The expected pop in Biotech is well underway. I hope you didn’t miss it. It has the hallmarks of a 1990’s rally. There’s nothing particularly ‘healthy’ about it; it’s pure momentum, enthusiasm and greed. And I expect it to get overdone before it’s done.

To be fair, the main Biotech ETF (IBB) sports a trailing P/E ratio of 18, so things have changed quite a bit since the heady days of the Great Bubble, when the Nasdaq 100 had a p/e > 100.

Another thing that’s changed is the capital flow from mutual funds to ETFs, which is adding hedge fund fuel to this rally.

Each year, editors at Morningstar pick the best 500 mutual funds from the universe of roughly 8,000 funds. Surprisingly, among this crème de la crème, nearly half have experienced at least a 10% decline in assets under management (AUM) in the 12 months ending in February. But even more curious is the report that 79 of these superior funds have seen a 25%-40% drawdown in AUM over that period. This would be normal in a bear market… but it’s unprecedented in a bull.

This is evidence of the secular shift that is moving capital to more efficient vehicles, and certain ETFs are among the beneficiaries of this trend. The main biotech ETF (IBB), which sports a reasonable valuation and an annual expense ratio of .48%, is a good example. Plus, for those with a technical bent, one can time investments in ETFs much more easily than mutual funds.

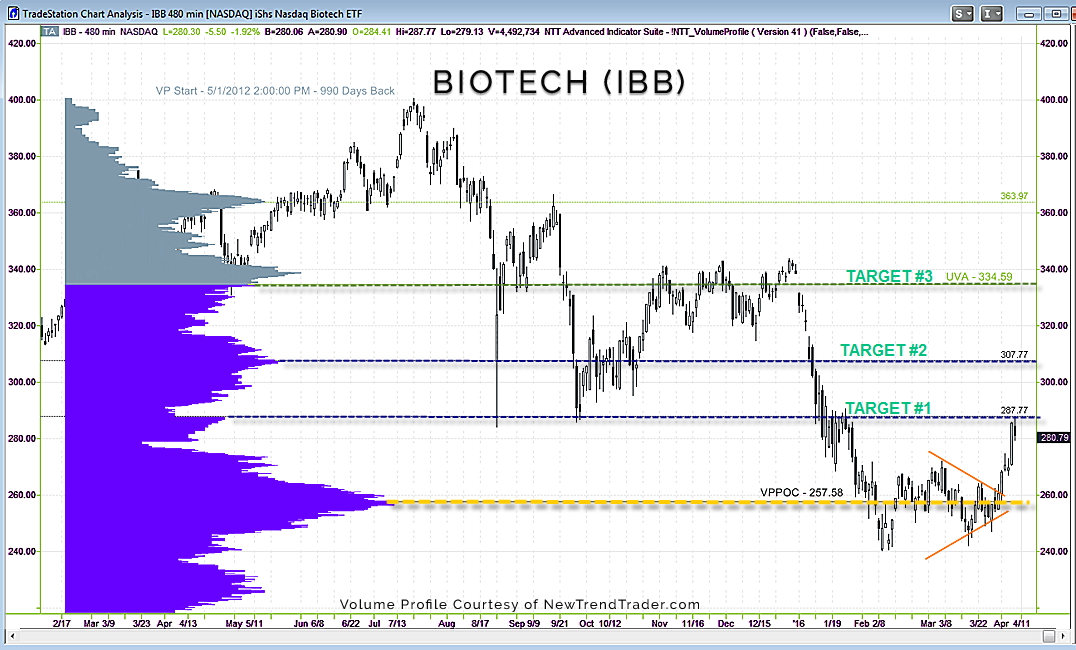

Biotech was an early casualty of the January 2016 bear market, falling 27% in a little over one month. But the Biotech Phoenix is rising and the high daily volume on this up-move suggests that hedge funds are piling into the theatre.

The accompanying chart shows two higher targets. A move above $287.77 will put the next one in play: the high volume node at $308.

There’s quite a difference between analyzing the market correctly and capitalizing on the analysis. They are really two different skills. If you want to sharpen your mental edge, so you can profit from well-telegraphed moves like this, check out daytradingpsychology.com/mastermind .