In 2014-2015 the US dollar became stronger and the yen and euro depreciated. As a result, there was a need for International ETFs that hedged currencies. DXJ, WisdomTree Japan Hedged Equity Fund, grew from roughly $1b to $13B in assets at its peak in a little over 2 years. Similarly, HEDJ, WisdomTree Europe Hedged Equity Fund, had huge growth as the dollar became stronger. However, as the dollar has been moving sideways this year (see chart below), money has been withdrawn from these funds.

UUP – US Dollar Index Bullish Fund

Source: Bloomberg

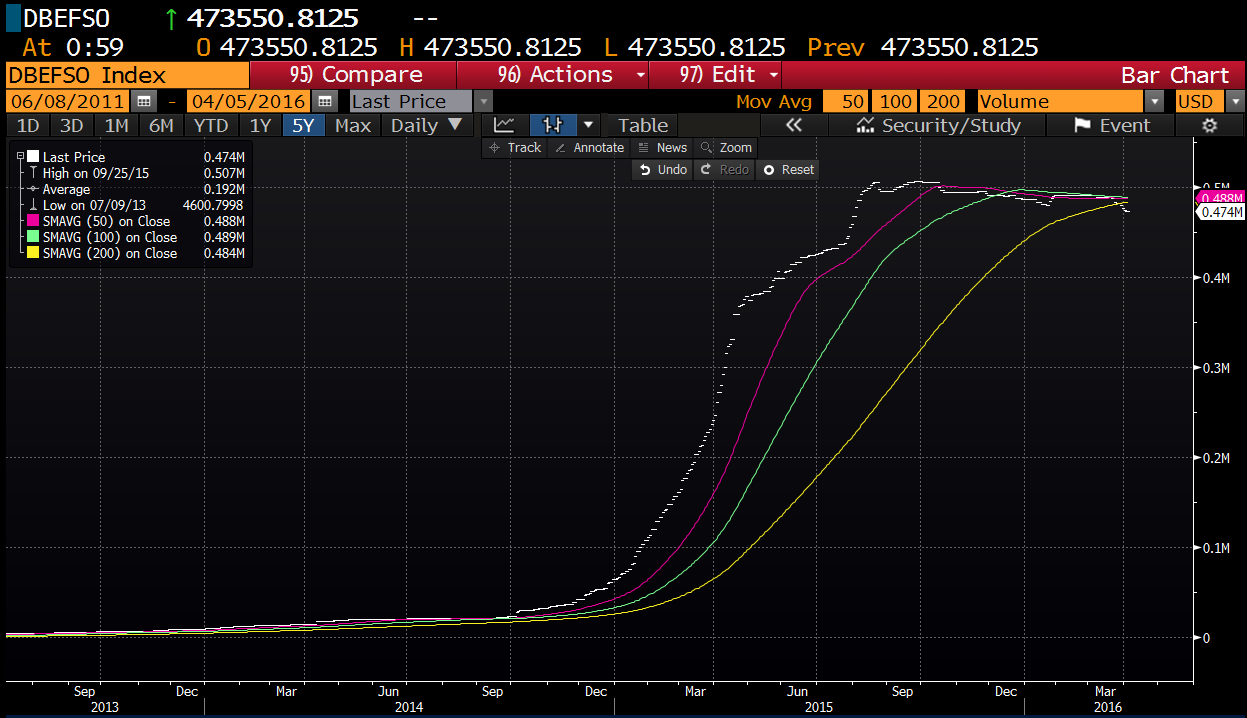

So far in 2016, DXJ has lost $2.9B in assets and HEDJ lost $2.5B in assets. A similar style International ETF is the DBEF, Deutsche X-trackers MSCI EAFE Hedged Equity ETF, which contains International Developed companies and also hedges the currency exposure. The chart below shows the outstanding shares of DBEF, and while the fund has also had tremendous growth like DXJ & HEDJ it has not had any major outflows. If the US dollar further weakens and breaks the sideways channel in the above chart, currency hedged ETFs may have further outflows as there may be less of a need for them in a weaker USD environment. In addition, the DBEF ETF is in a downtrend and has recently climbed back to the downward trend line.

The Tribeca Trade Group Trade:

If the UUP breaks $24.40, buy the DBEF Aug 24 strike put @ 1.20