The Commitments of Traders Report is issued by CFTC.

It reports all open positions in futures markets of three main groups of traders:

Commercial Traders – Hedgers

Non-Commercial Traders – Money Managers

Non-Reportable – Retail market

The report breaks down each Tuesday’s Open Interest and gives us a powerful view on what exactly the big guys have been doing in the marketplace and what their plans might be.

It is issued every Friday and includes data from Tuesday to Tuesday. The three days prior to the release date are not included.

In this report we cover EURO, GBP, AUD, JPY and we focus on Non-Commercial traders as an indication of profit driven bias.

How to use it.

COT report is not designed as a market entry tool. The market can be short term bullish in a long term downtrend.

COT report is designed to gauge supply and demand of important market participants.

It can be used to confirm mid/long term fundamental bias in a given market.

For example:

Decrease/flat non-commercial long positions on rising prices might suggest the top is imminent. Traders should seek a short setup near the resistance.

Increase in short non-commercial positions on falling prices might support the downtrend.

Highlights

It was a short week with bank holiday Monday when most exchanges were closed for business. Nonetheless markets saw some volatility and decent price action for the rest of the week. Clearly the price was driven by two main events: Yellen speech on Tuesday and NFP together with Average Earnings Report on Friday.

Yellen delivered rather dovish statement warning about weak market conditions and called caution with raising interest rates this year. Markets reacted by selling US Dollar and downgrading probabilities of interest rate hikes this year. This month’s NFP came in at 215,000 slightly higher than expectations of 206,000. Hourly earnings came in at +0,3% also ahead of expectations of +0.2%. The only laggard was the unemployment rate at 5% even, slightly above the 4.9% expected. Looking at Commitments of Traders this week, no much change was reported from the previous week.

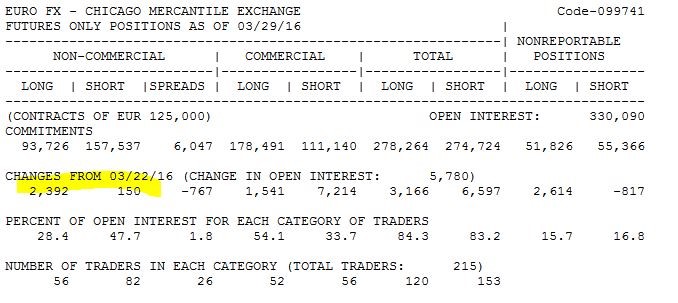

EURUSD: Flat

GBPUSD: Flat/Bearish

As this report is compiled on Tuesday, not all positions after Yellen statement would be included. EURUSD, as expected printed another leg up. The pair moved from 1.11 handle towards the major resistance zone at 1.1350. It closed the week at 1.1390

Looking at Commitments of Traders, speculators added 2.3K new and left their shorts unchanged (added only 150 contracts)

Still, Non-Commercial traders are not buying into weak dollar as of yet. Next week’s report will include all bets placed after Yellen’s speech and Friday’s NFP. The picture can prove to be different.

Looking at open interest and volume in Euro FX Future, the current up move is well supported. Euro FX ended the week at 339,794 open interest vs 330,090 on Tuesday. High volume also indicates traders are opening new long contracts in this market rather than covering shorts. I would expect more long positions next week and more confirmation of bullishness.

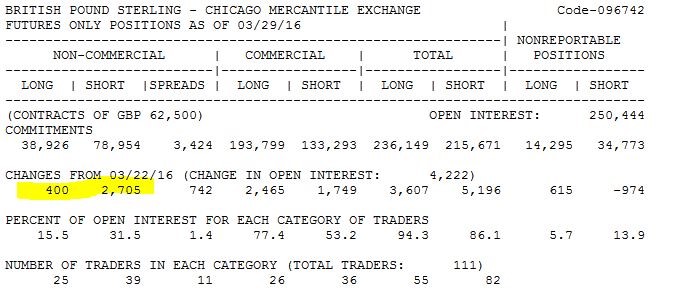

GBP – British Pound Future

Cable had a great run to the upside and gave up most gains towards Friday. GBPUSD ended the week at 1.4220. There were no major risk events for this currency. Cable reacted mainly to US Dollar sentiment.

Looking at speculators, they added 2.7K new short positions and left their longs unchanged. Short bias seems to be intact. We might see double bottom at 1.3850 in coming weeks.

Non-Commercial are still NET BEARISH they hold 78.9K short contracts vs 38.9K shorts.

For most recent reports go to Commitments of Traders