Despite Spring Rally, Fundamentals, Seasonals Spell Trouble for Coffee Prices

Coffee prices have enjoyed an upswing as of late – having benefited from a plethora of scattered fundamentals that have lifted them from their lowly depths. A jump in the Brazilian Real has some producers holding off on forward sales. Near term supplies are tight. El Nino dryness in Eastern Brazil and Vietnam is clipping yields for the Robusta crop. And in infestation of the “mealybug” has many predicting damage to cherries.

September 2016 Coffee

Coffee prices have seen an upswing as of late

But knowing fundamentals is one thing. Deciphering them and determining how they fit into the big picture is another. While these news items may have given coffee prices a nice little jolt as of late, you may think of them as flies on the back of the elephant in the room. Make that a Mammoth.

For despite these distractions, coffee prices will soon come under the influence of a mammoth Brazilian coffee harvest – one that is expected to be the largest in recorded history.

El Nino to Mealybugs

Dry conditions in the eastern part of Brazil have led to an infestation of mealybugs which eat the coffee cherries (coffee beans, in their natural, unroasted form are often referred to as cherries.) Recent tours of the area have led some analyst to conclude that yields of the Brazilian Robusta crop could be off by as much as 25%. At least that’s the headline that gets the news.

What gets less headlines is this: Robusta coffee makes up less than 25% of Brazilian coffee output. Higher quality Arabica beans account for more than 75% of Brazilian production and is not affected by the mealybug. In addition, Arabica coffee is what makes up the Coffee futures contract at the ICE Exchange in New York.

Coffee beans are often referred to as “cherries” when they come off the tree. Brazil’s 2016 harvest could potentially be the largest on record.

Dryness in tiny eastern states like Espirito Santo may lead to a reduction in Robusta yields. But in bigger states such as Minas Gerais, where Arabica coffee grows, Conab (The Brazilian agricultural bureau) describes weather conditions as “very favourable.”

Record Harvest on the Way?

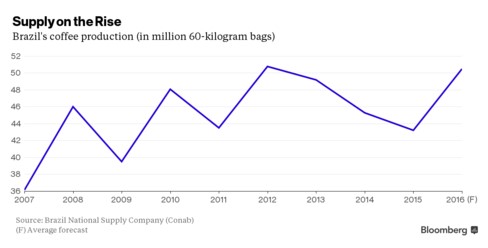

April marks the beginning of the annual coffee harvest in Brazil. And CONAB was not kidding when it used the term “very favourable.” The agency predicts the 2016 harvest to yield between 49.13 and 51.94 million (60kg) bags of coffee beans. The higher number would represent a 20.1% increase over 2015 production. More importantly, it would be an all time record for Brazilian coffee production.

Even conservative estimates put the 2016 Brazilian coffee crop over 50 million bags. The previous record was set in 2012

While this is bearish in and of itself, consider the fact that CONAB is notorious for underestimating the size of the Brazilian crop (whether this is out of self serving interests or not is a point of debate.) Some private estimates such as Olam and Rabobank have the crop pegged as high as 58 to 62 million bags.

The Seasonal Twist

Coffee prices have one of the most defined seasonal tendencies of any commodity on the board. That is the tendency for prices to decline as harvest begins. This is because harvest comes at a time when supplies go from their lowest levels to highest levels in a matter of months.

Caption: Historically, coffee prices have tended to decline as the Brazilian harvest gets underway in March and April. The 5 year average indicates this “break” is tending to occur later in April in more recent years.

Conclusion

Recent news items in Brazil have caught the attention of speculators and driven the price of coffee up over 17% from its early March lows. Media is focused on weather and current (admittedly tight) supplies left from last year. While recent price strength may or may not continue in the short term, speculators caught up in the buying are ignoring the biggest fundamental of them all. A potential record coffee harvest gets underway this month in Brazil. These new supplies flooding the market will not only begin to alleviate short term supply concerns, they will go a long way towards driving up world ending stocks from current levels.

Seasonally, prices have tended to decline, sometimes drastically, into the Brazilian harvest as the new supplies arrive. As economics 101 dictates, price will tend to be lowest when supplies are highest. Mealyworm yield losses will likely be a distant memory by the time the bulk of harvest is bagged. A loss of even a few million bags of robusta beans will be a drop in the bucket and still likely result in a record or near record harvest.

Given the nearly ideal weather conditions in the high yielding Arabica regions, it is the Premium Sniper’s opinion that the arrival of the freshly picked cherries will have the typical seasonal effect of bringing pressure to coffee prices.

Where will prices go once the full harvest is realized? There are simply too many variables to give an accurate answer to that question. Trying to answer that question will be a mistake too many coffee traders will make this year. Fortunately, that’s not a question you need to ask as an option seller. The only relevant question is “where won’t they go?”

Strategy

In our opinion, prices aren’t going to surge by 80% over current levels with potentially the largest crop in history bearing down on the market. Yet, thank your local speculator; strikes at precisely that level are available to option sellers now.

December 2016 Coffee Showing 2.50 Strike Price

We suggests considering selling the December Coffee 2.50 calls for premiums of $400 or higher. For those looking to build a position, additional strength in coffee prices could present opportunities for selling 2.60 or 2.70 calls for premiums of $500+. More aggressive traders can consider the September 2.00 calls for similar premiums.

We’ll be working closely with managed client accounts this month to optimize positioning in the coffee market.

(For more information on option selling accounts managed personally by James Cordier, request your Investors Discovery Pack now at www.OptionSellers.com/Discovery Minimum capital requirements apply)