I frequently like to take the opposing view of my positions and play devil’s advocate — something we at Macro Ops call “Red Teaming”.

I’ve been bearish on the overall market for nearly a year now and I still consider the bearish hypothesis the highest probability scenario. But the relentless retracement in equities and credit over the last month forces me to consider the bull side of the argument — one must respect price above all else.

Our team at Macro Ops normally views markets through the lens of liquidity (i.e. cost of money + spreads). And over time we’ve been able to build a liquidity model that’s very good at predicting future market returns. The problem is, our modeling becomes a lot more complicated when interest rates are at or near zero and the real cost of money is negative. There isn’t a lot of past data to help analyze this type of environment since the only comparative time is the Great Depression. We also find that this environment makes game treeing policy decisions much harder (since actors have stronger incentives for extreme measures in both directions). So although our model is still effective, it tends to give off more false signals. Simply put, it’s tough to speak with much conviction on where the market will be 6-9 months from now.

The US started a short-term tightening cycle in 2014 when the Fed began cutting QE. The tightening can be seen in both the Wu-Xia shadow rate and also in wider junk bond spreads coupled with a stronger dollar.

Most short-term tightening cycles like this one don’t stop once started. They simply play all the way through until there’s a shift back to short-term easing when the economy begins to run hot.

But there are some exceptions to this rule and this cycle could be one of them. The problem with this recent tightening cycle is that it was kicked off due to ideological reasons, not because the economy was actually running hot with rising inflation. The way it started may lead to its shortened duration.

The initial unwillingness to follow through on tightening is what caused the bull market to go vertical in the late 90’s. So the question for present times becomes — are we easing and doing the same thing yet again?

There has also been speculation that at the last G20 summit, China, Europe, Japan, and the US got together and formed a “Stealth Plaza Accord” — potentially agreeing to turn the dollar around and keep it in a “sweet spot”.

This would have the effect of easing conditions in China (whose currency is pegged to USD), relieving downward pressure on commodities (and therefore commodity producing countries), and easing global credit conditions (since the Fed is essentially the world’s central bank). Europe and Japan would join the accord because they are equally afraid of the tightening impacts of a rising dollar and the threat of a Yuan devaluation — which, asset manager Hugh Hendry noted, would throw the world into a “Mad Max like situation”.

Whether this “Stealth Plaza Accord” actually occurred is anybody’s guess. But it’s hard to imagine that these topics weren’t discussed by world leaders. The US dollar could simply be retracing because it was overdue for a correction. But either way, the results are the same. Markets, commodities, and emerging market equities have all rallied in response.

So if the “data-dependent” Fed is back to easing with inflation numbers where they are, the next question becomes — how hot will Yellen let inflation run? My guess is that with her history of decisions, she’ll error on the “hot” side.

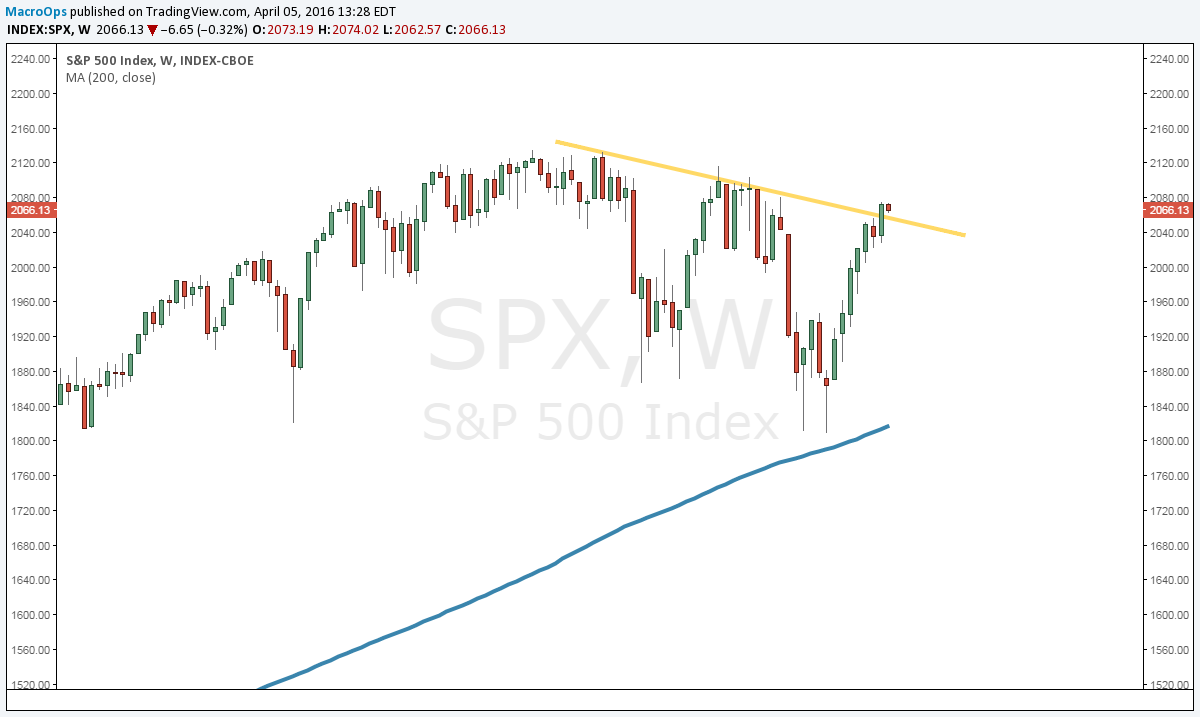

Will this temporary easing in conditions be enough to propel markets to new highs? We can’t know for sure. But if the S&P has a weekly close above 2100, I’d seriously consider pressing some bets to the long side. If we make new highs there’s real potential that the market goes vertical (for a short period of time) in an orgy of buying that forms a 2000 style blow-off top.

At the last Fed meeting, Yellen came out with very dovish comments and lowered the forward guidance on the rate path by half.

But this short-term bullish case doesn’t change the longer-term bearish view for the market. In fact, it makes the bearish case even more severe. The disequilibrium between market valuations and future returns will only grow, increasing the potential for a much larger dislocation in the future (more painful market crash).

Greenspan was rightfully ridiculed for juicing the markets too much in the 90’s. Back then, Yellen was one of the economists actually egging him on to ease more. So it’s not too much of a stretch to think Yellen can out-Greenspan Mr. Greenspan himself here.

In the 2000’s, the bubble was mostly limited to the tech space. But this time it’s everywhere. We followed up the tech unwind with an intentional inflation of the housing bubble (just like Krugman called for). But what’s left to inflate this time once markets crash?

Either way, if this bull run does start back up, we’ll hop on the Soros style false trend and profit in the euphoria (with some very tight risk-management, of course). We have no problem partying like it’s 1999, but we’ll just make sure to leave before the cleanup.

For more information about short and long-term cycles, please click here.