My last two posts have been based on a VERY big meeting that is taking place right now (as I am typing this), in Doha, Qatar. I didn’t want to be biased in my last two posts but deep down I saw this coming. I purposely stayed clear of my charts until the GLOBEX open this afternoon to see “the results” of this proposed meeting that would freeze oil production and eliminate the massive glut (excess supply) of oil that is not only keeping prices down, but making trading oil difficult due to the “stand-off” regarding price. After today’s meeting we’re right back to the drawing board as it relates to where will the “big picture” oil price be headed. A fact is a fact: Although freezing production would NOT have immediately driven oil prices through the roof, it would help eliminate some of the current over supply that is currently keeping prices down, affecting local economies, and further sealing the fate of alternative oil production such as the oil sands in Canada and the shale industry here in the United States; regarding the shale companies: Brace, brace, brace, I guess more layoffs are in store for the shale industry.

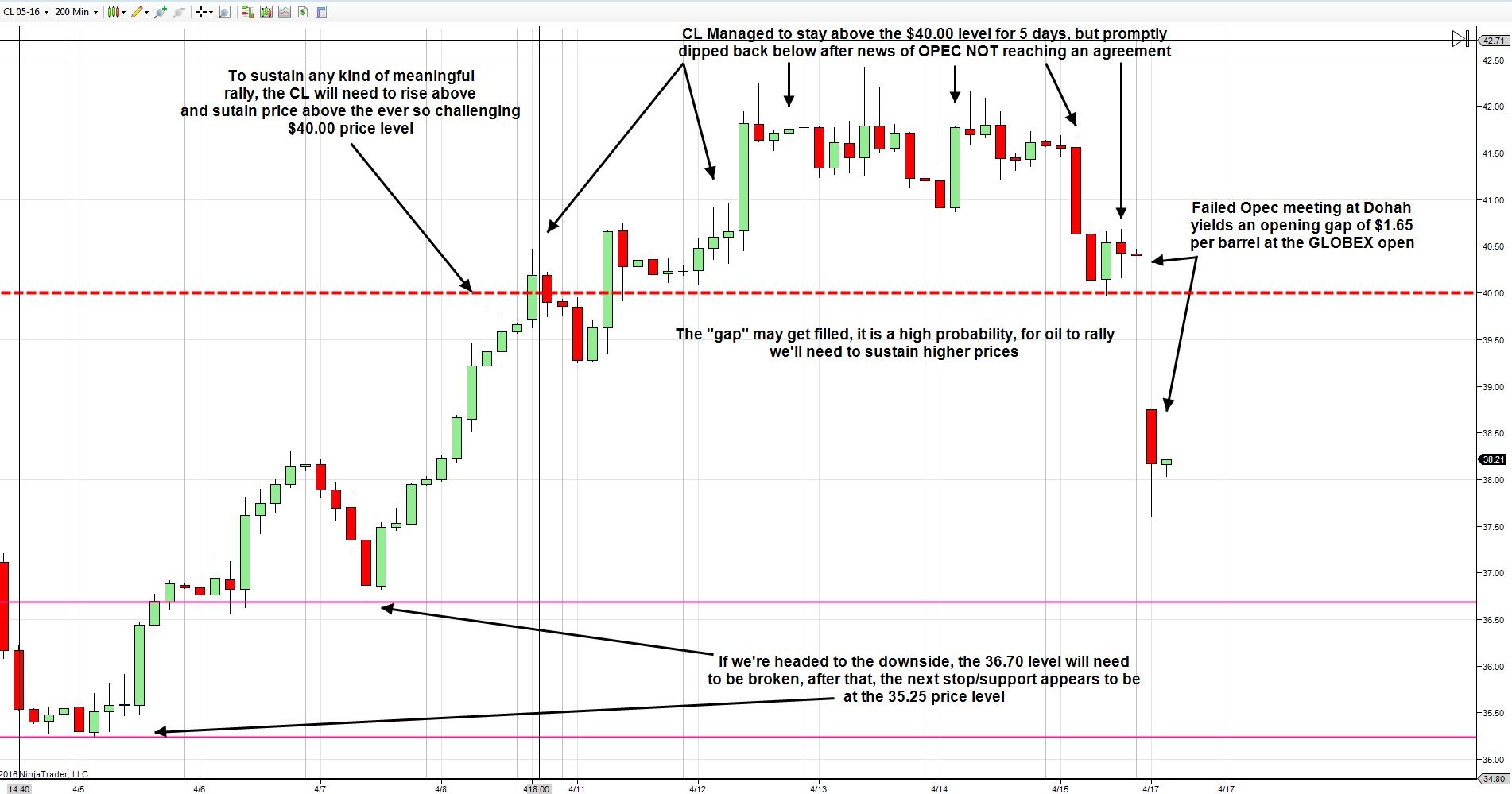

According to ALJAZEERA, “The world’s biggest oil producers have failed to reach an agreement during the meeting seeking to freeze output and reassure markets that a recovery in prices can be sustained”; in a nutshell, they failed to make the deal. While many nations participated and anticipated a solid deal would be struck, this disagreement will further increase uncertainty and volatility. Again, according to what I am reading in ALJAZEERA (and I concur) “Countries such as Ecuador and Venezuela have been hardest hit by the plummeting prices”. Furthermore, ALJAZEERA went on to say that “OPEC producers such as Saudi Arabia have insisted on keeping production high because they DO NOT WANT TO LOSE CUSTOMERS TO NON-OPEC PRODUCERS SUCH AS THE UNITED STATES”. Let’s be real here folks: It’s capitalism at its finest, what were we REALLY expecting? Lower crude prices will only continue to strain smaller oil producers and those producing alternative oil production. What you see below needs no explanation, only that the opening price has created one of the biggest gaps in price that I’ve seen in quite some time.

The previous 5 days trading was challenging to say the least, anticipation of a meeting that would freeze production kept everyone guessing as to whether what happened would happen, or all would agree and freeze production in order to eliminate the excess oil supply that will plague the planet for who knows how long. The CL closed at 40.40 just this last Friday (4/15/16) and opened today at 38.75, $1.65 per barrel lower! While this isn’t a $5.00 gap, it is substantial to say the least.

We’ll need to tighten our risk management and be VERY mindful of our charts in this upcoming week, there is a possibility of perhaps one more rally during the upcoming week that will fill this gap as the opening price DID fail to open below 36.79, the last major low that took place on April 7th, 2016. I suggest being very wary of the short play unless price falls below the 36.79 price level; as I mentioned before, we may see a rally in oil just to fill the gap, after that, who knows. In order for the CL to continue tom rally, we’ll need to see price sustained above the $40.00 level. Mind your charts and tighten up the risk, the failed OPEC meeting is going to produce some heavy volatility in the upcoming week….or even weeks. If we fall below 35.25 that may be all she wrote