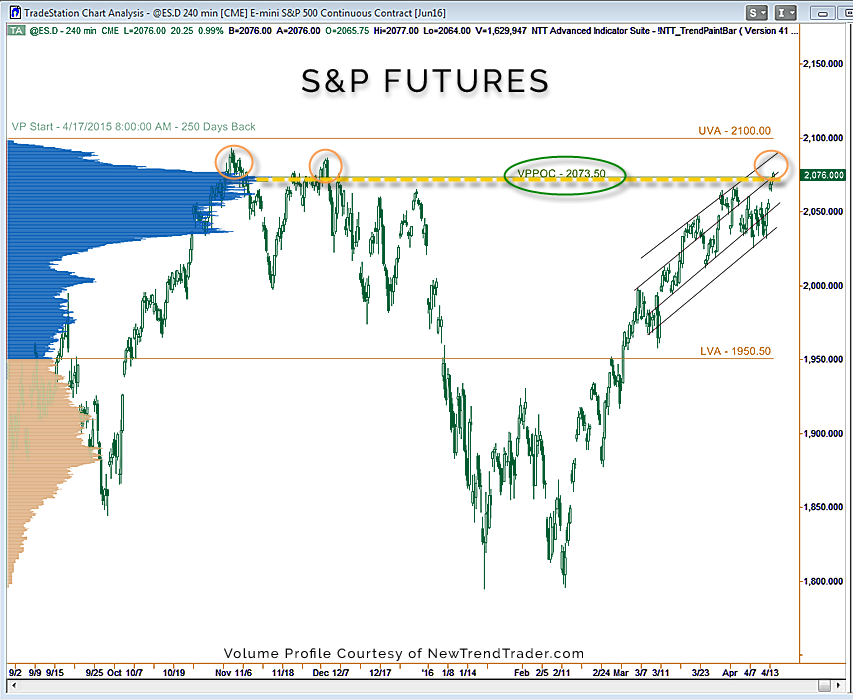

Last November and December I pointed out the distinctive volume profile pattern in the S&P 500, which is still apparent in the accompanying updated chart. The pattern has a shelf-like structure that will act to block upward progress, in the same way that a rock shelf makes it difficult for a rock climber to proceed higher.

The key level in the S&P futures is currently 2073.50, which represents the price at which the largest amount of volume has been transacted over the last year. Markets seek liquidity, so this area has acted like a price ‘magnet,’ but it also represents a level that will be difficult to surpass.

Such ambivalence seems to be unusually pervasive these days.

In her address to the Economic Club of New York, Federal Reserve Chair Yellen noted that “The future path of the federal funds rate is necessarily uncertain because economic activity and inflation will likely evolve in unexpected ways.”

On the one hand, with regard to the U.S. economy, the market has reason to think of its recent rally as reflecting a glass at least half-full. The steady expansion in the job market continues to impress, gifting us with an 8-year low in the unemployment rate.

On the other hand, Factset is anticipating that year over year U.S. corporate earnings will plunge by 15% in Q1, the largest decline since Q3 of 2009. Meanwhile, analysts at B of A Merrill Lynch are worried about the Stoxx 600 index, which has been particularly lethargic this spring while the S&P 500 surges. The analysts characterize the technical behavior of the index as “frightening” and point out that an implosion in European stock values could trigger a global domino effect.

How to play the ambiguity?

In my view, the U.S. equity market is the best house in a troubled global village, so traditional market metrics and econo-metrics don’t currently apply. This is why so many experienced, savvy pundits have been fooled into calling for a top. The S&P 500 is simply the beneficiary of a global flight to quality. This circumstance is likely to result in a massive equity bubble here, and bubble peaks are notoriously difficult to time. So sit back, stay long and enjoy the ride. If the day should come when you feel like the greatest stock genius of all time, send me a note… that will be the top.