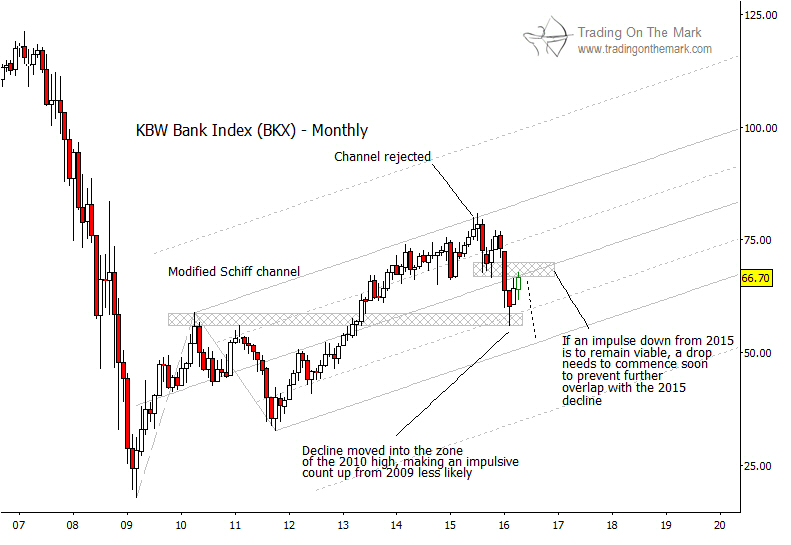

The banking sector has not kept up with the overall recovery in equities since the 2008-2009 crash, and that is even more true for the 25 large financial institutions that are represented in the KBW Bank Index (symbol BKX). While the substantially broader index of regional banks put in a higher high at the end of 2015, BKX put in a lower high. Developments during the next few months should clarify whether this divergence is a bearish signal for the financial sector and for equities generally.

From an Elliott wave perspective, the clearest bearish structure we could expect would be a five-wave impulsive move down from the 2015 high in BKX. For the move to be impulsive, the fourth wave must not overlap the first wave. The downward move in BKX does not quite meet that standard, although the only overlap was between the “wicks” of the candles for October 2015 and April 2016. An overlap of monthly closing prices would rule out an impulse more definitively.

On a weekly chart (not shown), we are watching 68.45 as the practical limit for the index to rise before it invalidates the idea of an impulsive wave. If the index declines from its present area, then the possibility of an impulsive move remains alive, with allowances for wick overlap. In that event, we would expect the index to test and break through the area of prior support near 55.99 to 58.83.

With an eventual breakdown of the support area, the index could test the lower boundary of the Schiff channel or even the 50% harmonic of the channel before attempting a larger bounce.

Keep up with posts and articles from Trading On The Mark by following us on Twitter and facebook!