally of winners and losers in the commodities markets. Therefore, keeping score is mandatory. It’s exciting to see who is going to be right and who is going to be wrong as the market’s biggest players push all of their chips into the center of the table. At least, that’s usually the case. This week, we’ll discuss the ramifications of a completely different type of record being set in the stock index futures and what this could mean in the coming week(s).

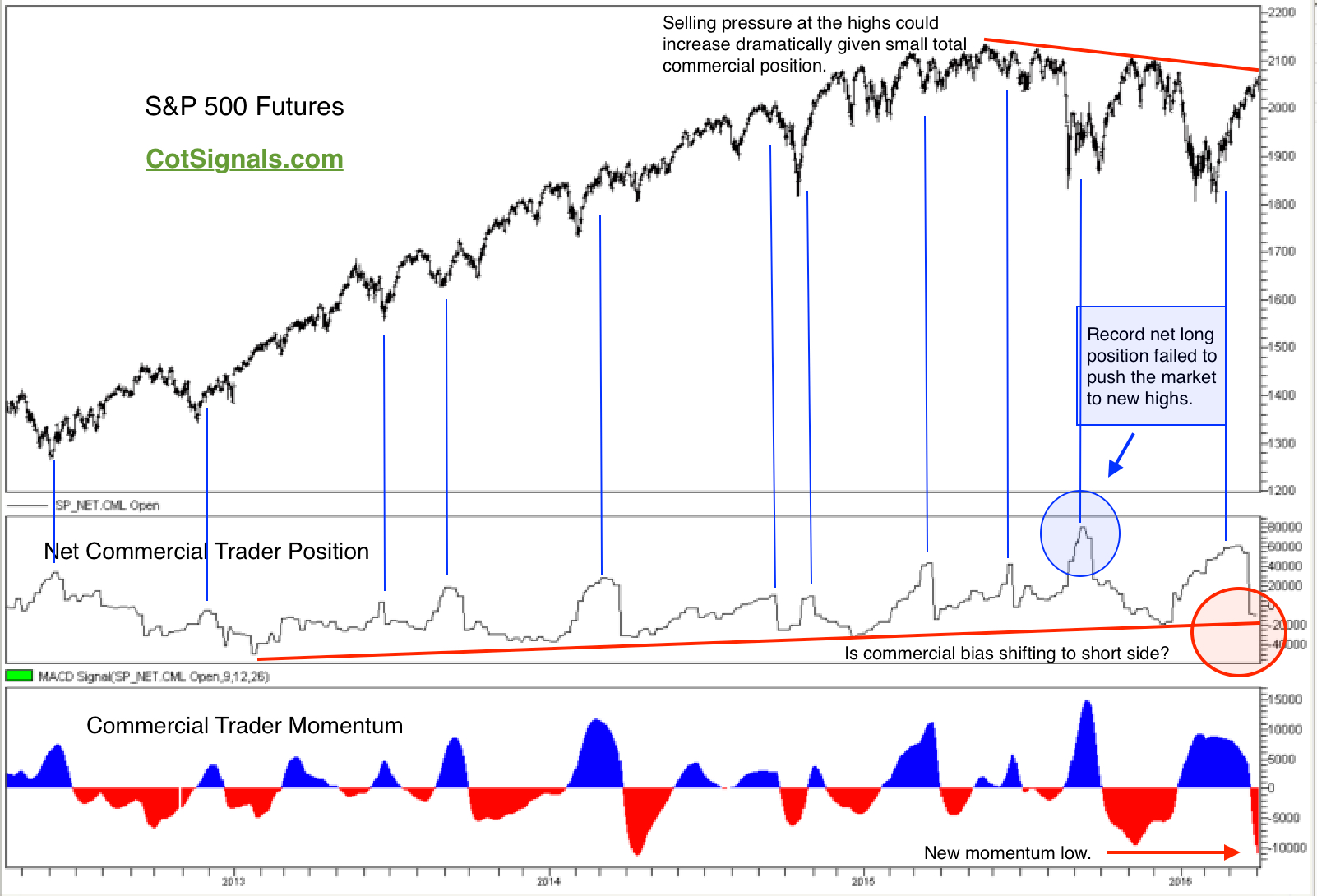

First, a bit of conspiracy to make sense of the included chart, below. The following point is a bit simplistic but, true in its base form. Commercial traders love 10% declines in the equity markets. The only thing better than a 10% decline is, a January 10% decline. Any manager buying in at a discount to year-end can guarantee beating their index by the percentage difference. Any manager that beats their index is a hero. Equity index managers have had seven years of a rally at least partially supplemented by increasing liquidity and a Federal Reserve Board that views the stock market as an economic health barometer. This has led to the consistent, bold and rapid purchases of equity market declines over the last several years. However, we believe this is coming to an end.

The one thing an equity index manager loves is, certainty. The Fed’s support has been fairly certain for several years. However, commercial traders are clearly losing confidence in their collective ability to lean on the Fed. We know this because, while the net commercial positon is still within normal bounds, the total position is flashing a major warning sign. The total position measures the total number of contracts outstanding in a given trader category. It’s very similar to open interest. The commercial trader position is one of the smallest in years in the S&P and Dow and it is the smallest ever in the Nasdaq futures. The lack of commercial trader interest at these prices (near all-time highs) suggests that we won’t be here very long. Furthermore, given their financial capacity, their impact on the market’s prices could be substantial once they’ve gained some certainty.

Historically, small total commercial trader positions have correlated with falling prices. Considering that the commercial traders have yet to surpass their long position total on the rally off the October lows, we believe their next actions will come from the sell side. We expect them to wait for new highs to unleash their selling, as is typical of their behavior. Therefore, long positions should be tightly protected and we’ll look to sell new highs in line with their typical reversal anticipation as higher prices may bring them back to the market. Finally, increased commercial selling short of new highs could break the multi-year trend that they’ve used to support prices. This would clearly put them on the bear side heading into late spring and summer.

View our mechanical stock market hedge portfolio using stock index futures at CotSignals.com.