It’s a classic call sellers set up. A market with overwhelmingly bearish fundamentals and depressed price levels catches a break. Speculators (nearly always looking for a reason to get long) hear a news story that sounds “less bearish” and jump all over it. Prices break higher. Volatility and open interest surges. The public rushes to buy call options.

And then reality sets back in.

As a fundamentally informed option seller, you should welcome moments like these. A core tenant of The Complete Guide to Option Selling is, if the public is driving the price of a commodity in the opposite direction of its fundamentals, the market is ripe for taking premium. If the general public is in the mood to make a donation to the cause of your net worth, why not let them?

This week’s soybean rally may be your opportunity to oblige these generous givers.

What is Driving the Recent Price Rally?

Soybeans, like the coffee market featured earlier this month, are facing an oversupply issue. Yet, soybean prices have rallied by over 11% since early March – a 5% price surge coming just this week.

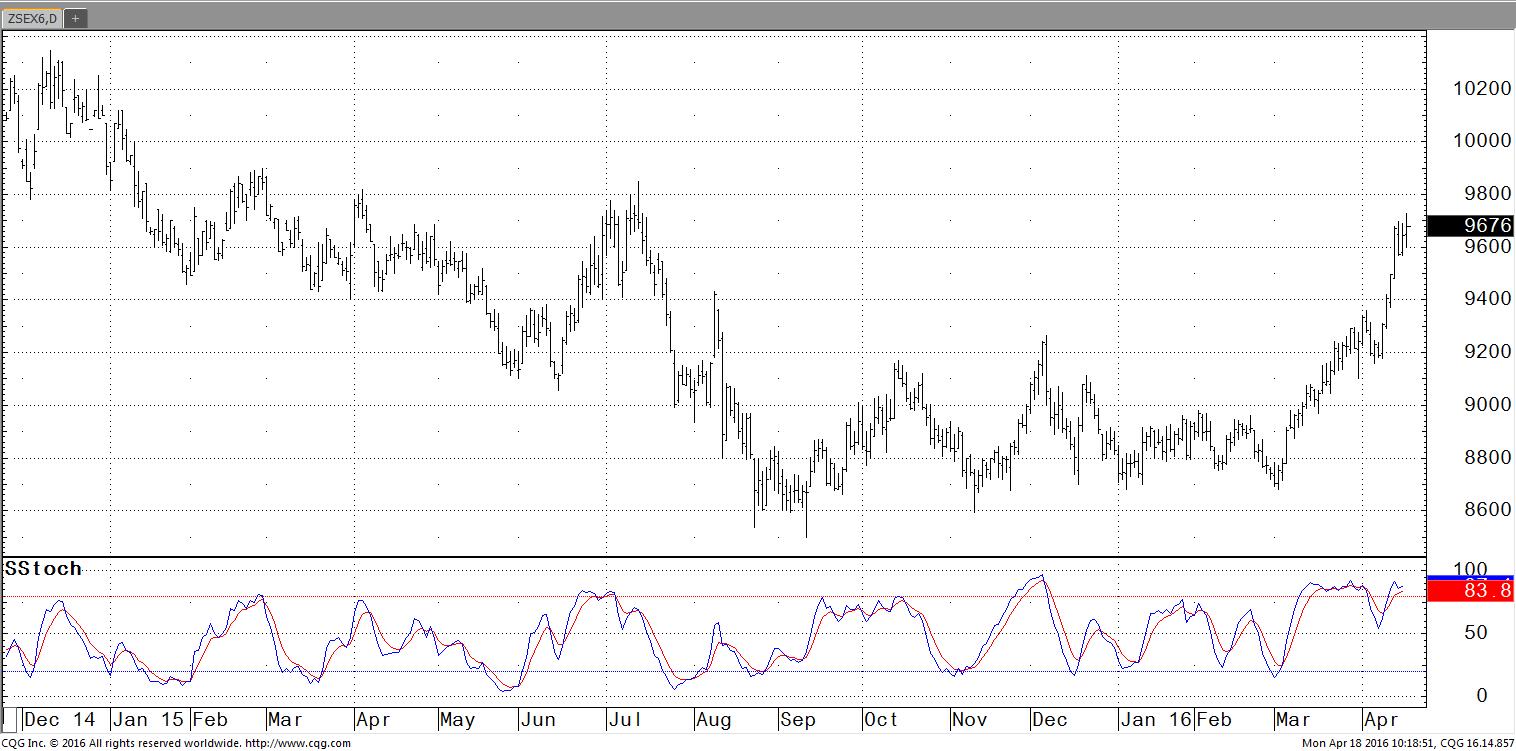

November Soybeans

Soybean prices rallied by over 5% in a 4 day trading period this week.

Why the strength? Several reasons:

- Prices tend to make lows heading into harvest (when supplies expected to be highest). This is known as a seasonal tendency. The market has been anticipating another bumper crop out of South America for some time. Harvest there began last month. With that anticipation out of the way, Speculators became wary of pressing the short side of the market.

- Seasonally, the arrival of the US planting season brings with it some anxiety – another reason for Specs to lighten up on shorts

- The USDA’s latest Supply and Demand report was deemed “less bearish” than expected. This brought some short covering into the market.

