Since peaking in early 2011, both commodity prices and commodity-related companies have been mired in a bear market, despite the Federal Reserve’s third-round of quantitative easing policy and subsequent injections of stimuli by the world’s central banks, the latter of which continues to this day. From its peak in early 2011, the CRB BLS Spot Index (a broad-based price index of 22 commodities, excluding energy) declined by 30%. The bear market in commodities has hit uranium especially hard. Since early 2011, the uranium spot price has declined by 50%; the stock price of Cameco (CCJ), the world’s largest uranium miner, is down by a similar amount.

The bear market in commodities is generally attributed to factors such as the strong U.S. dollar, overproduction, and a slowdown in Chinese-led investments. In particular, the bear market in uranium has been exacerbated by the following additional factors:

- The decrease in public acceptance of new nuclear power plants in the wake of the Fukushima accident in March 2011;

- Higher costs of construction and maintenance of the nuclear infrastructure due in part to enhanced safety regulations;

- The lack of favorable energy policy and electricity market incentives, despite increasing efforts by global policymakers to “decarbonize” the power generation markets.

More than 5 years after the Fukushima accident, the headwinds for uranium prices are turning into tailwinds. E.g. Following Fukushima, China placed a moratorium on new approvals and builds while enhancing safety requirements; China has since reinvigorated its construction of nuclear capacity, with 24 reactors currently under construction. Moreover, most global policymakers (including those from China, India, Japan, and the UK) continue to recognize that nuclear is the power of choice for non-polluting, low-cost, baseload power (note: despite the unfortunate circumstances surrounding the Fukushima accident, the resultant radioactive releases were just between 10% and 20% of the releases of the Chernobyl accident).

The renaissance in nuclear power generation is underpinned by the structural demand growth in global power generation and more importantly, the desire of policymakers to “decarbonize” the power generation industry, of which nuclear power remains an important option. The purest way to invest in this space is through a low-cost, pure-play uranium miner that operates in low geopolitical risk areas. Cameco Corp (CCJ), the world’s largest uranium miner, fits this bill.

CCJ has a market value of $5.1 billion, and an annual dividend yield of 2.5%. I find uranium, and particularly CCJ, attractive for three reasons.

1. The long-term demand outlook for uranium is highly attractive

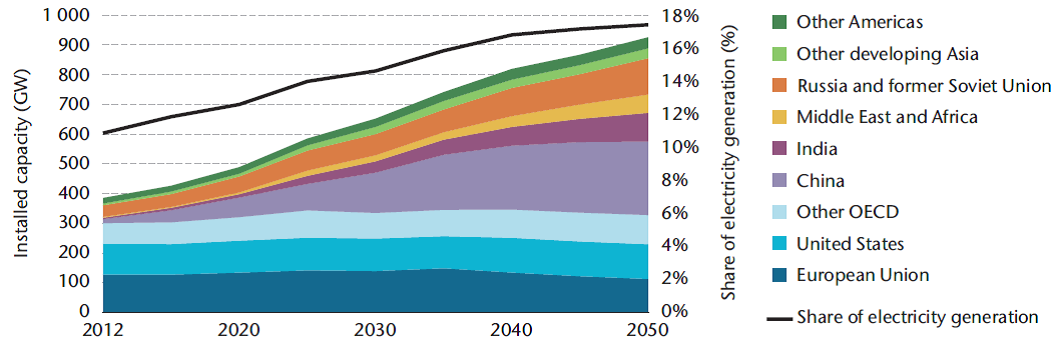

After a five-year lull in new builds, the number of reactors under construction (65, out of a global fleet of 440 operable reactors) is now the highest level in 25 years, with China leading the way with 24 reactors under construction. The current fleet of nuclear reactors has a capacity of 384 GW, making up 11% of the world’s power generation capacity; these reactors currently consume 172 million pounds of uranium annually. Based on the number of plants currently under construction and being planned (173), along with the planned Japanese nuclear plant restarts, uranium demand is expected to increase by 40% over the next decade. Moreover, according to the International Energy Agency (IEA), an additional 930 GW of nuclear capacity is needed globally to support current goals to transition the world’s energy system away from carbon-based fuels; this means there is a strong likelihood for uranium demand to surprise on the upside should highly-polluting economies such as China and India switch more baseload generation to nuclear in an effort to reduce carbon pollutants.

Figure 1: Current and Projected Global Nuclear Generation Capacity (sources: NEA, IEA)

2. Uranium will enter a supply deficit by 2019 at current prices

2. Uranium will enter a supply deficit by 2019 at current prices

The uranium market is already struggling with a supply issue. E.g. current annual demand is 172 million pounds, but miners only supply about 147 million pounds; the rest is filled by secondary sources such as utility stockpiles, nuclear weapons stockpiles and recycled uranium from reprocessing used fuel. At $26 a pound, the uranium spot price is trading at 50% below its early 2011 peak, and 80% below its 2007 peak. Simply put: uranium prices need to recover to $45 a pound to incentivize additional mine supply. Moreover, secondary supply is not sufficient to fill this gap; new mine supply is needed to fill as much as 10% of all total demand over the next 10 years. Unless prices recover to the $45 level, uranium will enter a supply deficit by 2019.

3. CCJ has a clear growth plan and its stock is attractively valued

Despite the challenging price environment, CCJ’s 2016 EPS is projected to grow by nearly 50% (to just over US$1.00 a share) from its 2015 level, buoyed by a slight increase in production and ongoing cost-cutting efforts. CCJ possesses 3 of the world’s 15 biggest mines (and the world’s biggest, McArthur River mine in Canada), and is the world’s lowest-cost miner. Because of this, CCJ has sufficient cash flows to grow its production; this year, the company’s Cigar Lake property in Canada is expected to grow its production to nearly 8 million pounds, up from 5.7 million last year. Cigar Lake is expected to produce 9 million pounds in 2018.

CCJ trades at a P/B ratio of 1.1; this represents a 27% discount below its 2011-2015 post-Fukushima P/B average of 1.5. As uranium demand continues to grow, I expect CCJ to experience significant P/B expansion, bringing the stock back to around $17.50, or an appreciation of 36% from its current stock price.

Disclosure: Neither I nor does my firm, CB Capital Partners hold any shares in CCJ.

Henry To, CFA, CAIA, FRM is Partner & Chief Investment Officer at CB Capital Partners. Established in 2001, CB Capital Partners is a global financial advisory and investment firm headquartered in Newport Beach, California, with an office in Shanghai, China and an affiliate office in Mumbai, India. Visit http://www.cbcapital.com and http://www.cbcapitalresearch.com for more information.