Soybeans have rallied more than $1 per bushel or just over 11.5% since bottoming in early March. Based on the commercial traders, who’ve come out of the woodwork since we popped back above $9 per bushel, we think this is a rally to be sold, rather than the beginning of a larger bull run.

We often talk about the battle that plays out in the markets between the speculators and the commercial traders but, rarely do we see it as symmetrically as it has appeared over the last six weeks in the soybean market. Over this period, commercial traders have sold more than 125k contracts. Meanwhile, large speculators have purchased 161k contracts. Briefly, it’s important to understand where we are in the planting cycle. Soybeans and corn battle for acreage every spring as farmers determine which crop is most likely to create the most profit for their operation. What we have here is the fight between farmers selling forward production at prices at which they know they’ll be profitable versus speculators jumping the gun on a spring rally.

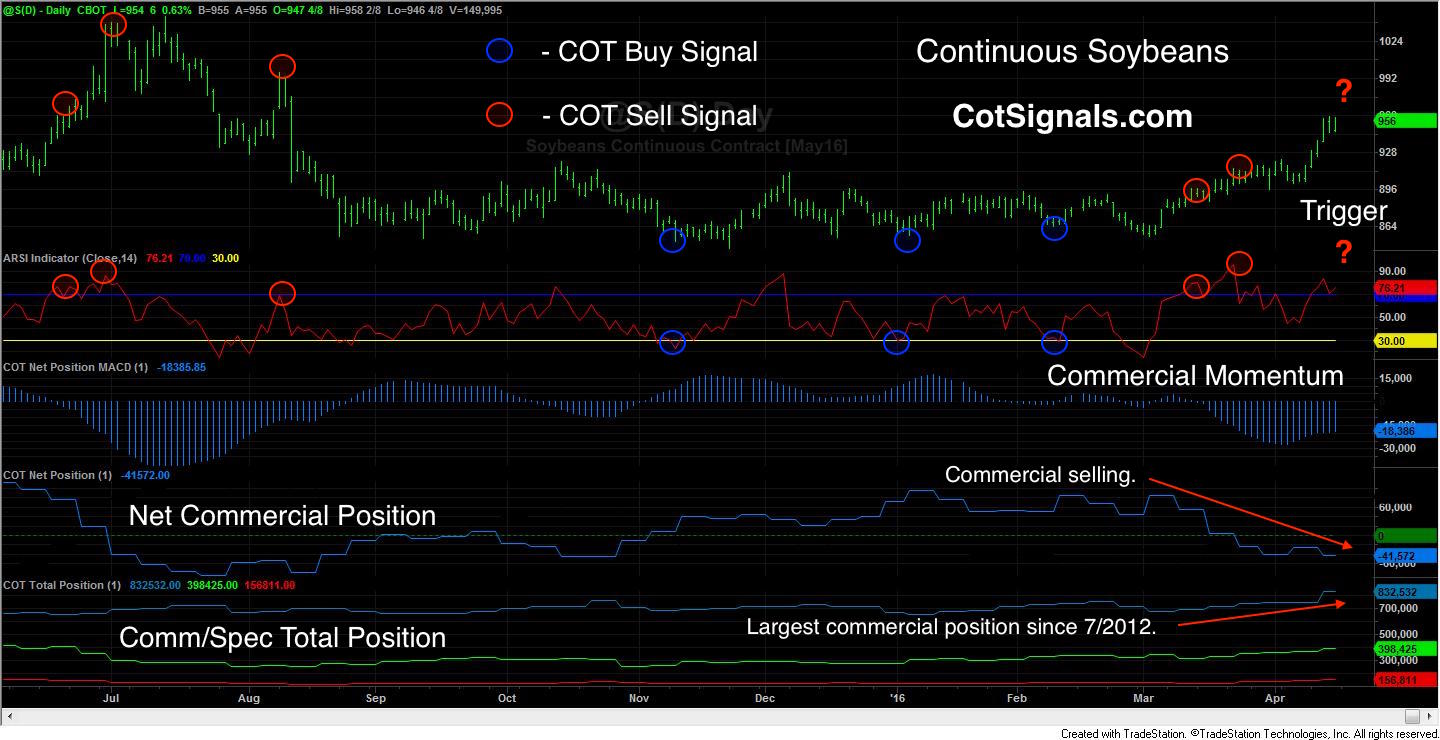

We’re not weather predictors so, we don’t know what El Nino has in mind beyond the expectedly cool spring. What we do know is that farmers’ consensus is beans above $9 are a good sell and beans at $9.50 are a great sell. Looking at the included chart, you’ll see two important factors working in harmony in panes 4 and 5. Pane 4 plots the net commercial position (longs – shorts). Pane 5 plots the total position for the markets’ players. Notice that the commercial position has grown much faster than the speculative position and that commercial traders have been net sellers over the last six weeks. Commercial traders have accumulated their largest total position since July of 2012 when they were net short more than 260k contracts. This is the kind of action we mean when we talk about quantifying commercial traders’ behavior at a given price level being at least as important as some of the other more readily accessible COT metrics.

We fully expect forward selling of soybeans to intensify rapidly if prices trade much higher. As it is, the commercial producers are already the happiest they’ve been with prices received since 2012. Furthermore, we feel the growing total position on top of a small net position is a reflection of anecdotal evidence regarding beans in the bin finally finding their way to market. Therefore, we’re selling soybean futures. Our mechanical program issued a sell signal Sunday night while our discretionary program is armed, cocked and waiting to pull the trigger, as shown in the chart.

For more information on our mechanical and discretionary Commitments of Traders strategies, please visit CotSignals.com.