Emerging Market ETFs have now seen 8 straight weeks of inflows and EEM (iShares MSCI Emerging Markets ETF) is now +6.7% vs the SPX +2.8% year to date (ytd). While the EEM ETF has attracted +$2.8B in assets year to date, the AUM in this ETF are still -37% from the 2013 peak. Meaning there may be a further rotation into Emerging Markets (EM). One particular area in EM that looks attractive is Latin America.

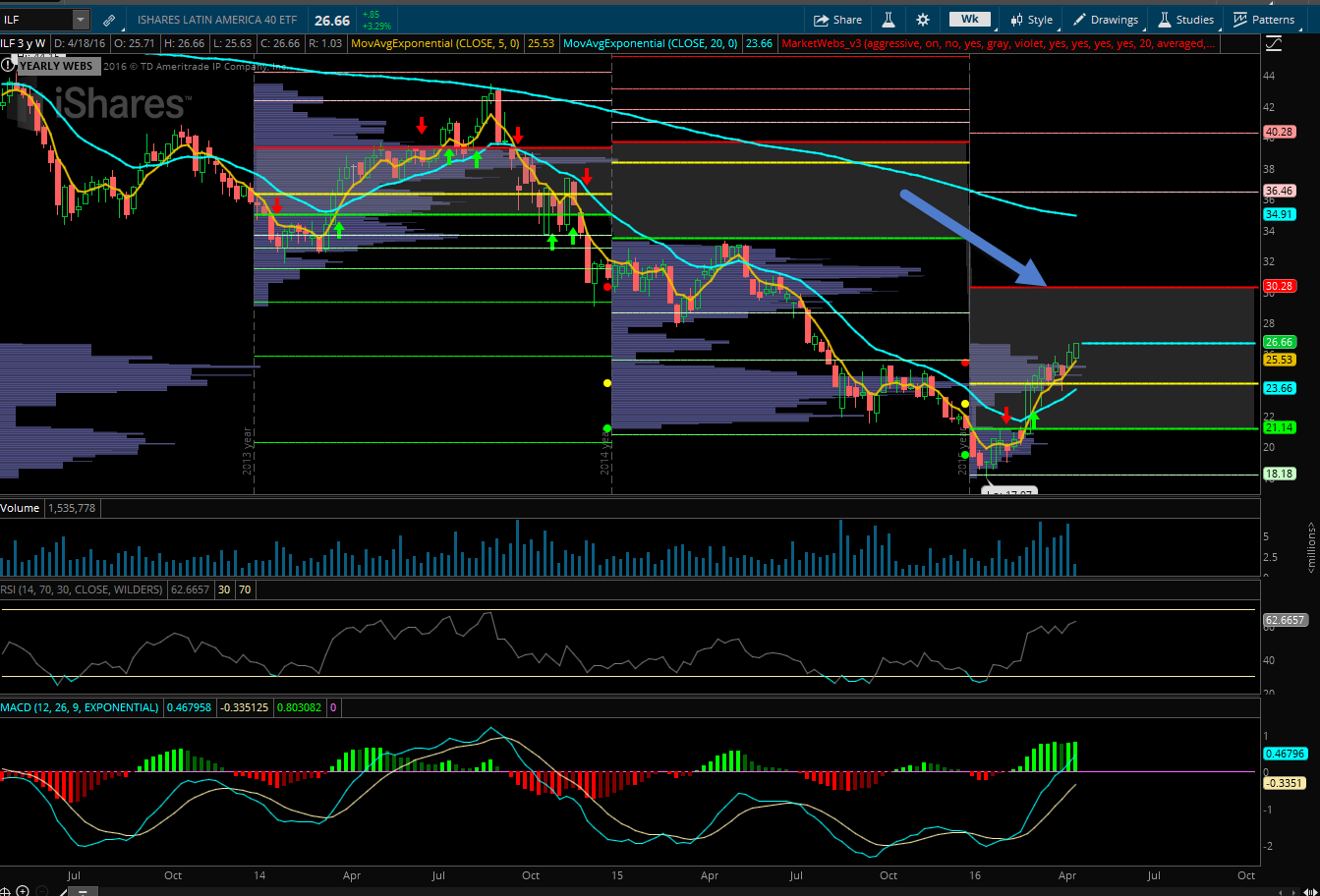

ILF (iShares Latin American 40 ETF) is an ETF that can provide exposure to this region. This ETF holds 49% Brazil, 33% Mexico, 11% Chile, and 4% Peru companies. Note in the below chart, the price is now in the middle of the weekly value area and I am looking for a move to the top of value (red line) at a price of $30.28

The Tribeca Trade Group Trade:

Go long ILF stock or buy the Sept 27-30 call spread @ $0.75

ILF – iShares Latin American 40 ETF