This past week the Financial sector did the heavy lifting. The financial ETF (XLF) far outperformed the main ETFs in technology, industrials, materials, energy, biotech… you name it.

I consider this surge a significant development; one that bodes well for higher prices in the major indices, even though financials comprise the most unloved sector in the S&P. Here’s the backstory.

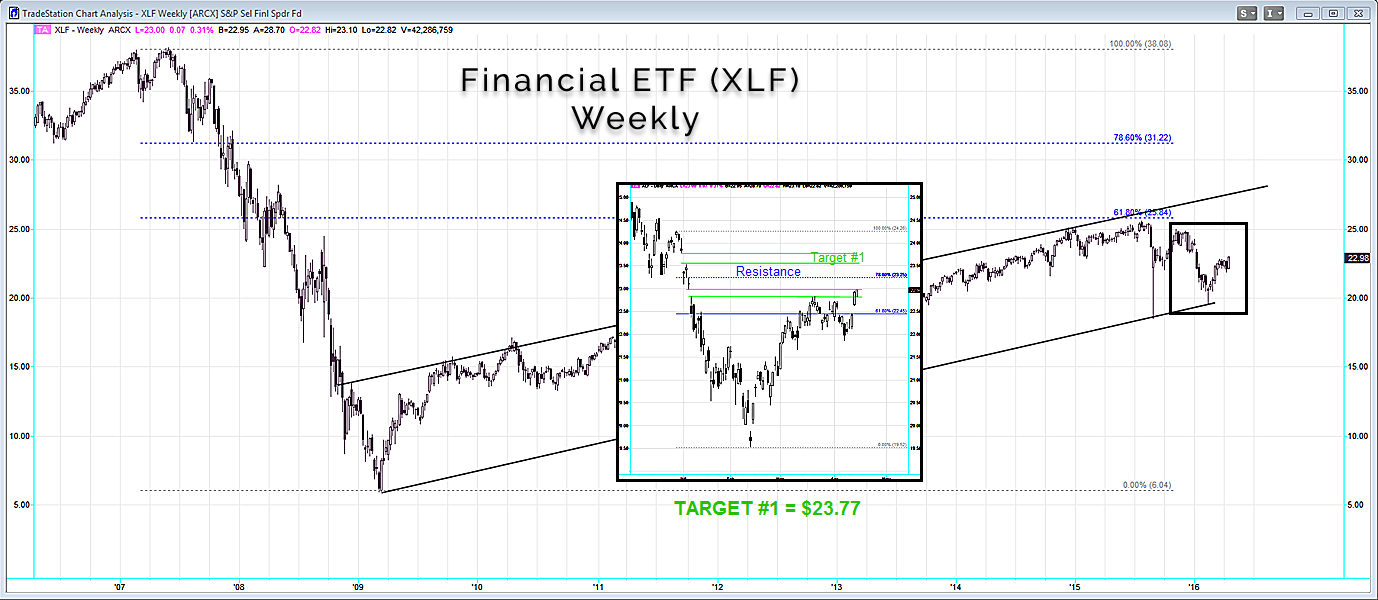

In the midst of the market carnage back in February I noticed a “morning star” candlestick pattern on the daily chart of the financial ETF (XLF). It took a while for the upside momentum to ignite, but on March 1st the XLF crossed another key resistance level at $21.50 and it was game on.

To be sure, as indicated by the accompanying chart, not all is well with the financials. The 6-year rally off the 2009 bottom fizzled in July of 2015 at $25.62 and the sector has yet to reclaim those highs. Few would have predicted that the S&P 500 could be within a few percent of all-time highs without the full recovery of this sector, but that’s the nature of the New Market. It is different this time.

Financials remain something of a pariah; as a group they are among the most mistrusted companies in America, perhaps because they have been so reluctant to admit wrongdoing and change policies. This week the Fed identified 5 major banks as too big to fail and also labeled them unprepared for a crisis and in need of supervision.

Nevertheless, despite declining revenues and increased write-downs, Bank of America (BAC) and J.P. Morgan (JPM) were up 9% and 7.5% respectively over the last 3 trading days. Investors are looking across the darkened valley to brighter days ahead. Moreover, these numbers are about double the performance of the ‘FANGs’ over the same period.

Bottom-line: If the banks are alive and well, the market will be, too. One more reason to stay long and buy dips.

www.daytradingpsychology.com/mastermind (Peak performance coaching for private traders)