The major indexes are now within a stone’s throw of all-time highs. Is it time to declare a fresh-new bull market, start loading up on risk, and get ready to sit back and collect fat returns for the next few years?

Has external risk been extinguished, do business cycles not cycle anymore, and are indexes at a new “permanently high plateau”!?

Slow down there Irving Fisher… before we start pounding the kool-aid, let’s quickly take a peek under the hood of this market and see what’s really going on.

First up, equity valuations are near historical highs. And some metrics show they’re at all-time-most-ever-new-highs.

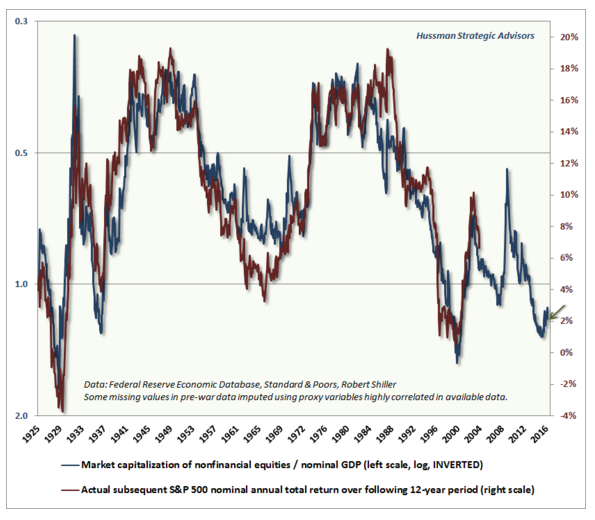

Take a look at the chart below from Hussman Strategic Advisors. This indicator is one of Buffett’s favorite valuation measuring sticks.

The blue line indicates the market capitalization of non-financial equities over nominal GDP. The red line shows the S&P 500 nominal annual total return for the next 12 years.

There is a very strong correlation between the two. One leads the other, which does not bode well for future equity returns.

Given the current market cap of nonfinancial equities, the projected return over the next 12 years for the S&P 500 is a paltry 2% per year. This means that if you were to buy and hold at this point, your account would barely keep up with the Fed’s targeted inflation rate.

Do you want to buy and hold equities here with the prospect of 2% per year?

The Macro Ops team sure doesn’t. Especially given all the volatility and risk we would have to stomach along the way.