- The newswires are very excited about a deluge of rain in Argentina which is slowing harvest and causing concern about reductions to the crop. As many roads out of growing regions are dirt, mud is making it difficult to transport crops to shipping docks. On Monday, only 612 trucks of soybeans arrived at docks in Argentina. That compares to 4,273 trucks at this time last year.

The Argentine story in particular is bringing a wave of speculative interest to the soybean market. Spec open interest is up over 20% in just the last 3 weeks. This has not only helped prices to surge, its served to fatten the premiums of distant call options.

The Hard Cold Facts about Soybeans

The hard cold facts about soybeans are this:

Fact 1: The World is Awash in Soybean Supply

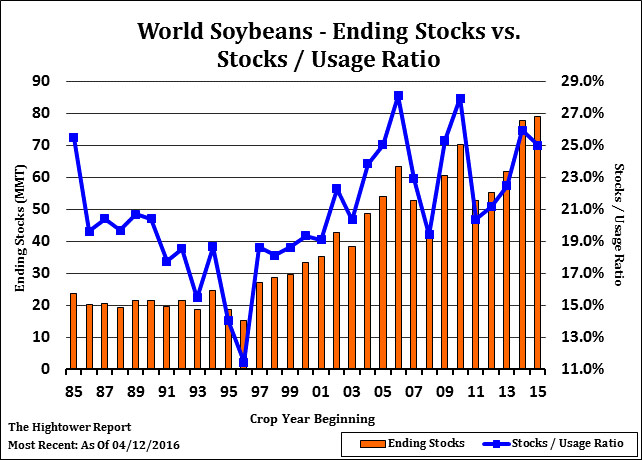

As per the USDA’s latest report deemed “less bearish”, 2015/16 global soybean ending stocks were adjusted upwards to 79.02 million metric tons – the highest in ever recorded in history. Ending stocks are what is left over – after all demand has been met.

Global Soybean Ending Stocks are expected to hit an all time record this year.

US ending stocks were adjusted lower to 445 million bushel from 460 million bushel –still the highest in a decade. You see, the public judges USDA supply demand reports as bullish or bearish only in comparison to trade expectations. If the trade expects the number to be raised by 5 million and they drop it by 5 million, they consider that “less bearish.”

Option sellers should look at the big picture. And the big picture continues to be one of a supply glut.

Fact 2: Another Bumper US Crop is likely on the Way

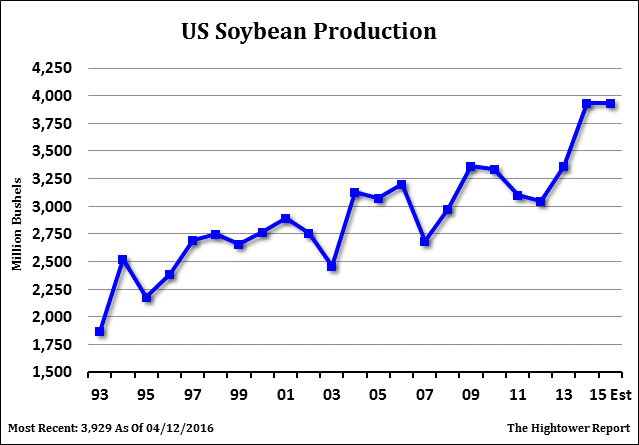

Last year, the US harvested 3.929 billion bushels of soybeans. The USDA’s March 31st Planting Intentions report indicates US farmers intend to plant 82.2 million acres of soybeans this year. Despite the US massive 2015 harvest, this is down less than 1% from last year. Normal weather would produce a crop nearly identical to last year’s monster.

Assuming normal weather, the 2016 US soybean harvest could be nearly identical to last year’s record.

Fact 3: The Argentine Issue is Likely Overblown

Prior to the rain issues, Argentina is expected to harvest 59 million tons of soybeans this year. The latest estimates indicate the rain could cut production by 2-3 million tons. Assuming 3 million tons are lost, this would drop global ending stocks from 79 million tons to 76 million tons – still the second highest on record (and only missing the record by a smidgen). In short, the real effect on supply is a drop in the bucket. The Argentine story is primarily a media event.

Summary and Conclusion

While a combination of recent stories and seasonal events have supported soybean prices as of late, the big picture fundamentals remain overwhelmingly bearish. While continuation of the Argentine story or adverse US weather during planting could still provide some strength to prices, we expect the considerable overhang of supply and the looming prospect of another massive US crop to keep rallies to a limited nature.

November 2016 Soybeans

Selling November Soybean 11.40 calls and 12.00 calls.

With surging spec open interest and a gap just closed on the daily chart, the market appears to be reaching some technical exhaustion in the short term. We suggest considering the November Soybean 11.40 call options for sales this week. Premiums of $600+ per option are currently available. Consider adding to your position by selling the November 12.00 calls on additional strength this Spring. Volatility also makes this an ideal market to consider option credit spreads.

———————————————————————————

We’ll be working with managed accounts in capturing soybean option premium this month. To learn more about managed option selling accounts with OptionSellers.com, to schedule a consultation or visit www.OptionSellers.com/Discovery for a free Account Information packet.

——————————————————————————————–