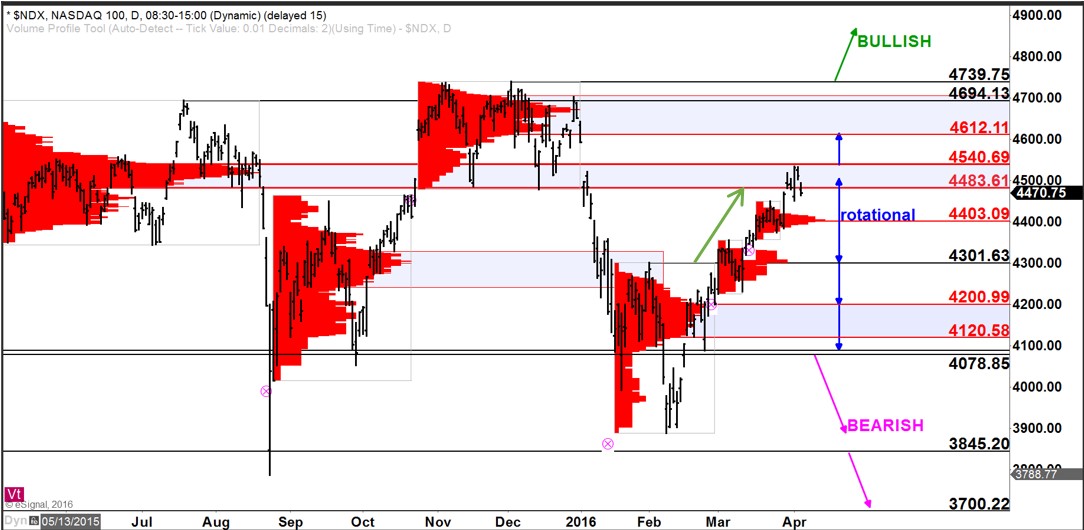

The Nasdaq 100 index ($NDX) has rallied from below 4000 to above 4500 in the space of 2 months. This is approximately +12.5% gain in just 8 weeks. So with that as a backdrop, what’s next for the NDX? Is it more upside dead ahead? Or has it run out of steam?

Click here to watch a video explaining how to read the stock market using volume at price.

The Nasdaq-100 reached an important targeted resistance zone at 4483 – 4540 last week. This was the target following the initial push above 4301. So far, this resistance zone has put the brakes on the rally but thus far it has been merely a pause and hardly a pullback. The longer the index remains at/within this zone of resistance without a pullback, the more likely an upside break becomes. Any move above 4540 would target higher resistance at 4612 – 4694. On any decline there is support established at 4403.