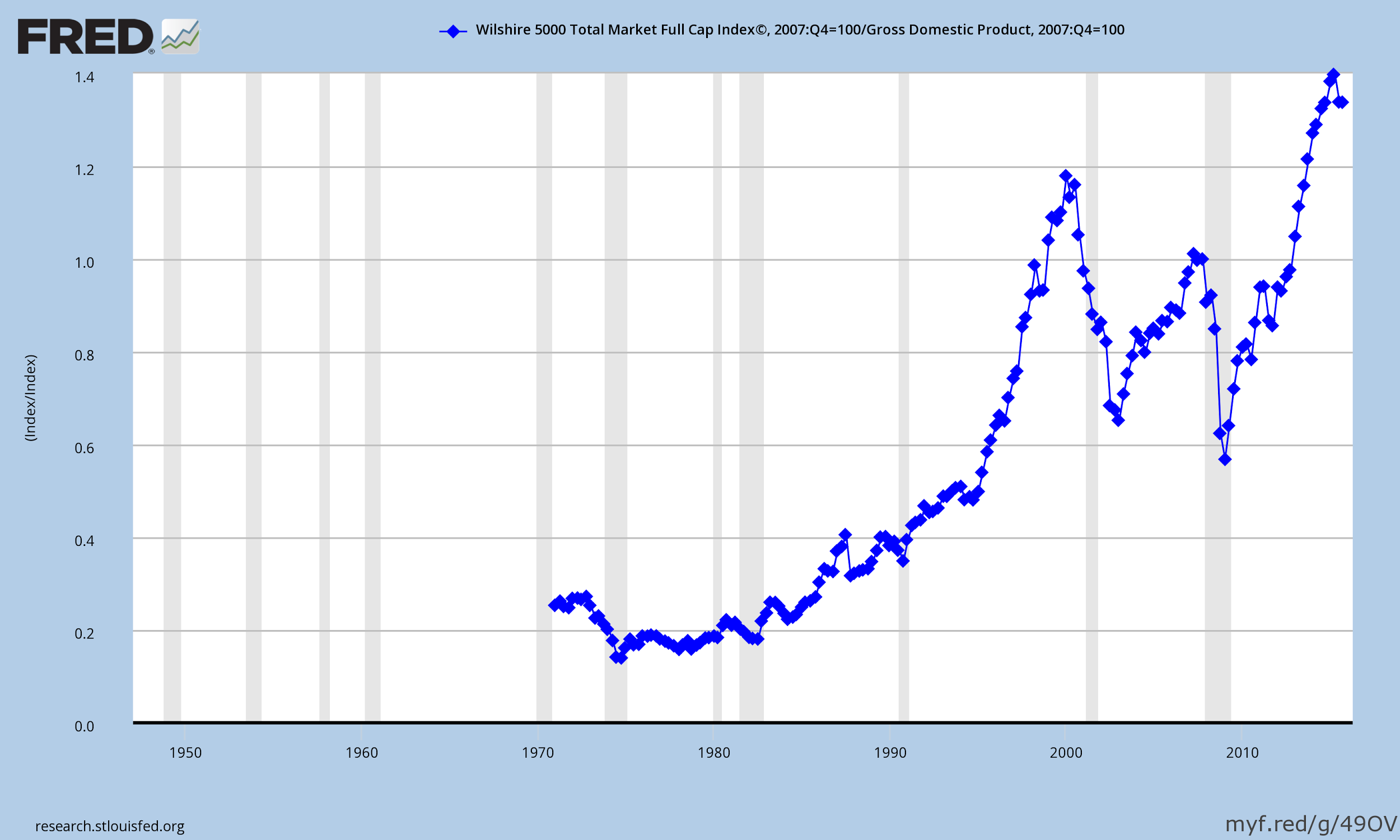

Another Market Cap to GDP indicator, using the Wilshire 5000, is at all-time highs!

Current valuations are an enormous red flag for anyone looking to put money to work in equities.

In fact, the only way for this picture to get any better is for economic growth to accelerate. This would raise GDP and help justify these valuations.

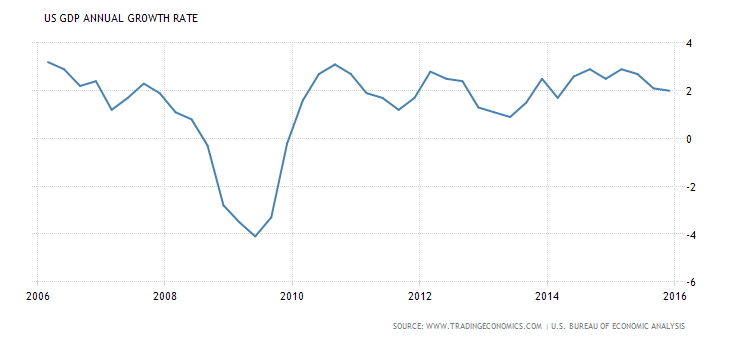

But take a look at US growth in the graph below. Growth in GDP has all but stalled since “recovering” from the ’08 recession.

And with the Fed “pushing on a string” at the zero bound, it’s not likely to increase anytime soon.

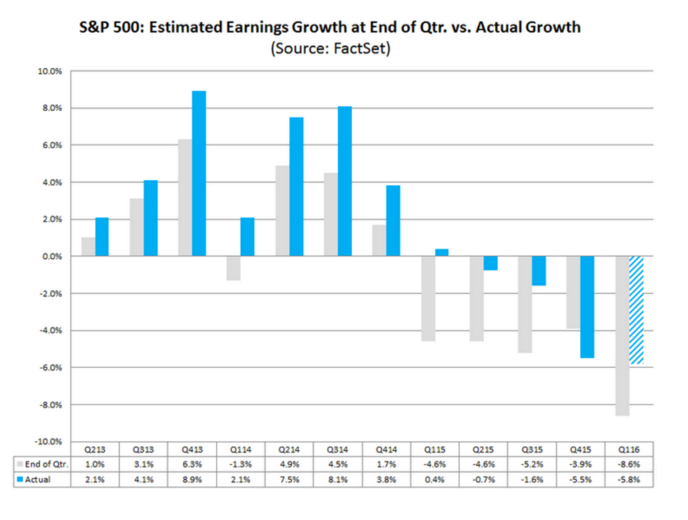

This is especially true when considering the massive downtrend in companies’ earnings growth over the past six quarters. Since early 2015, EPS growth has been contracting.

No wonder equity investors saw so much volatility and so little return over the last 18-months. Earnings estimates for Q1 2016 look just as bad too. Given this trend, it’s understandable why GDP growth is struggling.

At the end of a business cycle, a tight labor market gives employees more negotiating power. They demand higher wages which in turn eats into corporate margins. This is what’s happening right now and is another reason the long-term outlook for equities is so bearish.

And Let’s Not Forget the Dollar…

Just because the USD is currently weakening, does not mean its bull market is over. And as we know, a stronger USD is a negative for US corporations’ international profits. Goods sold overseas become more expensive, leading to less demand. And any profits brought back to the US will be worth less due to the currency differential.

Europe and Japan cannot afford a strong dollar. They continue to be mired in economic weakness and completely stalled growth. So we know what that means: more intervention (money printing) by the ECB and BOJ. This will cause the dollar to resume its rally. And a stronger dollar will put MORE pressure on corporate profit margins.

The Takeaway

Given the current fragile system, we’re left with little to no upside in equities. The market is showing too many red flags. Buying here is an uncomfortable proposition for any long-term investor.

Short term tactical trading is an option, though it’s difficult to execute unless you have the time and energy to protect your six properly.

Right now, we think it’s a sideline market. Cash is powerful. It’s more ammunition in the arsenal for when the bottom does finally give way. In the future there will be plenty of opportunities to buy assets for pennies on the dollar — just remain patient.

That’s where the money is going to be made. Remember, as with much in life, good things do come to those who wait. Especially to those who strike with precision and do not give into the fear of missing out.

For more information about equity valuations, please click here.