For the Nasdaq, Biotech is one of the ‘systemically important” sectors. Two Monday’s ago I wrote an article for Trader Planet describing a possible ‘W’ bottom in the biotech ETF (IBB). It has taken a bit of time for that bottom to ripen, but Friday was finally the day the fruit began to look juicy.

Like Tesla (TSLA), biotech was an early casualty of the January 2016 bear market, falling 27% in just a little over one blistering month. The Icarus-like trajectories of the speculative EV stock and the ETF were very similar and presumably the same group of sellers were involved.

Flash forward 30-odd trading days and Tesla has been one of the best performing stocks in the market, but biotech has continued to languish. No doubt the Valeant (VRX) scandal put a damper on the bull case for biotech during the month of March.

But Biotech shorts have not been further rewarded during the general market surge and Investor’s Business Daily, which had recommended a continuation short in IBB, urged subscribers to cover around breakeven on Friday. Presumably, the biotech shorts have begun to capitulate.

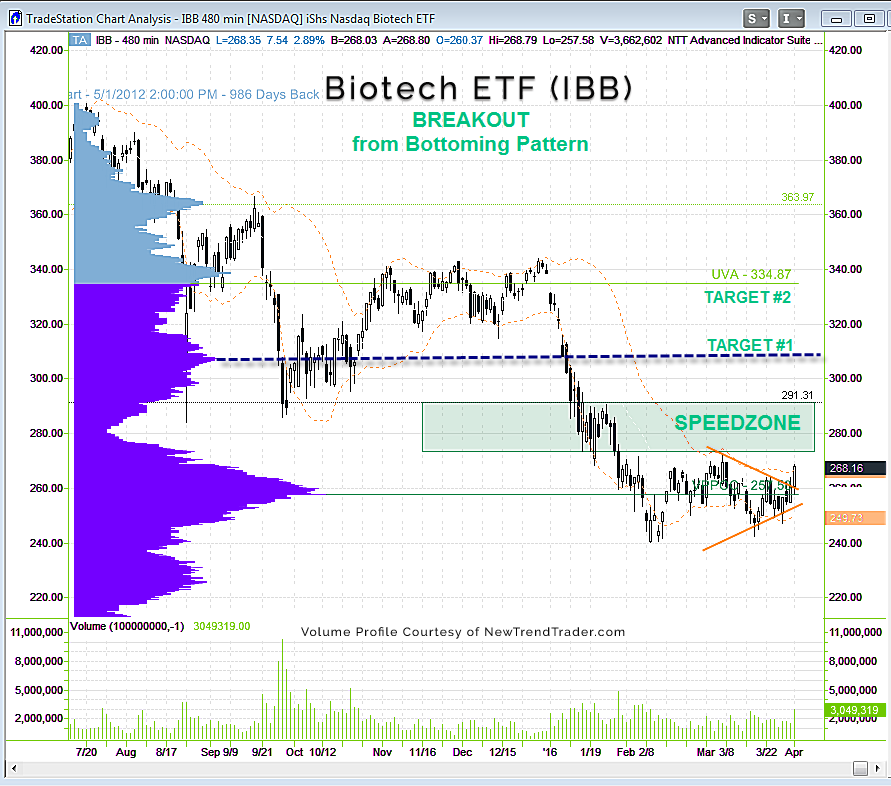

In the article two weeks ago I noted that the attempt at forming a ‘W’ bottom was occurring at a very key level for IBB, the Volume Profile Point of Control at $257. The VPPOC represents the price at which the most volume was transacted for the lookback period, which in this case is 969 days. In other words, this is no ordinary pivot. It is a significant line in the sand.

It’s often difficult to objectively perceive a reversal in a sector with an established trend, but it looks to me like Friday was indeed a pivotal day for the IBB. Five ETF components were up double digits that day, with a combined market cap of $49 billion.

If you missed the rally in Tesla we may get an echo pop in biotech, as there is little volume resistance above. The first serious resistance is the high volume node at $308.

FD: Long IBB

www.daytradingpsychology.com (Peak performance coaching for private traders)

www.trader-analytics.com (Services for traders at RIAs, banks and hedge funds)